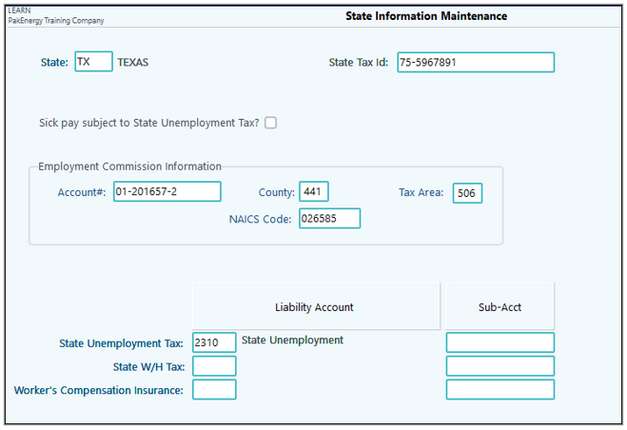

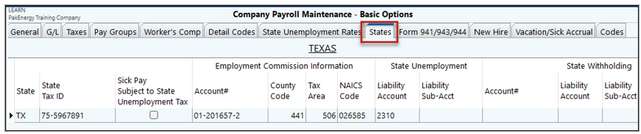

•Set up all the states that you have employees and the State Tax ID.

•Check if you wish to include sick pay in state unemployment wages.

•Enter the Accounts/Sub-Accounts for recording the liability for State Unemployment Tax, State Withholding Tax, and Worker's Compensation Insurance. The Liability accounts are used when the company has the corresponding Compute Accruals switch turned on. The expense accounts/Sub-Accounts are defined on the Accrual Accounts.

•Employment Commission Information - This information is used on the Texas Unemployment report. All information in this section can be obtained from your latest TWC report filed. The rate is used to calculate the amount of the tax to be accrued during each payroll cycle.

Clicking on a State grid row will bring up the State Information Maintenance screen. This will allow for easy access of the State’s information such as Employment Commission Information and Liability Accounts.