Pak Accounting’s General Purpose Invoicing provides a complete system for customer invoicing and account management.

The optional Inventory system provides parts management and advanced purchase order capabilities. Setup options are conveniently grouped separately from the invoice entry, so the invoice entry procedure is quick and easy.

Duplicate data entry is eliminated through a seamless interface to the Accounts Receivable, Accounts Payable, and General Ledger modules.

To begin using Pak Accounting's Invoicing you must complete the following basic setup requirements:

Setup:

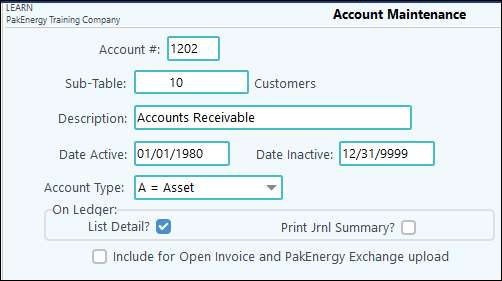

•Review Chart of Accounts (F11) for: Accounts Receivable account, Sales Tax account, and Income account

Depending on how our company is set up, we must ensure we have the appropriate accounts. For the Invoicing side of things, we must have the appropriate Accounts Receivable (AR) and Income accounts set up. For the Purchaser Order/Inventory side of things, we must have the appropriate Accounts Payable (AP) and expense accounts set up. Also, if you want to track the difference between receiving items from a PO vs. receiving the Invoice, you will need an accrual account. One of the first questions to ask yourself as you are deciding how to set up your Chart of Accounts is “how will I want this to look on a report later?” Will you want everything lumped together into a single account? Or, will you need to have an account broken out by customer, vendor, or location? Some typical accounts that are needed are: •Accounts Receivable (who owes you money) •Clearing Account (A/P) if tracking the difference between ordering parts and receiving parts. •Accounts Payable (if ordering items) •Sales Tax Account(s) •Income Account(s) •Cost of Sale(s) / Expense Account(s) For example, your Accounts Receivable account. This account will typically need to be reported by Customer so the account will need to have the Customer Sub-Table attached.

|

•Setup Company Maintenance

•Setup Custom Fields

•Setup Class Codes

•Setup Parts (F3)

•Setup Sales Tax Rates

•Setup Customers (F12).

Also see: Invoicing FAQ