Overview

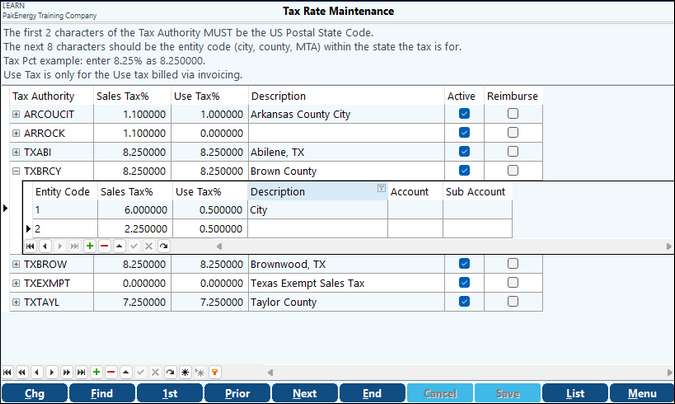

If charging sales tax on invoices, enter the tax rate for each state/county. A sales tax consists of the standard tax imposed by a city, county, and/or state.

Set up

•A Sales Tax Payable account must exist in the Chart of Accounts

•That account must be defined in General Ledger Company Maintenance, Company Options, Accounts tab.

•Tax Rates must be set (see below).

•The most common tax rate can be set as your default rate in Company Maintenance, to minimize data entry.

•You can also set the Tax Authority at the Location level if using the Optional add on Multi Location Feature as *DIV. This will then look at the Location Sub-Account setup to allow the default to be set separately based on the Location.

Notes

•If you have more than one tax authority set up for any one state, all of the Sales Tax Payable entries will be created using only the first 2 letters of the taxing authority (which must be a valid US Postal State Code) as the Sub-Account.

•Once a tax rate is created you cannot change it. In order to make changes to the Tax Authority code use the Tax Authority Change Utility, once this utility has been run, then you will need to do the Sub-Account Change in order to change the Sub-Account and G/L posted detail.

Tax Authority |

This represents the agency or governing body to which the sales tax is paid. •First 2 characters MUST be the US state code •Next 8 characters should be entity code (city, county, MTA) |

Sales Tax % |

•The tax rate associated with that authority. •The Tax percent can also be split out by State, County, and City tax. (See the TXABI in the above screenshot as an example.) If splitting out the tax the Account and Sub-Account fields must be filled in, it will not look at the default account setup. |

Use Tax % |

This is only for use tax that is billed through Invoicing. |

Description |

A brief description for this tax rate |

Active |

The ability to make tax rates active/inactive by checking/unchecking the Active box. If you make a tax rate inactive you will not be able to use that taxing authority on any new invoices. This can be toggled on and off at any time. |

Reimburse |

This field is used with the optional Use Tax feature. For more information please see Use Tax. |