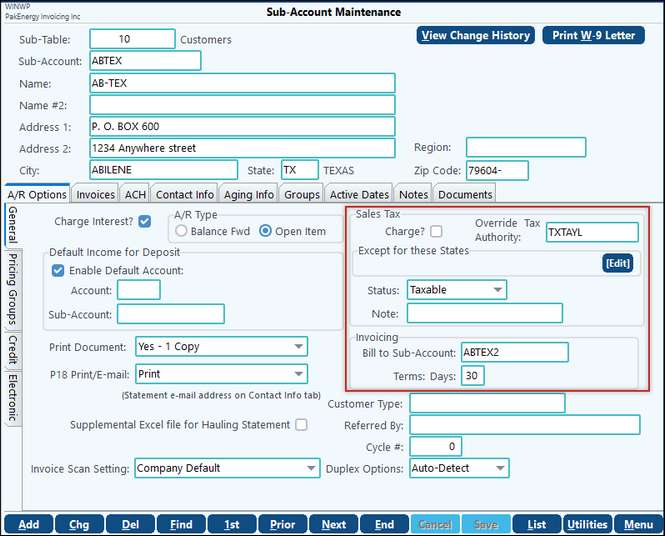

Also see the general Sub-Account Maintenance help doc for more information. There are a few additional Sub-Account fields only available in the Invoicing module, they are as follows: Charge Sales Tax, Override Tax Authorities, Bill to Sub-Account and Terms: # of Days. In the Sales Tax section you can uncheck the Charge box so they are not charged tax. You can also change the Override Tax Authority box if you need it to be something other than the company default.

The main point on the A/R Options tab is if you want them to be Balance Fwd or Open Item. This will affect the way paid dates are applied to the invoices when payments are made.

Open Item tracks each entry/invoice entered, and keeps an accurate record of exactly which entry/invoices remain unpaid. While Balance Forward tracks entries and a total balance due.

The following table highlights the difference between A/R Balance Forward and A/R Open Item.

Feature |

Balance Forward |

Open Item |

|---|---|---|

Application of Payments: (Deposit Entry) |

Automatically applies payment to the oldest invoice |

Manually apply payment to one or more specific invoice(s) |

Paid Date |

No paid date on entries until A/R acct is zero |

Paid date on each invoice once paid in full |

Accounts Receivable Statements |

Lists “Starting Balance” from previous month, plus current month activity |

Statements list all outstanding (unpaid) invoices; or can be ran with Balance Forward format |

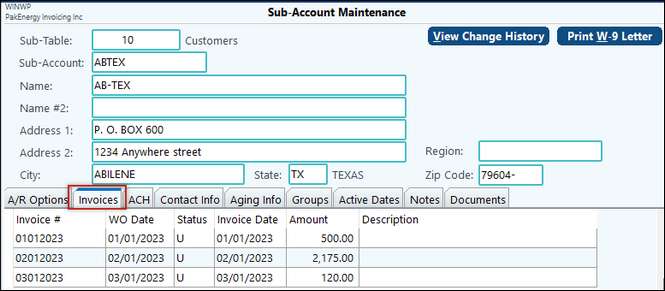

There is also an additional tab available called Invoices, this tab will display all invoices for this one customer.

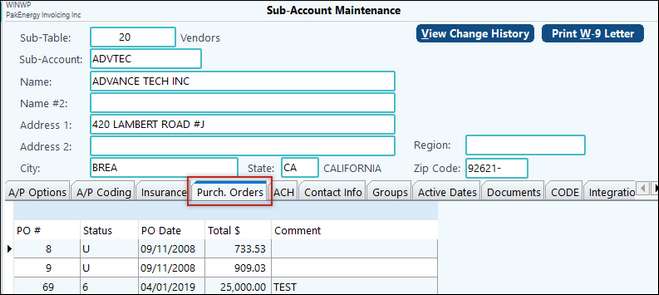

A new tab will also appear on your Vendor Sub-table which will show all Purchase Orders for this one vendor.

Contact Info Tab

This tab provides all necessary contact information fields for phones, fax, and emails. In addition there is space to input comments. Multiple contacts can be entered for the Sub-Account with the ability to define contact titles, emails, extensions and related comments.