Sometimes you may have an employee who has a deduction to setup that will need to be a % of the employee’s net check (example: IRS Garnishment).

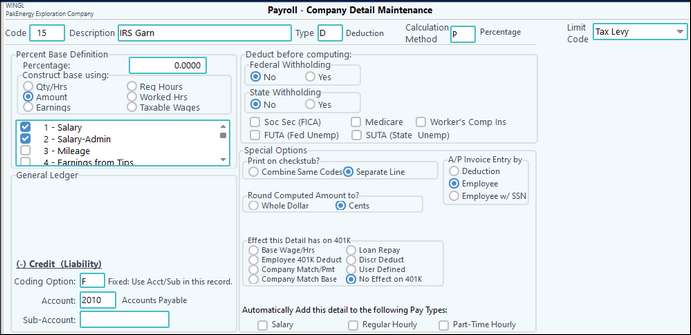

1.Set up a company detail code for the garnishment with a calculation method of ‘P’.

a.Note that all “Subject To:” taxes are “None” and all other tax/accrual deductions have been unselected.

b.Also, the expense account can go to the regular A/P or third-party payable account. Set the Coding option to “F” for specific vendor to be defined at employee level.

c.You will need to mark Construct base using: Amount and select all earnings, deductions and taxes that need to be used for calculations.

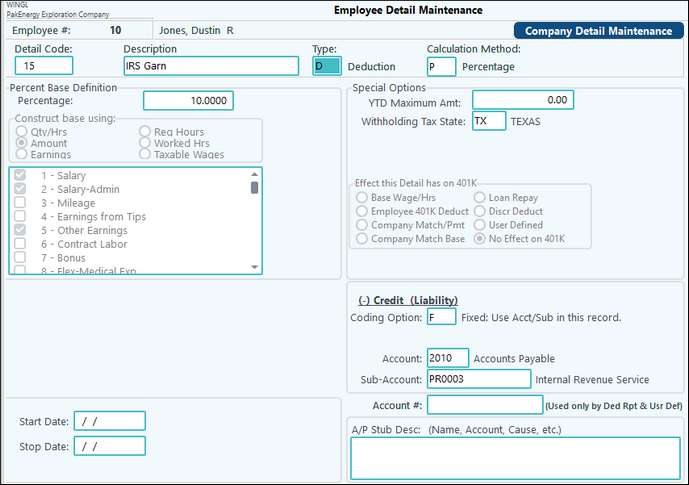

2.Add the detail code to the employee level.

a.Add any information that needs to print on the check stub under the A/P Stub Desc area as well as the % that needs to be deducted.

b.Also will need to add the Sub-Account.

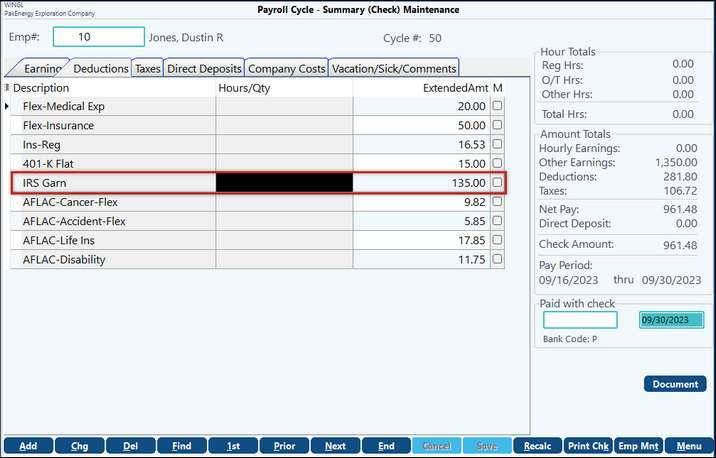

3. Start payroll cycle as normal. With these settings, this employee’s net check will be calculated based on these options. His earnings were $1,350 with 10% set to deduct from his check. But since his net is being used, this is the amount that will be deducted.