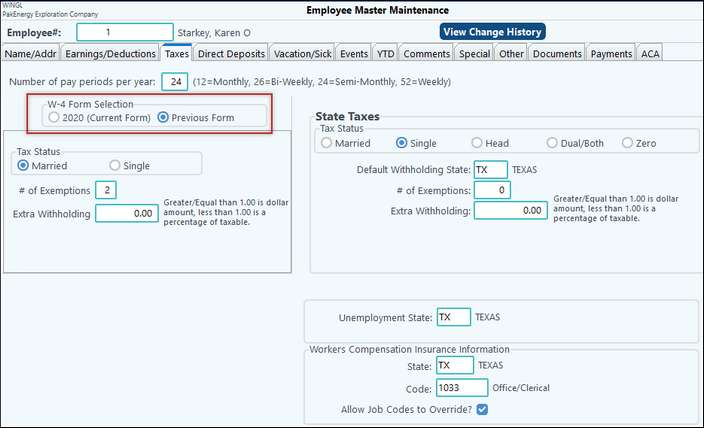

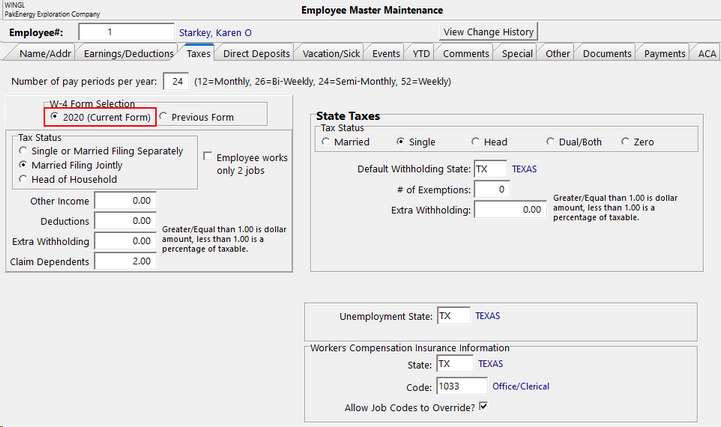

This information affects the way that payroll taxes are calculated. The default values, which should be appropriate for most employees, are set up under Tax G/L Tab in Basic options. If necessary, they can be changed here.

Tax Information |

|

|---|---|

Number pay periods per year |

Used in adjusting the employee's wages to an annual basis for withholding tax purposes. This may need to be overridden if the employee gets paid differently than the default. (52=weekly, 26=Bi-weekly, 24=Semimonthly, 12=Monthly). |

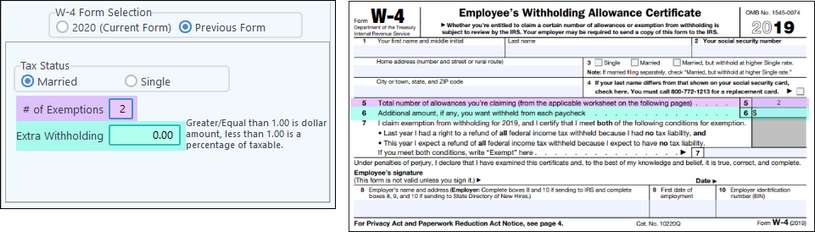

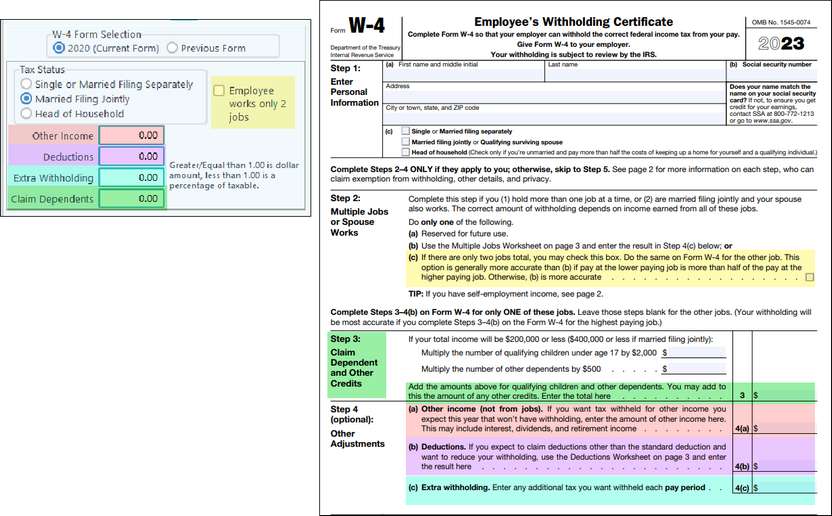

W-4 Form |

2020 - new IRS form Previous Form - 2019 and prior Select the correct option for the form you have for your employee. |

US Federal Taxes |

|

If Previous Form box is checked |

Tax status: Used in determining which tax table to use. Choices are Married or Single. Note: If an employee submits a W-4 with the “Married but Withhold at Higher Single Rate” option selected, choose the Single option when setting him/her up. # of exemptions: Used in calculating the withholding tax. Extra Withholding: Dollar amount added to what is normally calculated for withholding tax. If the amount is less than 1.00 then the system will figure this as a percentage of the taxable wages. Example: A figure of .10 will be calculated as 10% of the taxable wage amount to arrive at the extra amount withheld. |

If 2020 (Current Form) is checked |

Enter the information provided by the employee on the W4 into the available Pak Accounting W4 fields. This will effect which tax calculations will be used. If you are unsure of what needs to be entered into these fields, please check with your tax adviser. |

State Taxes State and Federal tax fields will need to be entered from the W-4 the employee fills out. Even if the state does not have State Taxes, like Texas, we highly recommend filling out the State Taxes section appropriately. The tax tables loaded into the system will know no taxes are required and will not calculate them. |

|

Tax Status |

Used in determining which tax table to use. Choices are Married, Single, Head, Dual/Both, Zero. |

Default Withholding State |

Determines the default state for state withholding tax .The state can be changed for any payroll via the Pay Summary Maintenance. |

# of exemptions |

Used for calculating the withholding tax. |

Extra Withholding |

Dollar amount added to what is normally calculated for withholding tax. If the amount is less than 1.00 then the system will figure this as a percentage of the taxable wages. Example: A figure of .10 will be calculated as 10% of the taxable wage amount to arrive at the extra amount withheld. |

Unemployment State |

Enter the state code for the employee. Used in calculating unemployment. |

Work Comp |

Individual employees’ Workman's Comp code that was set up in Company Maintenance - Worker's Comp Code Maintenance. This field has “?/” lookup capability for the list of w/c codes and is used to accrue the w/c expense on salaried employees. |

Allow Job Codes to Override? |

Default is checked. Job codes are setup in Pak Accounting Time entry programs |

|

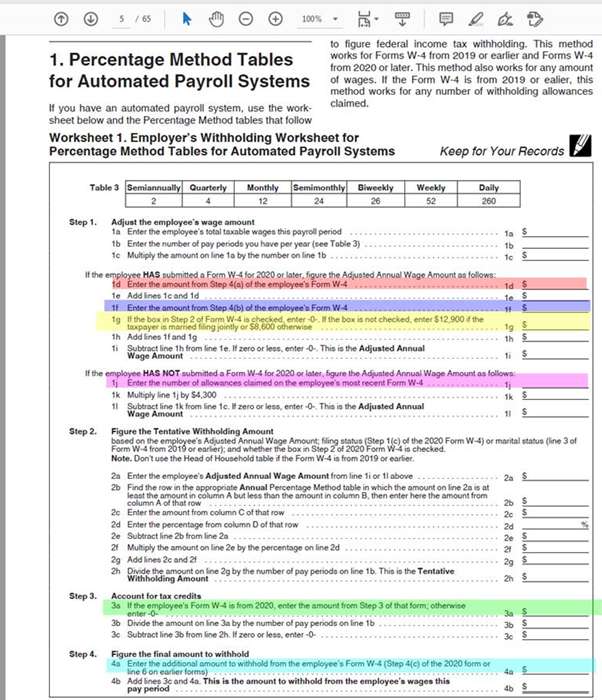

Now as to “what each field does specifically” – the you can download and look at the latest IRS Publication 15-T for 2020 (new form issued in 2020) that gives you the exact steps to calculate Federal Withholding tax based on either the NEW 2020 W-4 or any previous W-4 form. These instructions will tell you how each W-4 form field is used in the calculations. It will allow you to manually calculate the Federal Withholding tax, to match up with what the program is showing.

Also see: Utilities-Global-P/R Federal and State Tax Tables.

|