Overview

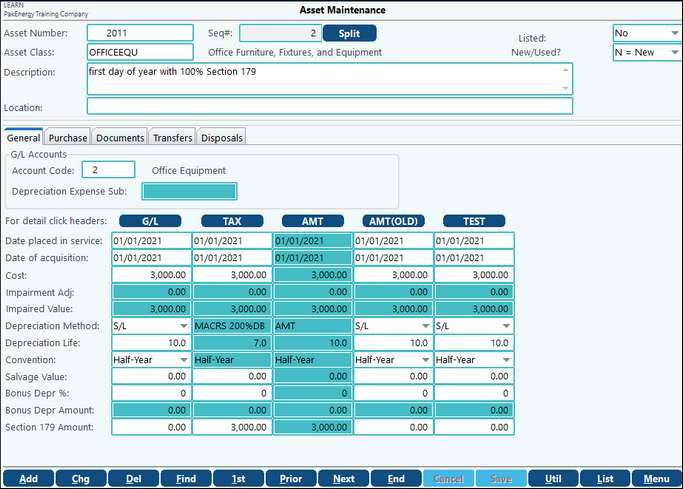

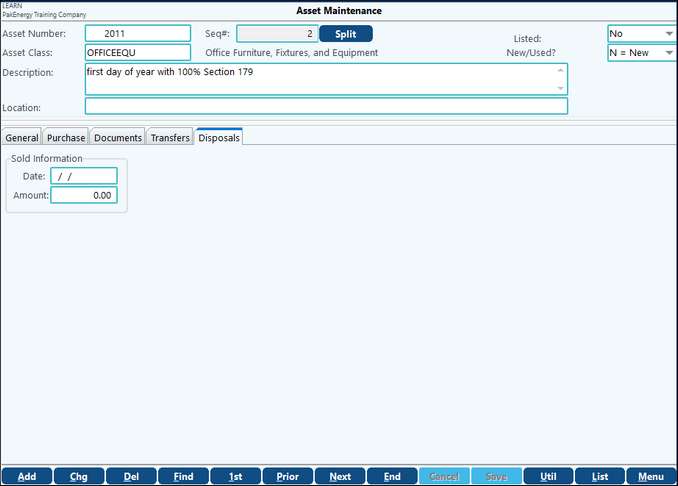

Asset Maintenance contains all of the information necessary to maintain your depreciation entries. Paying careful attention to the setup of the assets can make a big difference in how the system can be used.

Pak Accounting has streamlined the entering of Assets by creating a way to Import your Assets from G/L (General Ledger). Pak Accounting recommends using the Import as opposed to manually entering your assets. However, if you choose not to Import, you do have the ability to manually add assets in Asset Maintenance.

Also see Fixed Assets Overview

Entering/Adding an Asset

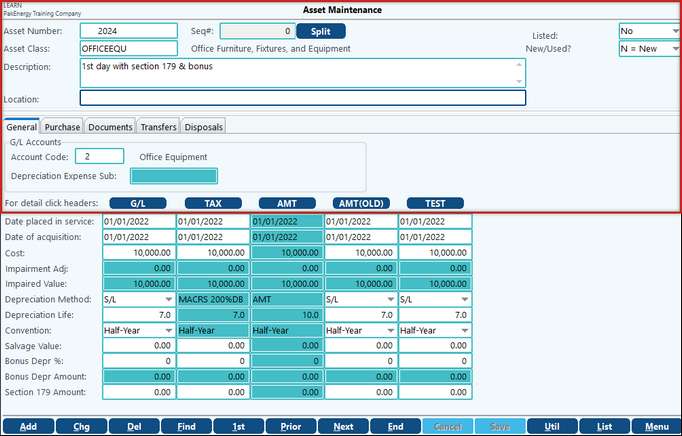

Click on “Add.” Pak Accounting will attempt to pre-number the asset, but the asset number can be overridden. If the asset number already exists, the user may still use the same asset number if it is given a new “Seq#” (sequence number).

The AMT column can only be edited on User Defined Class Codes.

Asset Maintenance |

|

|---|---|

Asset Number |

1-10 characters, can be automatically assigned or designated by you. |

Seq# / Split |

Sequence number of the asset. If an asset is split the next sequential sequence number is assigned. |

Asset Class |

The class this asset falls into. Information such as Depreciation Method, Life, and Convention, about the class can be seen at the Asset Class. |

Description |

Description of the asset. |

Location |

Location of the asset. Free-form field. Not required. |

Listed |

This refers to whether or not the asset is supposed to be “listed” on the Tax Report the user runs to help prepare Form 4562. If set to “No”, the asset will not be listed on the Tax Report. If set to “Yes”, the asset will be listed on the “Tax Report” if the asset is purchased in the year that the “Tax Report” is being run for. |

New / Used |

All assets are marked by default as “New.” If the asset is "used", the user must change the option. This information is critical regarding whether or not an asset is eligible for bonus deprecation. |

G/L Accounts - the Account Code links to Master File Maintenance / Account Code and may be filled in by typing in the Account Code or selecting it from the drop-down. This link is how Pak Accounting knows which General Ledger Asset and Accumulated Depreciation Accounts to tie out to when generating the G/L Verification Report. It also determines the Accumulated Depreciation and Depreciation Expense account that is to be used when creating the G/L Entries. If an asset is attached to an Account Code that has a depreciation expense account that is attached to a Sub-Table, then the “Depreciation Expense Sub” needs to be selected for the asset. If the depreciation expense account does not have a Sub-Table attached, the field is disabled.

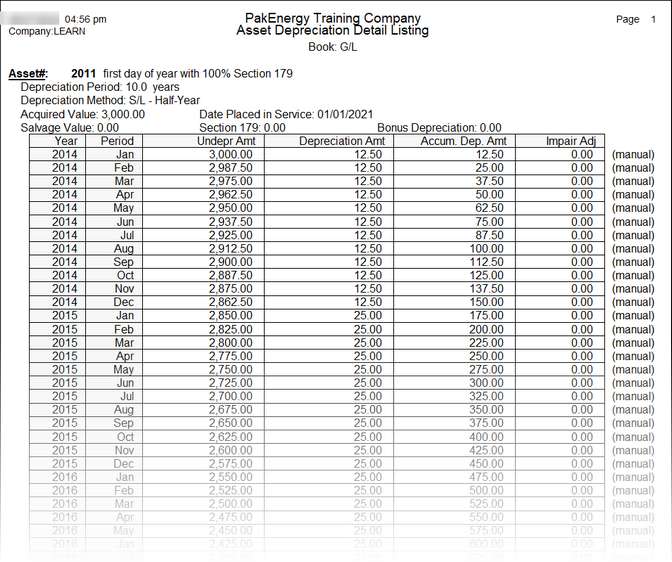

Changing Depreciation Values If you choose to change the values for an asset, the Depreciation Detail will regenerate when the asset is saved after the changes. The following values may be overridden: •Salvage Value, Bonus Depreciation percentage (provided the percent is less than the allowable percent for that period), and Section 179 dollar value. •The TAX and AMT books will mirror each other, so only the TAX book can be overridden. •All other books G/L and user defined may be overridden on this screen, too. The Depreciation Detail may be overridden by clicking on the corresponding book’s button in Asset Maintenance. This opens up the detail, and the user may override the “Depreciation Amt” field. Once an override is made the line will be marked as “manual”

|

|

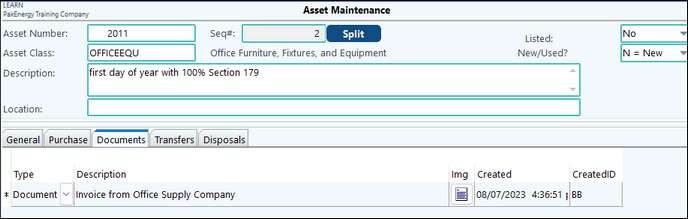

If authorized for scanning, this is where documents can be attached that pertain to the asset in question. Some examples include original invoice, sales sheet, maintenance reports, insurance information, etc. It is recommended that the client place a date at the beginning of the description because this field stores in alphanumeric order. Either documents or pictures can be added. |

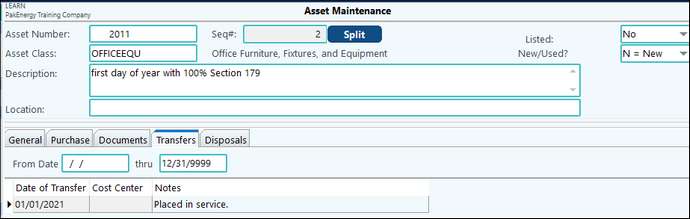

This is used to transfer an asset from one cost center (Sub-Account) to another in the Fixed Assets Module. Performing transfers timely will ensure that the depreciation is booked to the correct cost center. This only works on a change from one cost center (Sub-Account) to another. The user may not use the option to transfer from one general ledger account to another. For example, if there are producing leases in one asset account and non-producing leases in another asset account, the transfer cannot be used to take a lease from non-producing to producing. The asset would have to be disposed in the old account and added to the new account.

From Date/Thru - Restricts the transfers to the date range defined. Transfers are created when the Depreciation Expense Sub-Account is changed. You can manually create a transfer by adding a Sub-Account on the General Tab. The transfers are used to create General Ledger Entries and to sort the Depreciation Schedule. Note: In order to create a Transfer the Depreciation Expense account defined in Account Codes must have a Sub-Table defined on your Chart of Accounts. |

This is where the disposal date is entered for an asset that has been sold or otherwise disposed. Entering in the Sold Date is the only necessary field, but having the amount entered in the amount field will help when running reports. Disposing journal entries still have to be manually created in the General Ledger. Currently, all information needed to create the manual general ledger entry can be obtained by looking at the detail for the accumulated depreciation and the original cost of the asset. Credit the asset account, debit the accumulated depreciation account, debit cash for the sold amount (or AR if the set up a payment arrangement with the purchaser), and the difference goes to gain/loss on sale of asset. It is recommended to dispose of the asset prior to creating the General Ledger entry to make sure that the depreciation for the final year is accurate. Note: Assets disposed of in the first year will be allowed to retain the GL book depreciation.

|

||||||

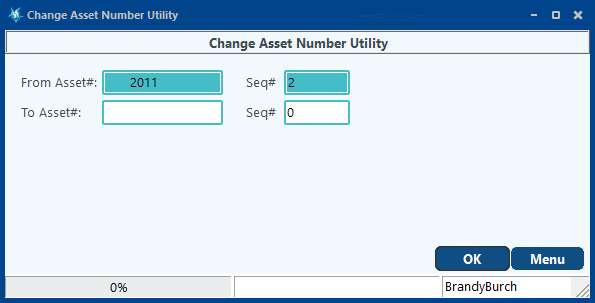

Change Asset Number This utility allows the asset number to be changed at the top of the screen. To change an asset number find the asset in Asset Maintenance, choose Util (Utility), Change Asset# (Asset Number). This will open the Change Asset Number Utility.

Fill in the new asset# (Asset Number) you would like to assign and press "OK." Note: Pak Accounting recommends leaving the Seq# (Sequence Number) Zero when using this utility. The Seq# (Sequence Number) is designed to be maintained by the system when Splitting and Unsplitting assets.

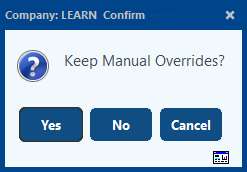

Regenerate Asset This utility allows for the asset to be recalculated for depreciation. If any manual overrides are made in the depreciation, the system will ask if you would like to keep them.

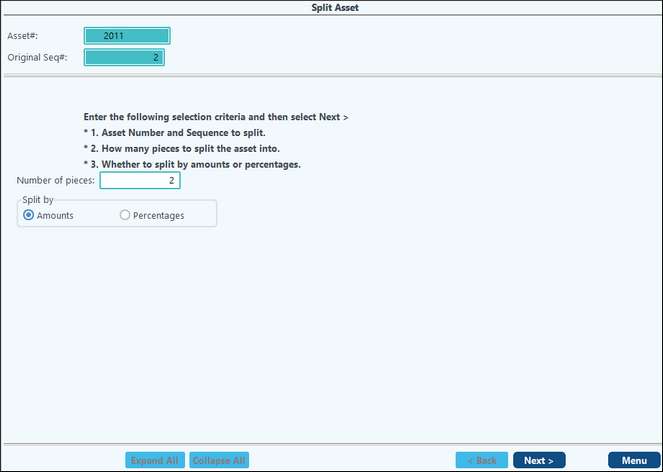

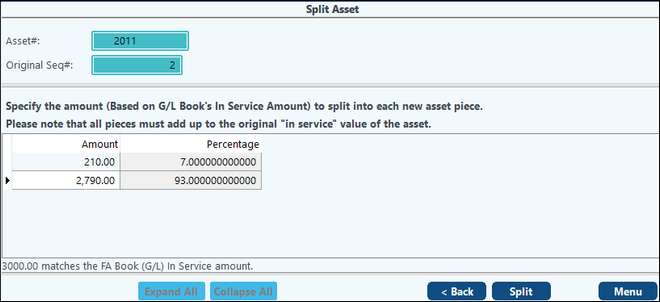

Split Asset This utility allows the asset to be split into multiple pieces based on an amount or a percentage. To Split an asset go to Asset Maintenance, find the asset to split, and press the Split button (or you can choose Util, Split Asset). This will open a Fixed Asset Split Utility. You will be asked to enter the number of pieces to split the asset into and if you want to split by amounts or percentages.

Next you will be asked to enter the amount to split the asset by.

Then you will choose Split. This will split the assets into the number of pieces you requested, assigning the new sequence number as needed. the cost center information will be copied to all of the split pieces.

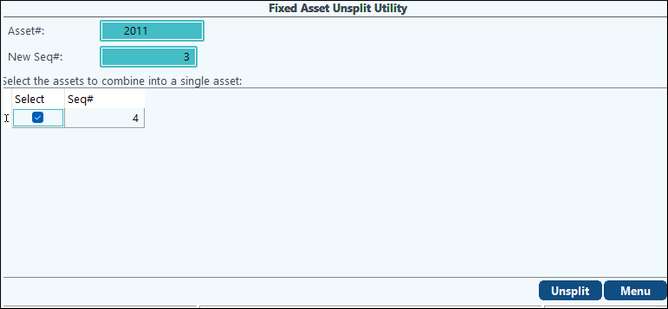

Unsplit Asset This utility allows for a split asset to be put back into one piece. To unsplit an asset, find the asset to unsplit (Only assets that have been Split through Fixed Assets can be unsplit), and press the Unsplit button (or you can choose Util, Unsplit asset). If the unsplit button does not appear this asset is not eligible to be unsplit. This will open the Fixed Assets Unsplit utility. You will be asked to select the sequence number of the asset to unsplit. The system will verify that all of the cost center information is the same before allowing the unsplit.

Then you will choose unsplit. This will unsplit the selected assets and merge back into one asset. |

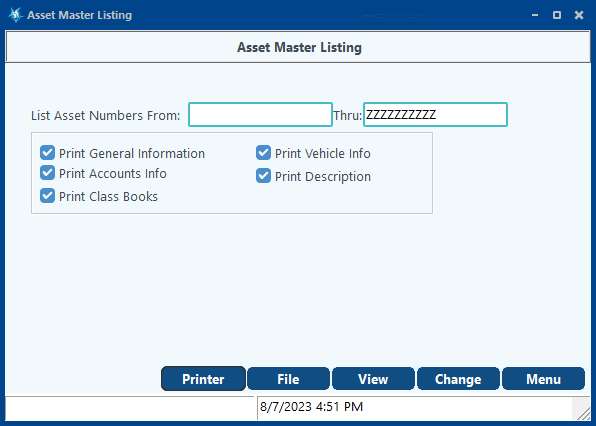

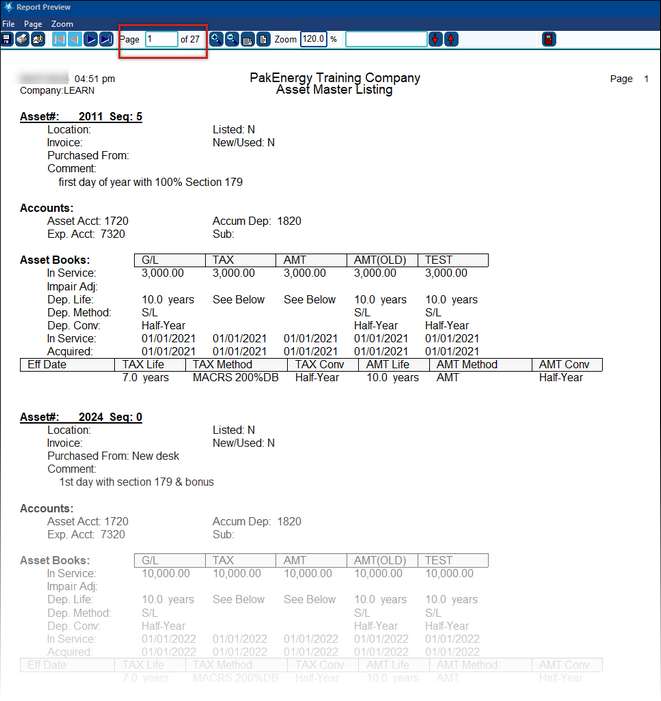

The Asset Master listing supplies basic information in regards to the asset or assets selected.

When all the options above are selected, this is an example of the output:

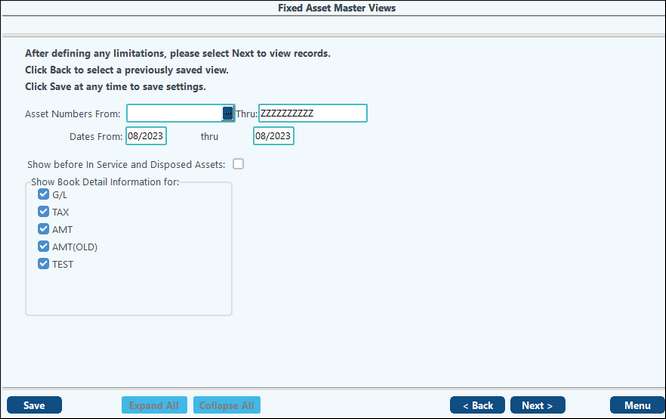

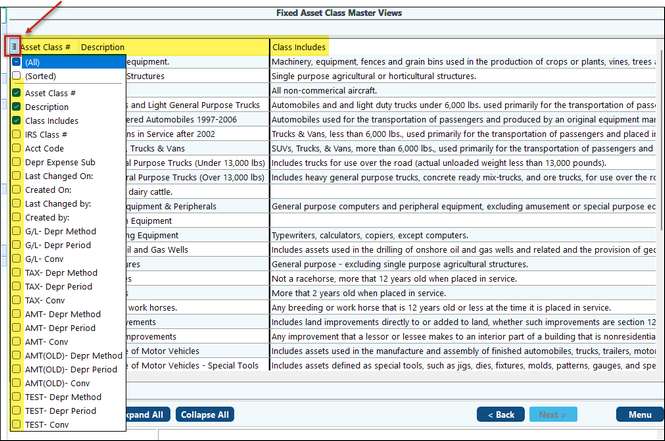

Asset Master View This is where the power of Pak Accounting Grid Views comes into play. There are several uses for the grid views: vehicle reports for governing bodies, run specific groups, etc. Asset Master Views works just like all the other grid views in the system.

Asset Detail Listing Provides a detail listing for an asset or range of assets for the specified book:

|