Classes are a way to group assets with similar properties together. This minimizes data entry by assigning default properties to the assets.

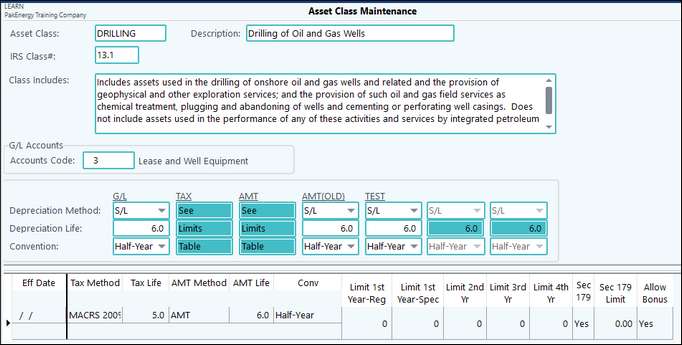

There are over 30 pre-defined classes, such as AUTOMOBILE or REALESTATE, which are used to categorize similar assets. These classes cover most accounting situations, but other classes can be added if needed. For example, the defaults for pre-defined class DRILLING will use 6-year, straight-line method for G/L (book1), 5-year MACRS (GDS) method for TAX, and 6 year life for ADS method or AMT book. Any assets you assign to class DRILLING will have these properties by default.

The default classes and values are adequate for most people, but may be overridden if necessary. To create a new class, use the Asset Class Maintenance screen. Use the First, Last, Next, and Prev direction buttons to review the pre-defined classes or click on list in the bottom, right corner.

If none of the classes fit your needs, define a new class using the Add button. The Asset Class may be up to 10 characters.

The G/L Accounts section must be completed, if you plan to import entries from the General Ledger or create accumulated depreciation entries from Fixed Assets module to the General Ledger.

Asset Class |

This can be up to 10 characters long. Pak Accounting will add and maintain limits for any IRS (Internal Revenue Service) class that does not already exist, as they are requested. You also have the ability to add your own class. All user defined classes will be set up using a prefix "U" to differentiate Pak Accounting maintained classes and user defined classes. |

|---|---|

Description |

Short description for the asset class. |

IRS Class# |

IRS Class number. |

Class Includes |

Basic assets that fit into the asset class. |

G/L Accounts |

Default Account Code for the class. By filling in a default account code as each asset is set up Fixed Assets will know what account code to assign to each asset based on the asset class. It can be overridden at the asset if needed. (Note: If assets are Imported from G/L the default account code will be ignored and assigned based on the asset account it was imported from). |

Deprecation Method/Life/Convention |

Default Depreciation Method, Depreciation Life, and Convention for each book. G/L (General Ledger) is set up by default but can be overridden if necessary. TAX (Tax) and AMT (Amount) are maintained by Pak Accounting and are shown in the Pak Accounting Limits section. As each new book is set up the remaining fields will become available to change. |

Set Pak Accounting limits |

Maintained by Pak Accounting on all default classes. Limits are set based on IRS (Internal Revenue Service) guidelines. (Note: The depreciation detail will show Capped if this limit is exceeded.) This also will show if the class is eligible for Section 179 deductions and what the limit is and if Bonus Depreciation is allowed. **User defined classes can fill in the Pak Accounting limits as needed. **Classes maintained by Pak Accounting cannot be overridden. |

List: There are two ways to list the asset classes.

•Class Master listing will list all of the classes and detail in a report format.

•Class Master Views will give a grid view format.