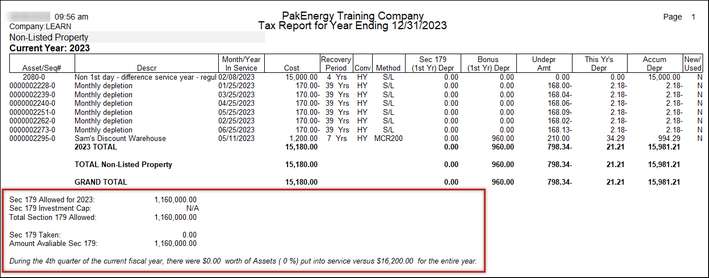

This report is designed to help you complete your Form 4562.

This should be run after all the assets are in for the year and should be the last step before sending the Depreciation Schedule to the CPA for tax preparation. It will run using the TAX (Tax) book and will list all assets for a company depending on whether they are listed or non-listed and whether or not they were purchased this year. For all assets purchased this year it will total the in service amount to see if the Mid-Quarter rule should be applied. If it meets the criteria it will apply the rule to the assets. The Mid-Quarter rule will be applied to the TAX and AMT books. You have the option to run for all years or to only include the current year. This will exclude asset values from the basis that were taken as Section 179 deductions.