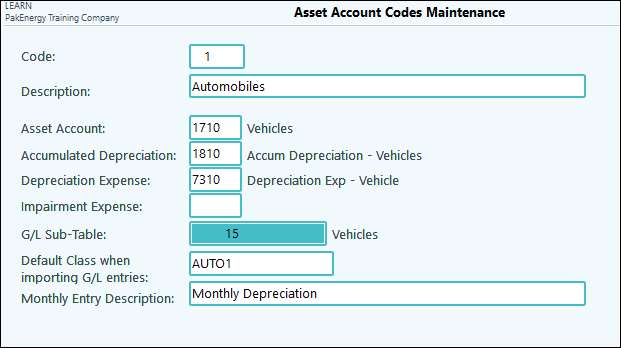

Account codes are used to determine which General Ledger accounts the information pulls from and which General Ledger accounts the information will post to when using the “Create G/L Entries”. This is also where the “Default Class when importing G/L Entries” is defined. The default class may be overridden, but the asset account, Accumulated Depreciation, and Depreciation Expense accounts always apply to assets that are given this particular Account Code.

Code |

Can be up to 4 characters long, either alpha or numeric. |

|---|---|

Description |

Short description for account code. |

Asset Account |

G/L (General Ledger) Asset Account number, used when creating G/L entries, when running the G/L Verification Report, and when Importing from G/L. Only asset accounts defined in Account Codes will be looked at when importing assets. |

Accumulated Depreciation |

G/L (General Ledger) Accumulated Depreciation account number, used when creating G/L (General Ledger) entries and running the G/L (General Ledger) verification report. |

Depreciation Expense |

G/L (General Ledger) Depreciation Expense account number, used when creating G/L (General Ledger) Entries. |

Impairment Expense |

Gives the ability to impair the value of an asset. |

Default Class when importing G/L (General Ledger) entries |

Used when Importing from G/L. The class will be automatically assigned if this is filled in, or it can be left blank. |

Monthly Entry Description |

Specify the description on the GL Entries. |