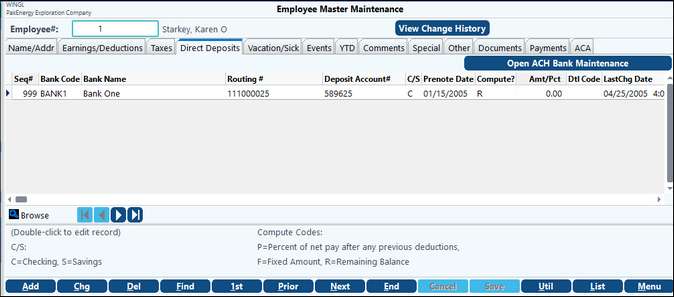

If an employee is having his payroll check deposited directly to a bank, this screen is used to define the amounts and bank accounts to use.

Double click on grid and enter the following information on the edit screen.

ACH/Direct Deposit |

|

|---|---|

Bank

[/?] |

Bank code as defined on Company Maintenance Menu > Advanced Options > ACH Direct Deposit Options. Each employee can split his or her check into (up to) 3 accounts. When the bank is entered, the bank name and r/t number will display, as defined in company maintenance. |

Pre-note Date |

If pre-note days were entered on the Company ACH options, a date field will display here. If you want a pre-note sent, this field should be left blank. If you change the account number or type and you want another pre-note sent, you should blank out this date field. After a payroll cycle is updated, the system will fill in the effective date of the pre-note (i.e. check date) in this field. The system will not create a direct deposit for this entry until the check date is after the pre-note date plus the number of days required for pre-note (defined on the company master). This should result in employees receiving a regular check for their first payroll. After x# of days, the system generates a regular transaction. |

Account Number |

Employee’s bank account number. Many credit unions use a different account-coding scheme for direct deposit vs. manual transactions. We recommend that you call each credit union and verify the account number to be used. |

Detail Code |

Select only when you want a specific Earning to go to a separate bank account. See example. Note: Only works with Percent or Fixed, remaining balance cannot be coded to a detail code. |

Account type |

Select what type of account will the deposit post. Checking acct or Savings acct |

Percent/ Fixed/ Remaining |

Defines whether the amount to be deposited is: •Percentage of the net pay after any previous deductions •Fixed dollar amount •Remaining Balance of pay check |

Amt/Pct |

If the above field is Fixed then: enter the amount of the deduction. If the above field is Percentage then: enter the percentage amount of net pay to be deducted (i.e. 10% would be entered 10.0) If the above field is Remaining then: no amount needs to be entered in this field |