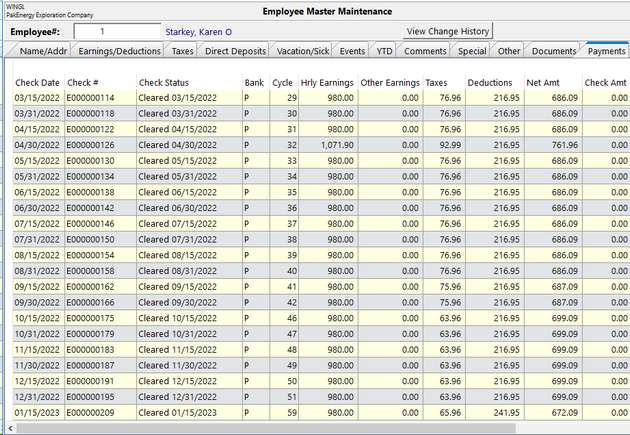

"Payments" tab that show the payments (check history) for the employee. This will list all checks written/voided to each employee. When the user double-clicks on the line, it shows the check history screen for that check.

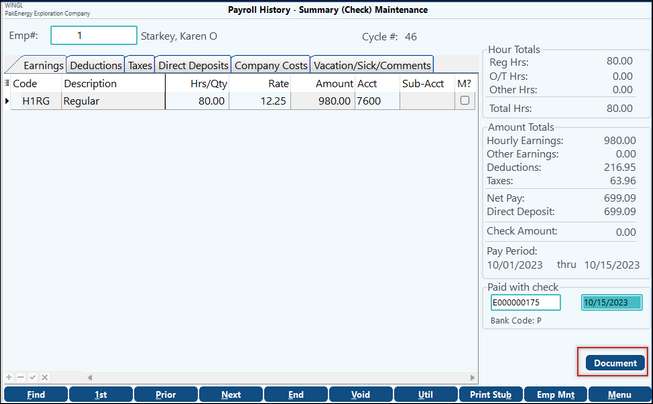

If an image was scanned in during the cycle, such as a time sheet, it can be viewed by finding the payment, double-clicking to see the check history, and then clicking on the "Document" button. In addition, if there is a need to scan in documents for prior payments for employees, simply find the payment, double-click to see the check history, click on the "Document" button, and scan the document in as normal.

On any line of the grid, in addition to the double-click option to see check history detail, right click provides all of the master grid options (export, print, etc),

Additionally, right-clicking on the title row will make column related options available.

Void a Payroll Check and Create Reversing G/L Entries

This can be done through the Summary (Check Maintenance). As previously discussed, this can be accessed through Employee Master or Check History.

1.Find the Employee and Check that needs to be corrected.

a.If accessing through Employee Master > Payments tab, there will be a list of previous payments. Find the one that needs to be corrected and double-click on it.

b.If accessing through Check History, use the Find button to bring up the correct employee and check.

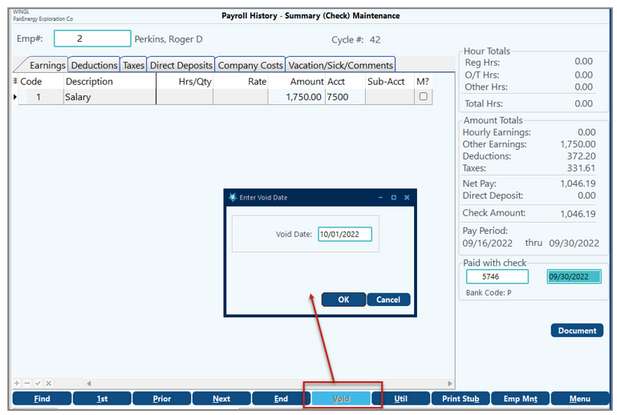

2.Once the correct item is in view, click on the Void button.

3.Input the General Ledger Effective Date of the reversing entries and press OK.

4.The system will then allow you to print out the reversing entries. This will show you all the entries it made to the G/L. Once you close, you cannot recreate this report, so print it when you can – you will need it later if also voiding the EFTPS payment.

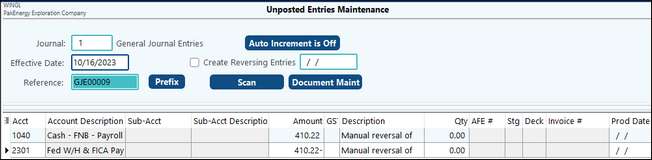

5.When you are finished, you must go to the General Ledger module/ Unposted Entries Maintenance to post these entries unless you have turned on the automatic post feature in Ledger options in Company Maintenance. An additional entry will have to be made to reverse out the company portion of the payroll taxes.

6.If you are using direct deposit, when voiding a check the ACH direct deposits amounts that were made will be voided and reversed also.

7.Print Stub - select this button to reprint

NOTE: Reference numbers are automatically generated in the general ledger for the entry. See next number assignment

Utility - allows you to Mass Change Check History or Mass Delete Check History

If you need to print a replacement payroll check, see Reissue Check Option.

Voiding an EFTPS Deposit Payment

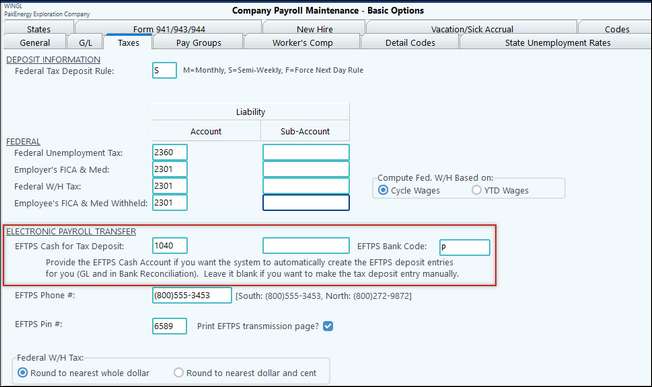

The EFTPS setup is in Basic Options/Taxes tab/Electronic Payroll Transfer section. If it is not set to create the EFTPS draft, then no further action is necessary.

When a payroll check is voided, the EFTPS payment that was made must be corrected. Voiding the payroll check will only create voiding entries for the payroll check. A separate journal entry will need to be made to manually void the tax deposit.

Using the report that was printed during the Void process find the accounts and amounts to be reversed out. The TAX section shows the employee portion of the taxes. The COM section is for the company portion of the taxes.

1.First, if you’re not sure if the EFTPS Deposit is created automatically, you can look in Payroll/Basic Options/Taxes tab. If the EFTPS Cash for Tax Deposit is filled in, then the system creates the tax deposit. Meaning, when you void a payroll check you will also need to do a Journal Entry to reverse out that employee’s portion of the tax deposit. If this box is not filled in, then no Journal Entry is required after voiding the payroll check since the company manually calculates their tax deposit.

The example below shows a payroll cycle that only included a single employee; however, it’s more likely that a single check will be voided from a larger payroll cycle. The steps are the same.

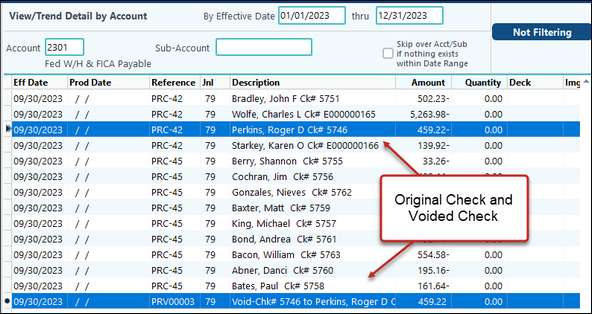

2.After you run your payroll cycle, you can look at your cash account in View/Trend and see the entries that have been made. There will be one for the payroll check and one for the EFTPS Tax Deposit. The payroll will add money to the liability accounts while the Tax Deposit will pay it out. Voiding the payroll check will only create voiding entries for the payroll check; however, we will need to do a separate journal entry to manually void the Tax Deposit.

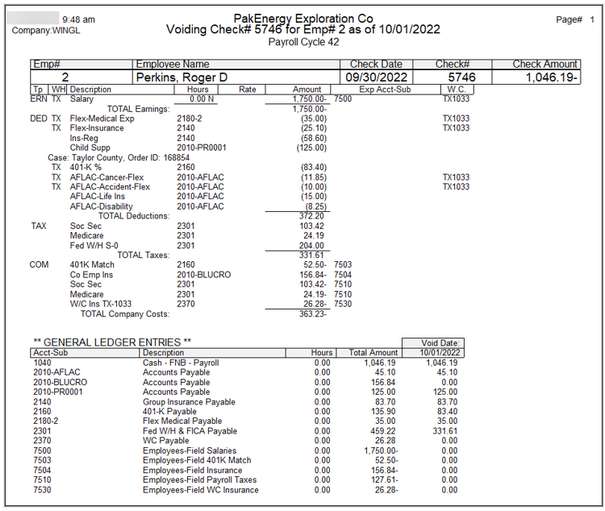

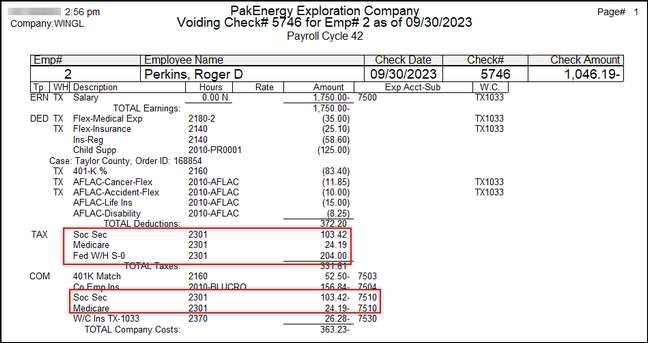

3.When voiding the payroll check print out the VOIDING CHECK # report (shown below), it’s the only time you will have access to this report. Looking at the highlighted area below you will see the entries being made back into the liability accounts.

a.The TAX section shows the employee portion of the taxes. Notice that the Soc Sec and Medicare both hit the 2301 account and total $127.61. The Fed W/H goes to the 2301 account and totals $204.00.

b.The COM section is for the company portion of the taxes. The total of these is $127.61.

c.We will need these accounts and this amount for the Journal Entry we will need to manually void the Tax Draft.

4.Using the amount from the Void report (shown previously) a Journal Entry will need to be done to manually void the Deposit that was done. In this example, since all the entries are going into the same account, I combined them together. It will be up to you if the entries should be separated or combined if going into the same account.

5.Once the Payroll Check and the EFTPS Tax Deposit have been voided you will be able to see the entries in the cash account. Depending on how your company maintenance is setup, the Payroll may post as a lump sum.

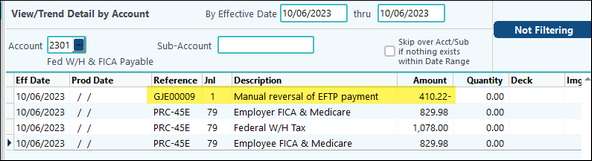

6.This is how the 2301 account will look after the void and correction.

The EFTPS payment is a little trickier since it's a lump sum from the entire payroll cycle.