Multi-Company A/P is an add-on feature to the Accounts Payable Module. It adds the ability to enter an invoice into one (parent) company, but code the entries (expenses) into multiple companies. Companies can either be Cash, Accrual, or a mix of each. See the summaries below for each option for information on how entries will be booked.

When using Multi-Company A/P with Pak Accounting’s Scanning feature, the images scanned at the time of invoice entry will also be sent to the subsidiary company for viewing. Multi-Company can also be used in Standard Entries.

There are three different ways of using Multi-Company A/P:

(Option #1 - No) Entire Invoice is paid by one company (uses inter-company account to record due to/from in both the paying and the expensing set of books).

•Invoices are entered in the company that will be writing the check and the user codes and breaks down the invoices to the appropriate company, account, and cost center combination.

•The system automatically uses an inter-company account (with a separate sub-account for each company) to offset the recorded expenses in the other set of books, but the entire Invoice stays intact in the accounts payable of the company it is entered into.

•Checks are written from A/P as normal with no real concern as to which company(s) the invoices were coded to.

•Sharing images across companies.

•Able to code deck in non-primary company.

•If Cash, Accrual, or a mix of both: The invoice portion will be dated according to the company it's entered in. The due to/from account will have the same date as the invoice regardless of if the company it's going into is Cash or Accrual.

(Option #2 - Yes) Invoice is split and paid by the company(s) expensing the invoice (Split Invoice).

•All Invoices (regardless of company that is to pay it) can be entered in one company.

•When the entered invoices are updated, the system will automatically send the invoices in whole or split the invoices into as many pieces as needed to correspond with which company(s) the invoice was coded to.

•Checks are written out of each company.

•Multiple company check writing and Due date list available to facilitate printing checks from two to hundreds of companies with one touch of the button (magic of the system’s MICR encoding).

•Sharing images across companies.

•Able to code deck in non-primary company.

•If Cash, Accrual, or a mix of both: The date of the invoice will depend on the company it's going to. For example, if it's going into a Cash basis company the date will be 12/31/9999. If it's going into an Accrual company it will be the invoice date.

(Option #3 - First Coded Company) First Coded Company Option. Invoice coded to the company that the first expense is coded to.

•All invoices (regardless of the company that is to pay them) can be entered into one company.

•When entered, the First Coded Expense is the company that the Invoice will be posted to.

•One check, written out of first company of first code expense.

•Sharing images across companies.

•Able to code deck in non-primary company.

•If Cash, Accrual, or a mix of both: The date of the invoice will depend on the company it's going to. For example, if it's going into a cash-basis company, the date will be 12/31/9999. If it's going into an Accrual company, it will be the invoice date.

Note: Advantage for using the First Coded Company Option, A/P Approvals also can be taken care of through one company.

Accounts Payable duplicate checking will still work with Multi-Company A/P enabled. If you would like to enable duplicate checking across multiple companies you will need to enable this feature in A/P Company Maintenance > Multi-Co Options. This option can be enabled via a switch in A/P Company Maintenance.

BONUS FEATURE: With the Multi-Company option turned on, the multiple company coding option also becomes available in Standard Entries!

Multi-Company A/P (Option #1 – Entire Invoice Paid by one Company):

Setup:

1.ALL companies (Parent and subs), must have the same setup for:

•Inter-company account (2105 in our example).

•Sub-Table for inter-company (65 A/P inter-company in our example).

•Vendor Sub-Table and setup in Sub-Account maintenance.

2.Set up Sub-Accounts (using the inter-company Sub-Table) for each company (parent and subs). Use the 5-digit company code for the Sub-Account.

3.In Company Master Maintenance, under A/P Entry > Multi-Co Options Tab, enter the Inter-company account and Sub-Table for inter-company.

For this option of Multi co A/P, the "Split Invoice by Amount" is set to NO.

NOTE: Company from which the A/P invoices are keyed into must have A/P setup on an Accrual basis and all of the G/L entries will be created on an "Accrual basis" (i.e. recorded into the G/L based on the entry's effective date) (Company books can still be maintained on a cash basis by knowing when an invoice is going to be paid and recording the invoice with an effective date of the payment date.)

USE:

Once you have Multi-Company A/P setup…

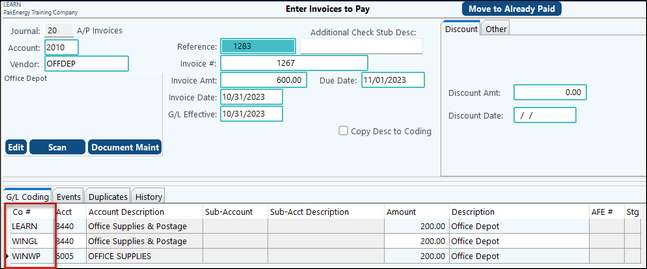

1.Enter invoices into the parent company using Enter Invoices to Pay Screen.

A new option will be available on this screen for you to select the company to record the entry.

2.Update/Post invoices.

NOTES:

•If you un-update the invoice, the system will un-update the parent company's portion of the invoice to the expense account but not the sub-company's portion of the invoice to the intercompany account.

oTo make changes to the sub-company's invoice, you must unpost the entry in General Ledger > Manual Entries > Unpost Entries in the sub-company, not the parent company.

oIf you change the amount, make sure you create corresponding entries in the parent company's intercompany account.

•If the entry you want to un-update involves a large number of subsidiary companies, it would be more effective to enter a credit invoice, reversing the invoice out. This will save you from having to un-update the invoice in each subsidiary company.

3.Print checks using normal A/P check writing.

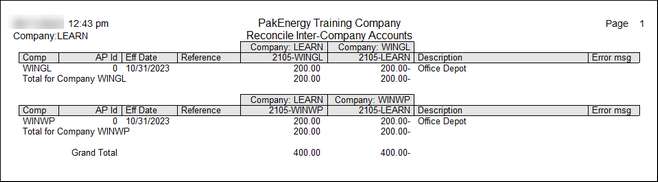

4.Generate Reconcile Interco Account report to help you reconcile your inter-company accounts (account #2105) if they get out of balance.

SETUP:

1.ALL companies (Parent and subs), must have the same setup for:

•Inter-company account (2105 in our example).

•Sub-Table for inter-company (65 <A/P inter-company> in our example).

•Vendor Sub-Table and setup in Sub-Account maintenance.

2. Set up Sub-Accounts (using the inter-company Sub-Table) for each company (parent and subs). Use the 5-digit company code for the Sub-Account.

3. In Company Master Maintenance, under A/P Entry > Multi-Co Options Tab, enter the Intercompany account and Sub-Table for intercompany. For this option of Multi-Co A/P, the "Split Invoice by company" is set to YES.

NOTE: Company from which the A/P invoices are keyed into must have A/P setup on an Accrual basis and all of the G/L entries will be created on an "Accrual basis" (i.e. recorded into the G/L based on the entry's effective date) (Company books can still be maintained on a cash basis by knowing when an invoice is going to be paid and recording the invoice with an effective date of the payment date).

USE:

Once you have Multi-Company A/P setup…

1. Enter invoices into the parent company using Enter Invoices to Pay Screen in Accounts Payable. A new option will be available on this screen for you to select the company to record the entry.

2. Update/Post invoices.

NOTES:

•If you un-update the invoice, the system will only un-update the parent company's portion of the invoice. To make changes to the sub-company's invoice, you must unpost the entry in General Ledger > Manual Entries > Unpost Entries in the sub-company, not the parent company. If you make changes to the amount, make sure you create corresponding entries in the parent company's inter-company account.

•If the entry you want to un-update involves a large number of subsidiary companies, it would be more effective to enter a credit invoice, reversing the invoice out. This will save you from having to un-update the invoice in each subsidiary company.

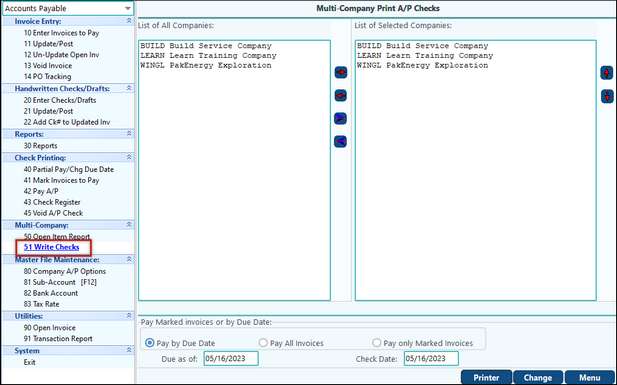

3. Writing check procedures

•Instead of writing checks using “Pay AP”, use the Multi-Company check writing option. (NOTE: this menu item is only available if using "Yes" option for Split invoice in company maintenance).

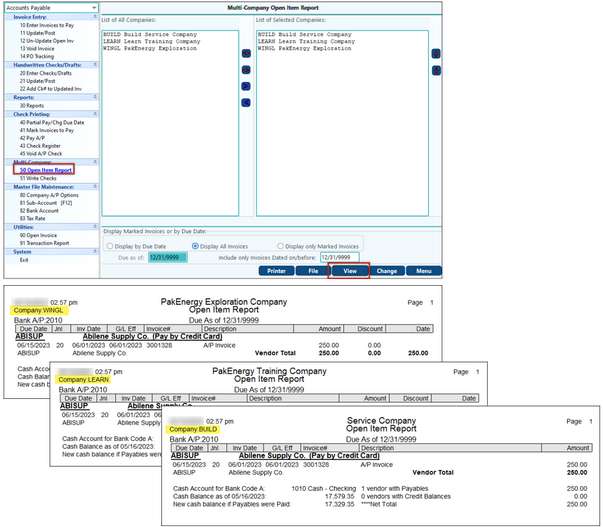

•Print the Open Item report (under Multi-Company) to view open item invoices that will be paid. Select the companies to print.

Note: The open item list will print one company at a time.

•The Check writing screen for Multi-company (similar to the Open Item report screen. Allows you to select the company's checks to write, which checks to write (by the due date, all invoices, or marked invoices (invoices are marked in the individual companies) and enter the check date to print on the checks.

Note: The checks will print one company at time.

First Coded Company Option (Option #3)

SETUP:

1.ALL companies (Parent and subs), must have the same setup for:

•Inter-company account (2105 in our example).

•Sub-Table for inter-company (65 <A/P inter-company> in our example).

•Vendor Sub-Table and setup in Sub-Account maintenance.

2. Set up Sub-Accounts (using the inter-company Sub-Table) for each company (parent and subs). Use the 5-digit company code for the Sub-Account.

3. In Company Master maintenance, under A/P Entry > Multi-Co Options Tab, enter the Inter-company account and Sub-Table for inter-company. For this option of Multi-Co A/P, the "Split Invoice by company" is set to First Coded Company.

The reason behind using the First Coded Company option is it allows you to stay in one company code to create all A/P Invoices for as many different company codes as you have set. This ultimately saves you time from having to change company codes just to create invoices. This also has them recorded and paid out of the company code that is listed on the first line item of the coding part of the invoice. So, whether you use a Single Invoice or a Split Invoice, it will always look at the first line of coding to know which company code is receiving and paying the invoice.

NOTE: When using First Coded, Intercompany Duplicates needs to be enabled.

USE:

Once you have Multi-Company A/P setup…

1. Enter invoices into the parent company using Enter Invoices to Pay Screen in Accounts Payable. A new option will be available on this screen for you to select the company to record the entry.

2. Update/Post invoices.

NOTES:

•If you un-update the invoice, the system will only un-update the parent company's portion of the invoice. To make changes to the sub-company's invoice, you must unpost the entry in General Ledger > Manual Entries > Unpost Entries in the sub-company, not the parent company. If you make changes to the amount, make sure you create corresponding entries in the parent company's inter-company account.

•If the entry you want to un-update involves a large number of subsidiary companies, it would be more effective to enter a credit invoice, reversing the invoice out. This will save you from having to un-update the invoice in each subsidiary company.

3. Writing check procedures

•Use the Multi-Company check writing option.

NOTE: This menu item is only available if you use the Yes option for Split Invoice or the First Coded Company in company maintenance.

•Print the Open Item report (under Multi-company) to view open item invoices that will be paid. Select the companies to print.

NOTE: The open item list will print one company at a time. Therefore, after you are done Viewing/Printing the Open Item Report for one company, close the report by using the Red Door icon, and the system will generate the Open Item Report for the next company that you have selected to see.

The Check writing screen for Multi-Company (similar to open item report screen), allows you to select the companies checks to write, which checks to write (by due date, all invoices, or marked invoices invoices are marked in the individual companies) and enter the check date to print on the checks.

Note: The checks will print one company at a time consecutively so that you don’t have to log off and log on.

Multi Company A/P and General Ledger Standard Entries

•An added bonus feature to Multi-Company A/P allows users to enter in Standard Entries.

•Standard entries for A/P are similar to the A/P invoice entry screen. Select the company to post the invoice to on the expense side of the entry.

•(To access the Standard Entries screen, first go to General Ledger > expand Automatic Entries > select Standard Entries)

•Standard Entries – G/L Entry Option also features the ability to handle G/L multi-company entries!

Multi-Company A/P Invoice Duplicate Checking

Just like your standard A/P duplicate invoice checking, Multi-Company A/P Invoice Duplicate Checking will check across all Multi Companies for duplicate invoices. It will display which company it finds a duplicate invoice in. Criteria that the duplicate is validating for are the Invoice # & Date and optional Amount. See Multi-Company A/P Invoice Duplicate Checking.