Frequently Asked Questions about the General Ledger

Click on the blue link for the answer.

When looking for entries just posted and not finding them, try looking in General Ledger/Entries > Unposted Entries Maintenance because all entries, no matter what sub-system they are coming from, go through the General Ledger when posted and if they have an error, will go here for you to correct and Post.

Common errors: Outside the Posting Allowed Date Range, Invalid Account, Sub-Account or posting a cash entry to a closed Bank Reconciliation period. |

When you start on Pak Accounting, before you can reconcile your first bank statement you must enter in the outstanding checks from your previous system. You enter just the checks that are still outstanding in Check History in the Bank Rec Module. |

YES. You do not have to have beginning balances in order to work on Pak Accounting. You can make journal entries, post A/P, enter Check stubs, etc, without having the balances entered. You enter your beginning balances in Entries Maintenance in the General Ledger module. We recommend you use journal 100 Manual Balance Forward Entries. Note: You must have the balances entered before you can reconcile the bank statement. |

See Troubleshooting Issues on Bank Reconciliation. |

There are some restrictions when unposting certain items. The most common reason that this particular entry cannot be unposted is that it has a Paid date or a Revenue / Billing Extract date. The entries could have been coded to an Accounts Payable account and subsequently paid or coded to Revenue/Billing accounts and been extracted through the cycle. Entries that involve an A/P account and were paid can be voided through the A/P system. Reversing entries can be made if necessary for the Revenue/Billing entries that will be included in the next cycle. If the entry is large in nature, the Copy Entries utility found in the General Ledger module can be used to copy the entry and to reverse it as well. |

The easiest way to change the incorrect sided of the entry is through View Trend. Find the account and the entry. Drill down to the Detail by Journal level and change the account by clicking into the account field and either typing in the correct account number or using the drop-down box to find the account needed. |

Pak Accounting does not force a traditional closing of the books at the end of a fiscal period. It is recommended that you move the Posting Allowed Date Range forward for all classes of users that work in Pak Accounting which will then allow the system to automatically make balance forward entries for the next fiscal period! You are allowed to go back into a prior year if necessary. Use caution if performing a task that could affect financial statements for the year. |

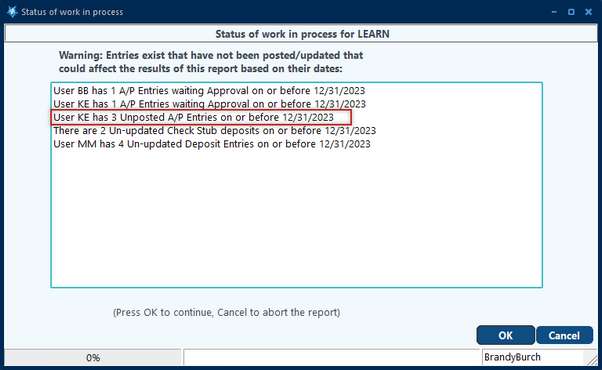

If anyone in the office has any unposted or unapproved entries in the system, you may receive a Status of Work in Progress window. This window is informational only and is just letting you know that there are unposted entries since only posted entries will pull into a report. This message will show the UserID of the person with unposted entries, and what module they are located in. The line item in the red box below tells us that user KE has 3 unposted Accounts Payable entries that could impact the report that is being viewed.

Once the entries have been identified, you can speak to that user about those entries to see if they will affect your report. If these entries are needed for your report, click OK to continue. |