Bonus Check using Direct Deposit Examples

Assumptions:

•Detail Code for Bonus (#7 in our example) is already setup in Company Detail Codes and is also on the Employee Earnings/Deductions screen.

•Direct deposit is already setup for this employee with remaining balance going to designated account.

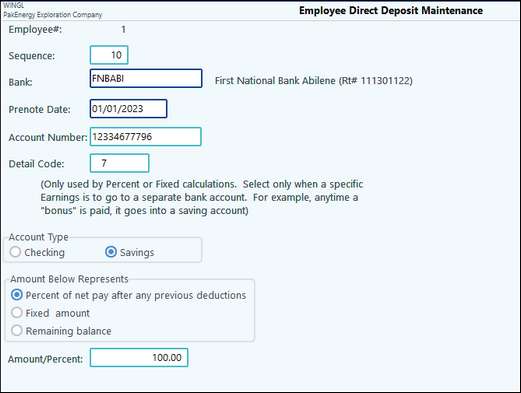

Example #1: Employee gets a separate Bonus Check and they want the entire check to be deposited to their savings account instead of their checking account.

Set up a new Direct deposit for this employee. Enter the detail code for Bonus (#7) into the designated field.

Select the Percent option and enter the 100% in the amount/percent field.

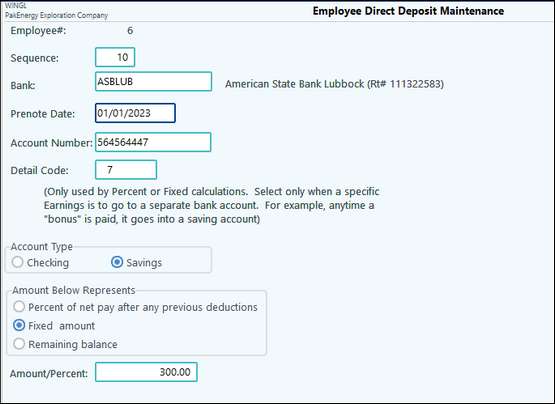

Example #2: Employee gets separate Bonus Check and they want the first $100 to go into Savings, and the rest to go where their check normally goes.

Set up a new Direct deposit for this employee. Enter the detail code for Bonus (#7) into the designated field.

Select the Fixed amount option and enter the $100 in the amount field.

Note: if the net amount of the check is less than $100, then the entire check will go to Savings.

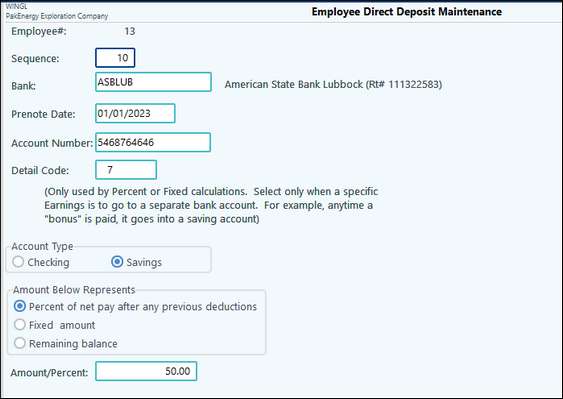

Example #3: Employee gets separate Bonus check and they want half of the net to go to Savings and the other half to go to where their normal check goes.

Set up a new Direct deposit for this employee. Enter the detail code for Bonus (#7) into the designated field.

Select the Percent option and enter the 50% in the amount/percent field.

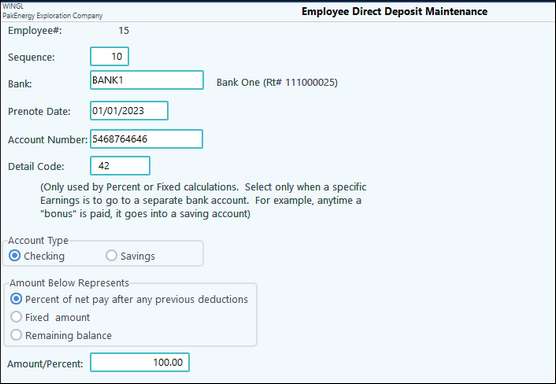

Example #4: Employee gets reimbursed via a GL Balance directly to payroll. Employee wants all of that reimbursement to go into a different bank account.

Set up a new Direct deposit for this employee. Enter the detail code for Reimbursement (#42) into the designated field.

Select the Percent option and enter the 100% in the amount/percent field.