Depletion – GAAP is an optional part of the General Ledger system. This module is used to generate General Ledger entries to adjust the Net Book Value via the asset's accumulated depletion account(s).

The Depletion – GAAP module pulls information from the General Ledger which may originate from other Pak Accounting modules. The three that will be focused on include Accounts Payable, Check Stub, and the General Ledger modules. First, in Accounts Payable the investor typically enters the Leasehold costs, as well as other costs, that were incurred to get the well operational. These entries help establish the asset balances.

After the well becomes operational the investor begins receiving revenue checks from the operator. These are entered into the General Ledger system using the Check Stub module. The information that is used from this data entry includes the Production data and the Gross Revenue quantity.

The use of the General Ledger is to update Pak Accounting to the latest values of accumulated depletion for assets that were being depleted prior to using the new Depletion – GAAP module.

Accounting Concepts In summary, using the Successful Efforts methods of capitalizing costs associated with drilling a well, capitalized costs are depleted based on the number of units produced. For some costs, the depletion is based on the Proved Reserves while others are depleted using the Proved Developed Reserves.

The Flow The big picture of steps surrounding the Depletion – GAAP update.

1.Accounts Payable – enter the invoice/JIB received 2.Check Stub Entry – record the revenue detail for each stub by asset (well) and production date 3.Update the Accumulated Depletion for the desired month.

|

Each Asset Account Type will have a corresponding Accumulated Depletion Account. For Example: If there are 2 different Intangible Asset Accounts (Intangible Completion and Intangible Drilling) there will be one Intangible Accumulated Depletion account. 1)Compute the Depletion Base – (Leasehold accounts – accumulated leasehold depletion) + (Intangible Accounts – accumulated intangible depletion) + (P&A accounts – accumulated P&A depletion) + (Tangible Accounts – accumulated Tangible depletion) = Depletion base 2)Compute the Unit Depletion Rate – Current Period Production / Current Reserves 3)Charge the depletion based on units of production for the current period – Depletion Base x Unit Depletion Rate New reserve studies can be entered monthly, quarterly, semi-annually, or yearly. The system will make adjustments to the “Unit Depletion Rate” based on those updated reserve studies to keep the Depletion expense accurate. When changes are made to the asset accounts, those changes will also impact the “Unit Depletion Rate”. |

1. Set up Depletion Accounts.

2. Set up Depletion-GAAP in Master File Maintenance > Company.

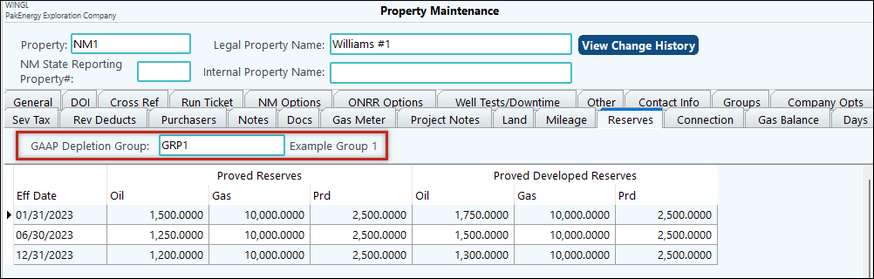

3. Enter / Import Reserve Studies in Maintenance > Property.

4. Calculate Depletion in Update > Calculate Depletion.

5. Review posted entries in View Trend (F4). |

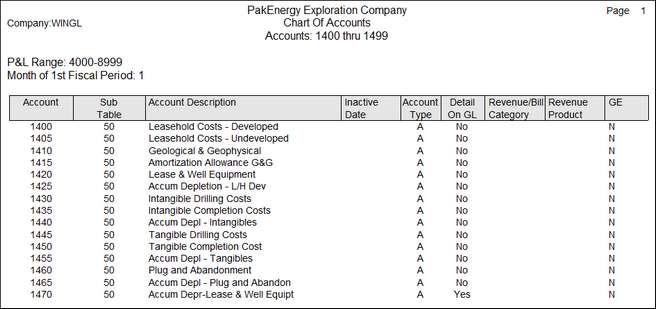

Review Pak Accounting’s Quick Start Chart of Accounts. The diagram below shows an example Chart of Accounts, summarized by account range.

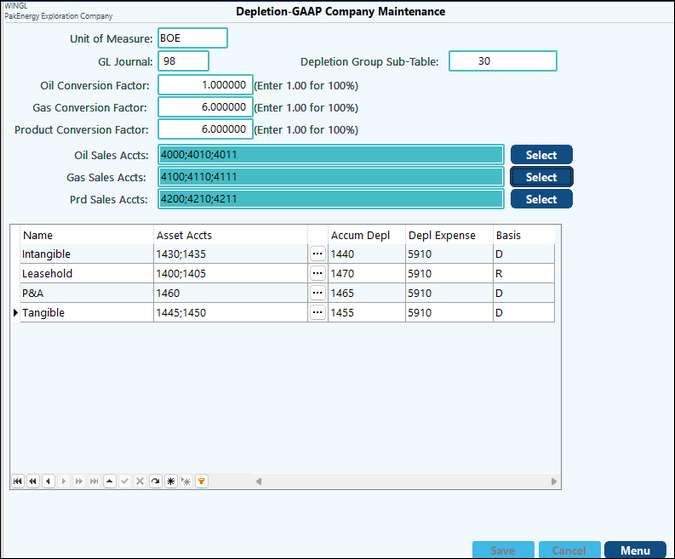

Make sure that the chart of accounts includes at least: •one asset account for each type of asset (Intangible, Leasehold, P&A, and Tangible) •only one accumulated depletion account for each Asset Type •one or more depletion expense accounts depending on desired impact on the Income Statement o Pak Accounting only requires 1 Depletion Expense Account, but there could be 1 account per asset type oThe corresponding revenue accounts for the products included in your reserve studies. Currently GAAP depletion supports Oil Sales/Gas Sales/Product Sales. However, it is only necessary to define sales accounts for the products that are included in your reserve studies. More than one account may be defined for each type of Sales (For example: Oil Sales – Working Interest., Oil Sales – Royalty Interest, and Oil Sales – Override Interest). Below is an example of Accounts that might be utilized (Note that they all have the Property Sub-Table: 50, attached).

|

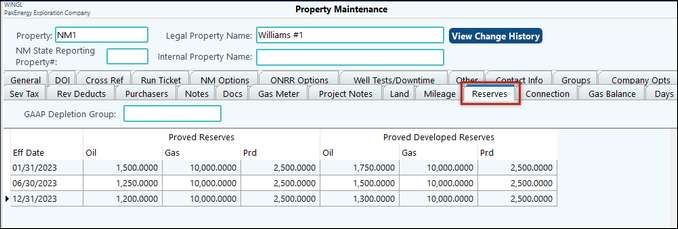

PR (Proved Reserves) vs PD (Proved Developed Reserves) – these are both bases that are utilized for calculating depletion. By default the Leasehold Asset accounts look to the reserve study for PR (Proved Reserves). The remaining asset types (Intangible, P&A, and Tangible) look to the PD (Proved Developed Reserve) study. The basis options for the Asset types are system defined meaning that the basis may not be overridden. However, if there are leasehold costs that need to be depleted based on PD (Proved Developed Reserve) study, include those Leasehold Accounts in another asset type other than the “Leasehold” accounts. However, if there is no “Proved Reserve” Study available, then all asset accounts should be reflected on the Intangible, P&A, and Tangible rows. To add a new reserve study, go the to the Reserves tab (last tab in the Property Maintenance), and then click on the green “+” sign (see below):

Enter each reserve study for the property, the effective date of the reserve study, and the corresponding reserve and product values. Once the data is entered click on “Save” or press the F10 hotkey on your keyboard to save. If there are multiple reserve studies, then add in multiple rows of entries. Import Reserves Reserves can also be imported from Excel. Supported formats are XLS, XLSX, or CSV. The required fields are LeaseNum and EffDate. The EffDate must be the end of a fiscal period. When importing reserves for Proved or Proved Developed, the effective date must be different if there are reserves that already exist. In addition, the effective date must be on the last day of a fiscal period (month, quarter, year). Reserves can also be imported to a fixed #Allocation. The #Allocation will need to be coded in the LeaseNum field and must be a fixed allocation.

Mass Delete This button provides the ability to remove reserves for a specified effective date (or date range) from the Property Maintenance / Reserves tab. It is recommended to create a Pak Accounting backup first. Exercise caution when using this utility. |

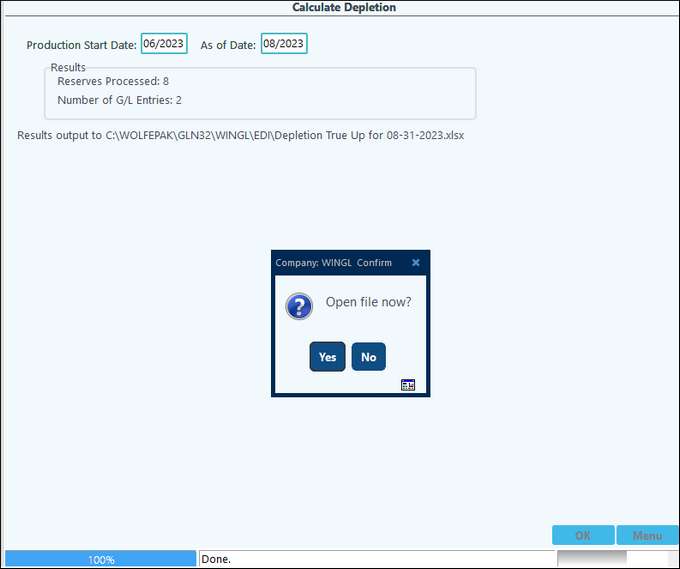

After the Oil and Gas income and asset adjustment entries are completed for the period, go to Depletion-GAAP module > Update > Depletion Reserves and enter in the General Ledger effective month and year (MM/YYYY) that is ready to be updated and click “OK.”

Once the data finishes processing the screen will populate with the number of reserves processed, number of G/L entries created, and location of the excel spreadsheet created (see below):

Once the process is completed for the period, review the entries the system created by going to the View/Trend (F4).

After the entries have been posted, for any questions about the values, review the Excel workbook that was created to show the calculation steps. The location of the Excel workbook is provided on the "Results” section upon generation. The excel file will provide one tab for each account type. |

|

Once all necessary accounts have been created, set up the Depletion-GAAP Company Maintenance.

|