This will create and automatically post all of your depreciation entries. You have the option to create the entries for any existing book. You can create monthly entries or year-to-date entries. If year-to-date entries are created the entire amount will be booked in the current period the entries are being created for. To create monthly entries for past periods you can select those periods one at a time and create the entries for each month. The effective date of the entries will be the last day of the month for the current month entries are being created.

Before Beginning

First, the General tab on the Asset Master Maintenance screen must be completed.

Next, it is a good idea to run the Tax Report. This will ensure you have not gone over on any Section 179 deduction or Bonus Depreciation limits. It will also test the Mid-Quarter Rule and apply it if necessary. You have the option to view the G/L (General Ledger) entries that are about to be created.

Notes about Adjustments

When creating General Ledger entries, Fixed Assets will make the entries needed to keep your accumulated depreciation account in balance. If you create depreciation entries and then change your asset detail, you can create depreciation entries again, and it will make the correcting entries needed to correct the prior entries already made. Fixed Assets will force the entries made from the system to stay in balance between General Ledger and Fixed Assets. Please refer to the (General Ledger) G/L Verification Report. to ensure the two are always in sync.

Please remember that if you make manual journal entries in General Ledger to your accumulated depreciation account defined in Account Codes Fixed Assets will not recognize the entries and will not make the entries needed to keep General Ledger and Fixed Assets in balance.)

Making Entries

Fill in the necessary information. The Effective Date controls which entries will be exported.

Depreciation entries - 2 entries are made for each asset:

•a CREDIT to accumulated depreciation.

•a DEBIT to depreciation expense.

Sales - Up to 4 entries are made:

•a DEBIT to cash for the sales amount (if not 0.00).

•a DEBIT to accumulated depreciation for total depreciation to date.

•a CREDIT to the assets Asset account for the original purchase amount.

•the difference is applied to the assets Depreciation Expense account.

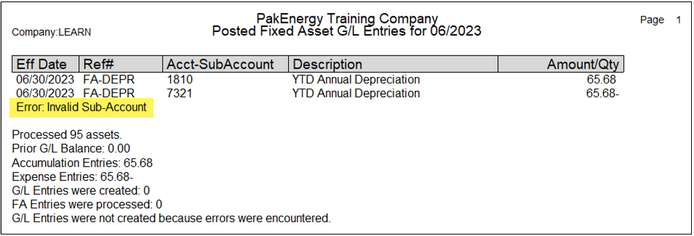

Click on Printer, File, or View to start the process. This will generate a report for you. Pay attention to any Error messages.

Invalid Account #’s can be researched in the Account Codes setup.

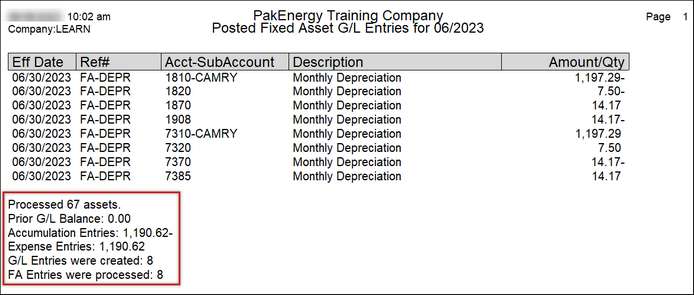

Example of completed posting.

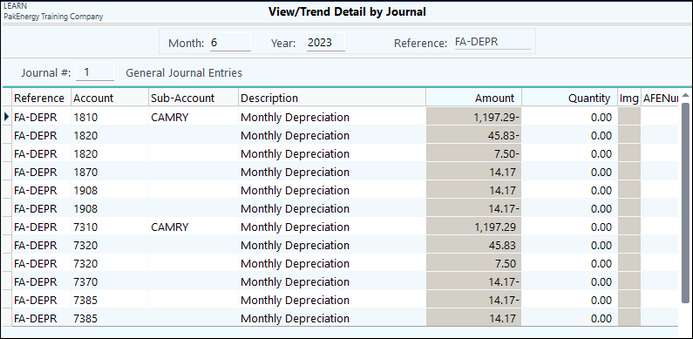

These entries can be seen in View/Trend. Pick one of the accounts from the report. Drilling down to the Detail by Journal, you can see the entire entry.