This report is designed to reconcile your assets to your General Ledger system. The comparison should only be done in the Book that the user creates the G/L entries in which is , most often. the GL Book. It will compare the detail in Fixed Assets to the asset and accumulated depreciation accounts defined in your Account Codes to your General Ledger.

If you have out-of-balance issues, this means that you have either not Imported all of your assets from General Ledger or that you have assets in your Fixed Assets system that are not in your General Ledger.

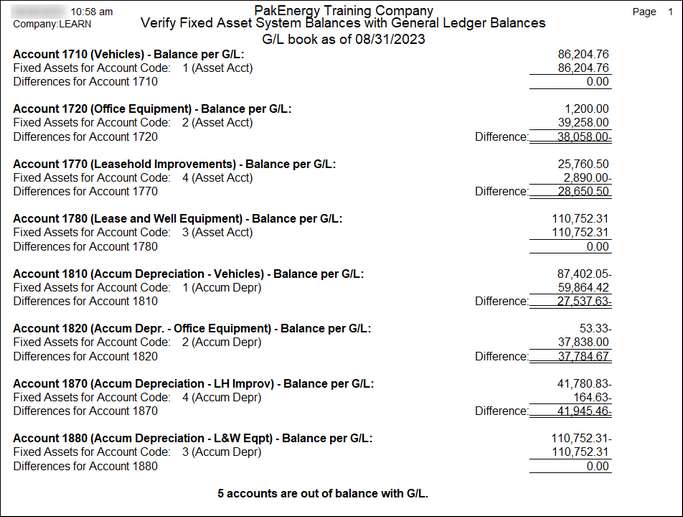

Example:

In the example above, the accumulated depreciation account balances are higher in Fixed Assets than they are in General Ledger. This is a good indication that the Depreciation entries haven’t been entered for that period. A comparison of the General ledger entries and the Depreciation Schedule for that period will verify whether or not the depreciation entries were created.

There are other situations that may cause these to become out of balance:

1.Entries to asset or accumulated depreciation accounts that are in General Ledger, but are not in Fixed Assets.

2.Assets that were manually added to Fixed Assets, but are not in the General Ledger

3.Assets that were marked as sold in Fixed Assets, but the “sale” was not recorded in the General Ledger.