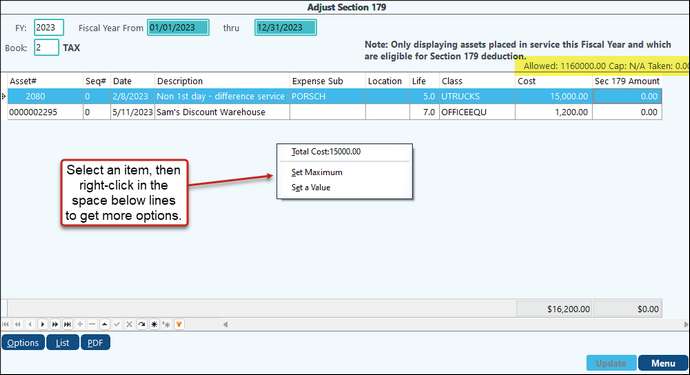

This screen will show existing assets eligible for Section 179 deductions and placed in service for the current Fiscal Year. The assets themselves are created in the Asset Maintenance menu.

This utility is used to adjust Section 179 deduction amounts. You can fill in the Section 179 amount per asset, when you have all amounts as needed select Update to add the deduction amounts to the assets.

Note: Please see Company Limits and Class Limits for annual deduction limitations on Section 179. The limits will only be applied to the TAX and AMT books.

Regarding Allowed, Cap, and Taken Calculations:

•If there is not a Class Limit detail record an error may be reported. (Normally this shouldn't happen)

•If Sec 179 is NOT allowed the value on an Asset is forced back to Zero and an error may be reported.

•If it is allowed and the Sec 179 Limit value is set as Zero, then the cap will be unlimited.

•If it is allowed but the Cap value is non-Zero, then the system checks if the value against the amount used. If it exceeds the amount used, the cap is applied, and the value for Section 179 on the Asset is forced to its Capped value. Otherwise, it will not modify the value.

•However, Section 179 may not exceed the basis of the Asset. If it does, the amount will be forced to max allowable value. Note that a special case of capping occurs when we have a 1st Year Special limit. This can reduce the amount we are able to use. The Bonus value is checked first and reduced if needed. Any remaining difference will then come out of the Section 179.