Setting up DIV in Check Stub Entry

The setup must be completed in Check Stub Entry and in Revenue Billing to have the ability to use the Rev 1099-DIV extract for 1099's. This menu item will not be visible in the 1099 module unless this setup is complete.

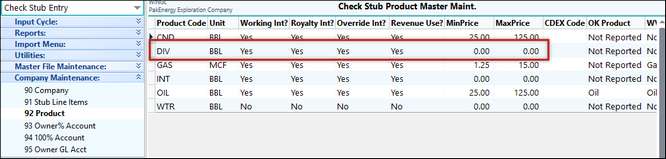

Go to Company Maintenance > Product and add the product code “DIV.”

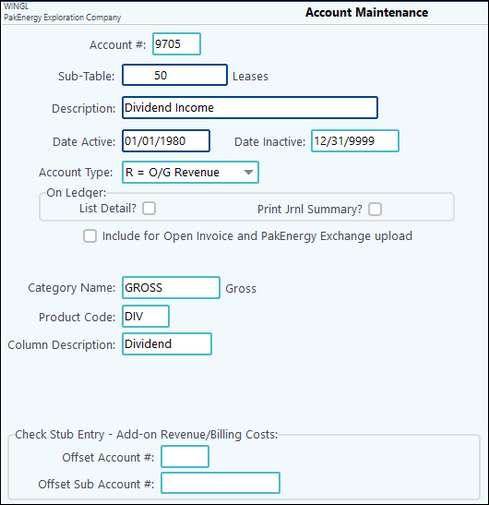

Once the DIV product code is setup, add the Dividend Income Distribution account for the DIV product code to the chart of accounts by clicking on F11(Account Maintenance) and adding the new account. Account 9705 will be used in this example.

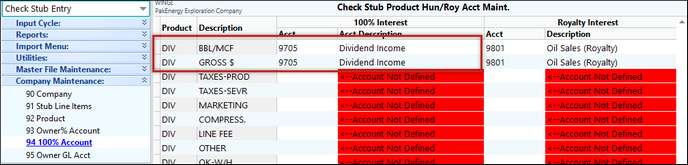

With the account setup, the mapping for the DIV 100% account needs to be setup in Check Stub Entry. This is done by going to Company Maintenance > 100% Account and adding the 9705 account to the gross line for product code DIV.

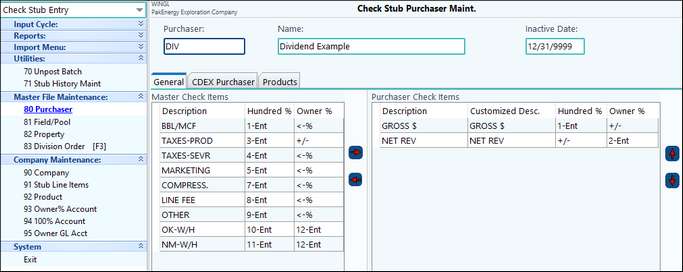

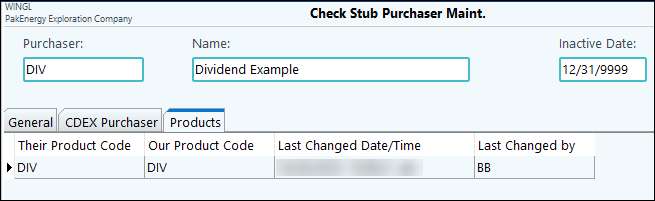

Now that mapping is in place it is time to determine whether an existing “purchaser” will be utilized for the recording of the DIV income that needs to be distributed or if a new one is to be created. In most cases a new one is created. To do this go to Master File Maintenance > Purchaser and add a new “purchaser” with Gross $ and Net Rev stub line items.

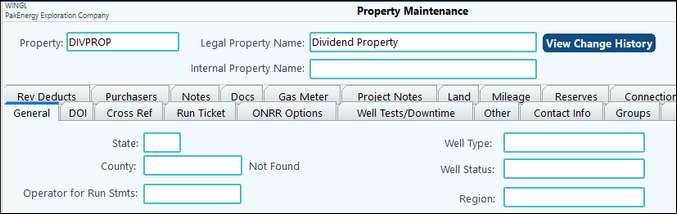

Dividends are not considered associated with a property. Set up a “pseudo” property to be used to facilitate the dividend distribution process.

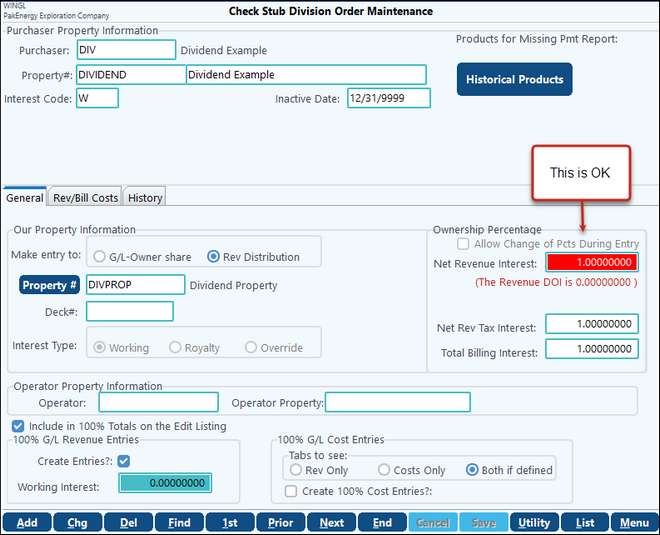

Once the “Purchaser” is set up, create a Division Order for the property (or properties) that will be distributing the DIV income. To do this go to Master File Maintenance - Division Order (F3). This will need to run through a Revenue Distribution cycle, so choose the option for Rev Distribution. If you have an existing DOI in Revenue Billing that contains the correct percentages, then, you can tie this entry to an existing DOI deck. If not, a new one will need to be created (directions provided for this in the Revenue Billing part of setup):

This completes the Check Stub Entry Module set up for the product code DIV.

Setting up DIV in Revenue Distribution

A DOI must be setup to distribute dividends. This DOI is not a "Normal" DOI." Dividends are not considered associated with a property, we are only using a pseudo property to facilitate the process.

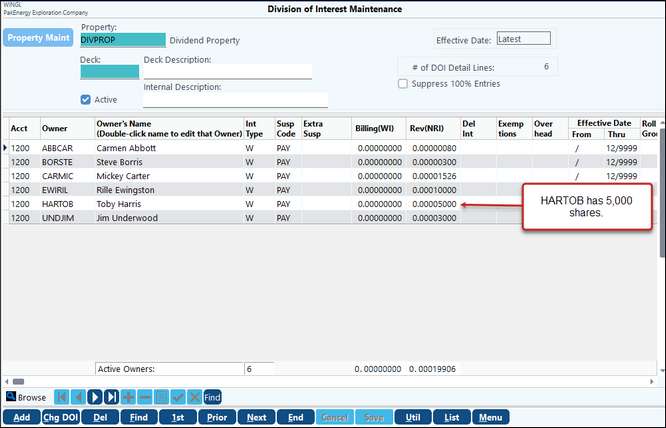

To do this go to Revenue Distribution > Master File Maintenance > Division of Interest (F3) and review the DOI or add a new one if necessary.

*****NOTE***** Each Owner's Revenue Percent is equal to the number of shares. (NOTE: DIV distribution – the # of shares (Revenue % column) will not equal 1.00000000 unless they have exactly 100 million shares outstanding. The distribution has special code to handle this.

Now that both modules are setup you will be able to enter a check stub into the check stub entry module for the DIV product code, post the stub, and do a revenue distribution in the Revenue/ Billing Module.

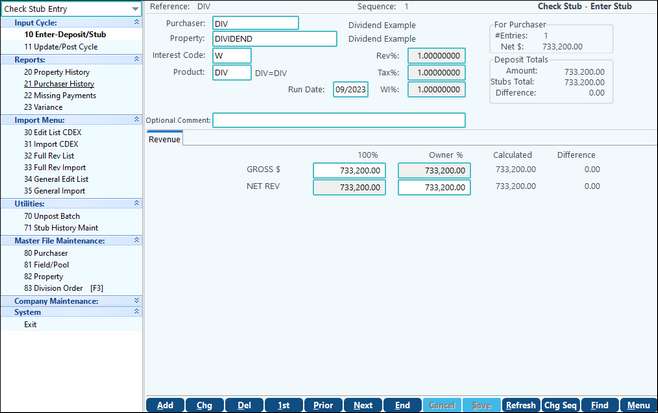

Enter the distribution in Check Stub, Enter Deposit/Stub. It is beneficial to set up a Current Year Dividends account and to have the Check Stub post to that account. Enter the Check stub as normal .

Run a Revenue cycle. This cycle can be run separately for the property.

NOTE: Netting should generally be turned off! We can net, but any netting will be associated with 1099-MISC type reporting and not dividend reporting.