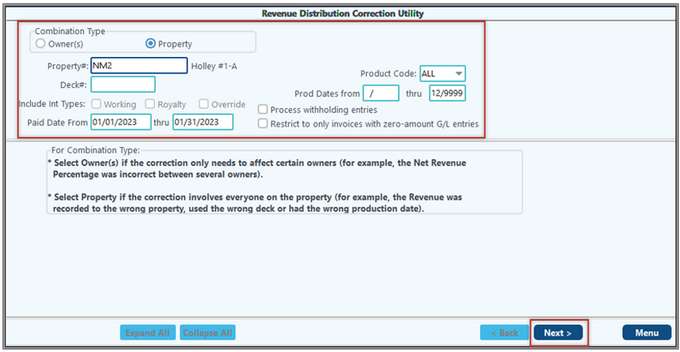

REVENUE CORRECTION - PROPERTY LEVEL

To do a Revenue correction at the property level, you will need to go to menu item Change/Correct/Void (Revenue/Billing module).

Select R-3 Revenue Distribution Correction.

Set the type of correction in the Combination Type box. Enter the Property # and Deck #. Select the product code and enter in the production date for the month you are running this correction for, or leave blank thru 12/31/9999. The Paid date can be used in lieu of the production date if desired. Click "Next" after selecting your filtering criteria.

TECH TIP: **Prior to running the Revenue Correction, it is recommended that the DOI is corrected to how you want it to disperse.

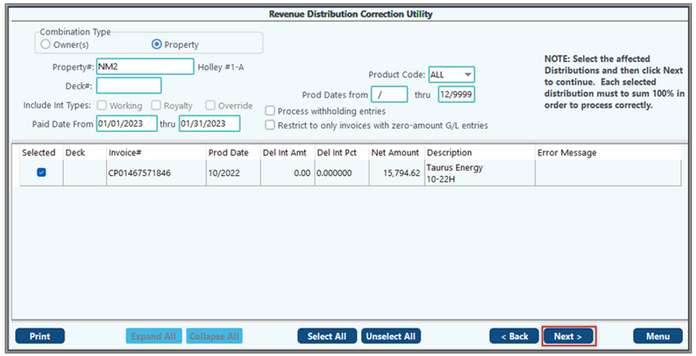

The Second Screen will give you the transactions for that property that meet your filtering criteria. It will auto-select those which you can adjust. Review this information, and then click the "Next" button to continue.

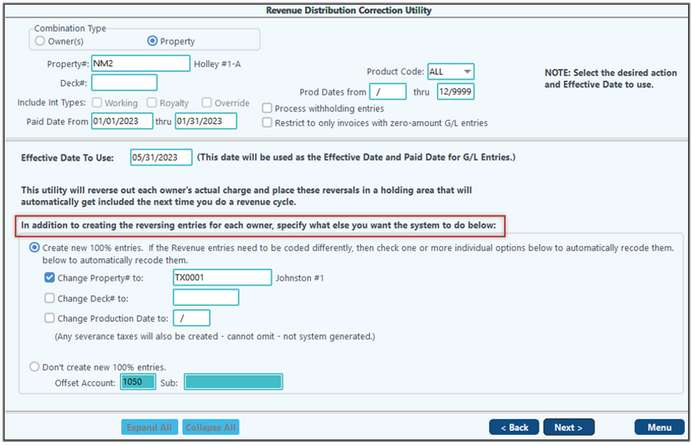

The Third Screen will allow you to select an effective date to be used for the new distribution records. You will then have the option to select to just create 100% entries to the same property if all that is needed is a change in the DOI. If you need to change the new distribution to a new property, deck #, or even production date, this can be input here. If you are utilizing the Pak Accounting severance tax module and you need the severance taxes to be recalculated, select the option to omit system-generated severance tax on the new distribution record. If you do not want to redistribute these entries you can select, don't create new 100% entries and select a clearing account to post them to instead. After selecting the necessary options, click "Next" and proceed to the finish.

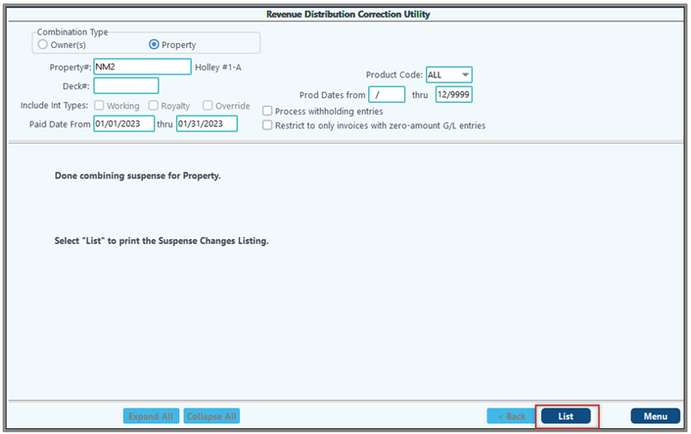

The Fourth Screen will tell you that it is done combining suspense for Property. Now all you need to do is click "List".

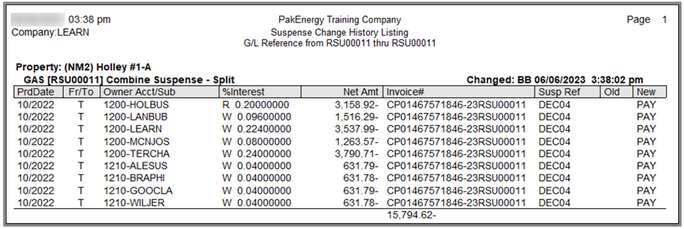

The"Finish" button will give you a list of what the effect was on your Suspense Change Log for this property. Print this out to keep on file.

Reviewing the Correction

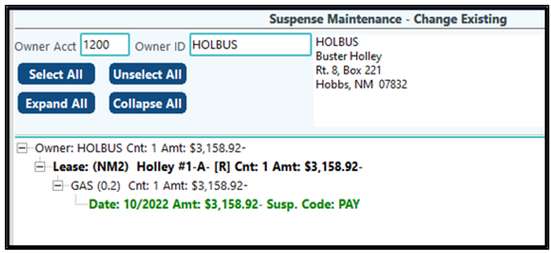

The correction is now complete, it creates a suspense entry for every distribution record that you selected to change for each owner from the original distribution historical file.

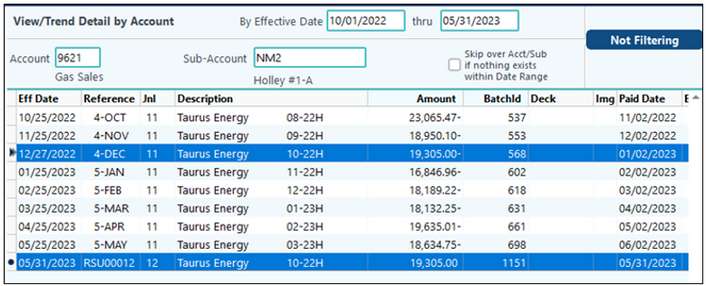

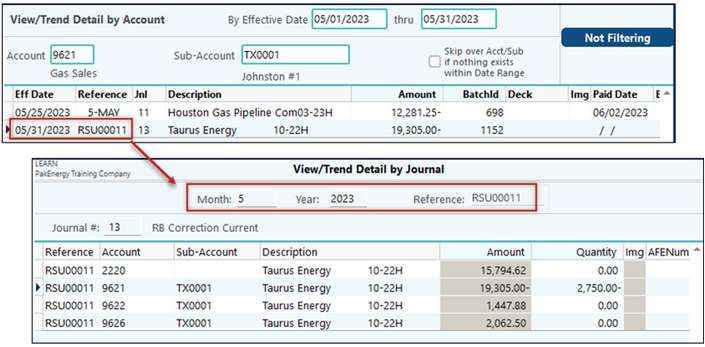

Additionally, the correction will created the Reversing Royalty Cutback Entries. After the distribution, the RSXXXXXXXX entries will have Paid Dates and the net in the 96XX Account will be a total of one. The Royalty Cutback Account will have three entries that net to a total of one.

Correction - Original Entry

Correction - New Entry

If the original check stub invoice reference started with CRXXXXXXXX, there were no royalty cutback entries created. Due to the "create 100% numbers" option not selected on the Division Order, there will be a new distribution that will create a RRXXXXXXXX invoice with no dates or royalty cutback entries. When the cycle is complete, the RRXXXXXXXX invoice will have paid dates and the reversing entry that will zero out.

To finalize the correction you will need to run a Correction Cycle.

NOTES:

•If there is a problem with the correction, errors will be given that with additional information describing what could be causing the problem along with specifics as to the entry causing the error. Additionally, you will only see previously uncorrected items.

•This utility will include the production date on royalty cutback entries.