QUICK PAY SETUP CHECKLIST

1.Setup Quick Pay Accounts, if not already set up.

2.Setup a Property called QCKPAY. On the Revenue Deduct tab, add the Rev Deduct for the Revenue Deduction account to use and the income account to record the income to.

3.Setup Owners as participating in Quick Pay and the Quick Pay Rate (Penalty) that will be charged to them per BBL for getting paid early (Sub-account/Owner Maintenance > Revenue/ Billing Tab > Other sub-tab located on the left-hand side of the screen).

4.First Purchaser > Selective Extract - select which ticket(s) to pay early. This locks in the pricing at the time of the extract.

5.Revenue/Billing > Extract Entries > Revenue Tab – Revenue Distribution is QuickPay instead of Normal.

6.Revenue/Billing > Pre-Checks Reports > Print Distribution by Property – Can see the deduction added. (also other reports…..)

7.Revenue/Billing > Write Checks > Check Stub & net check will include deductions.

QUICK PAY ACCOUNTS

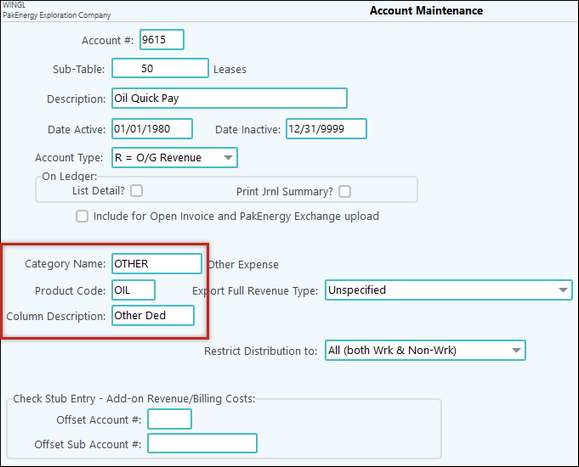

As part of the Quick Pay setup, a revenue account will need to be setup in Account Maintenance for each product that will be a part of Quick Pay (i.e. OIL, GAS, etc.).

An example of a revenue account for Oil:

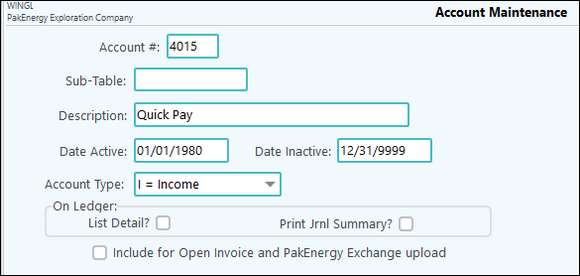

An Income Account will also be needed to record the income.

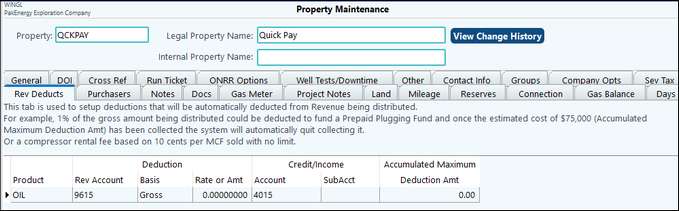

QUICK PAY PROPERTY

In order to deduct a fee to specific owners for paying them their share early, a QCKPAY property must be set up and a Rev Deduct must be setup that defines the revenue distribution account # to code the fee and the offset (credit/income account-sub acct) to. The Rev Deduct should look similar to this:

QUICK PAY OWNERS

Owners will need to be selected to participate in Quick Pay along with the Quick Pay Rate (or penalty) that will be charged per BBL for the early pay. This option is chosen on the Sub-account > Owner Maintenance > Revenue/Billing Tab > Other sub-tab.

Selective Extract

The next step is to choose which tickets to pay early in First Purchaser Selective Extract.

In Revenue/Billing > Extract Entries > Revenue tab-set the Revenue Distribution option to Quick Pay.

The deduction will be visible on the Revenue/Billing Cycle > Pre-Check Reports > Print Distribution by Property. When checks are written in Revenue/Billing > Write Checks, the check stub and net check will include the deduction.