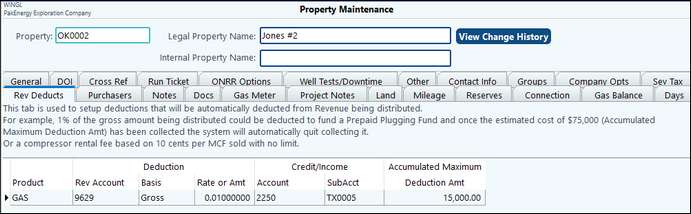

Revenue Deducts is a unique feature to create automatic deductions from revenue. An example is to set up an automated process to deduct for a prepaid plugging fund. Don't automatically add a "Rev Deduct" to a revenue item if the set of entries already has an entry to that Revenue account. This makes the "Rev Deduct" work similar to severance tax (it doesn't compute the severance tax if there is already severance tax computed).

Revenue Deducts Setup |

|

|---|---|

Product |

Select which product this "charge" will be associated with. |

Rev Acct |

After selecting the product, your selection for this field will be limited to the "other" type of revenue accounts for that product. Select the account. |

Basis |

Select the calculation basis for the deduction. The calculation can be based on one of the following: Gross, Volume, or Fixed Amount. |

Rate or Amt |

Depending on the basis selected, enter the percent or fixed amount to be deducted. Example of a percent rate to be entered: 10% would be entered as 0.10000000. |

Credit / Income |

Enter the account/Sub-Account combination to be used as the "funding" account. |

Accumulated Max Deduction Amt |

This is the total amount to be deducted for the property.

NOTE: The Accumulated Max Deduction Amt looks at the balance in the credit/income account when establishing if the max amount has been reached. |

Quick Pay Penalty - First Purchaser Only Option

PakAccunting is capable of distributing revenue and paying specified owner(s) early - charging them a per BBL fee for paying them early. All the other owners that are not getting paid early will be automatically put into petty suspense (unless they are already going into legal suspense).

The owners that are to be paid early will need to be marked on their owner master as receiving Quick Pay and coded as to what rate they are to be charged. During the update of a special Quick Pay Revenue Cycle, the system will automatically unmark all the owners for you.

For the system to know how to show the Quick Pay deduction on the check stub and where to record the income, see Quick Pay Setup.