Notes Receivables

This optional add-on gives you the ability to set up and record Notes and Payments on a sale or loan, such as the sale of property. So, as you enter in a deposit for a note, the system will automatically break it out for you.

Setup:

1.In Account Maintenance [F11], set up the following accounts. Make sure all accounts are subbed to the same Sub-Table:

Notes Receivable Asset

Insurance/Taxes Asset (if charging to note holder)

Unpaid interest Asset

Unrealized Gains Liability

Interest Income Income

Realized Gains Income

2.In Journal Maintenance, set up a journal to record note entries.

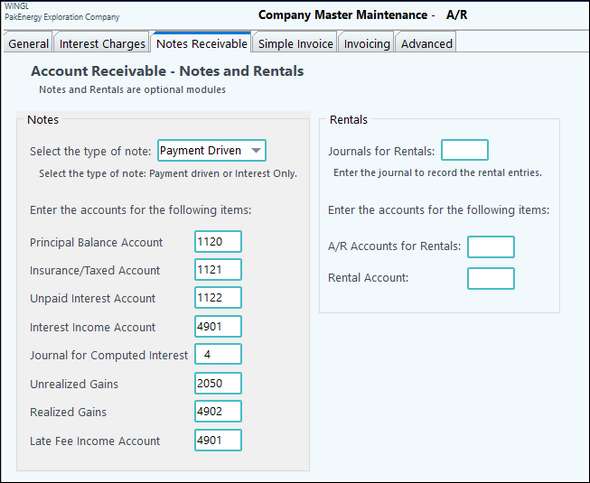

3.In Company Master Maintenance, enter the accounts and journal number.

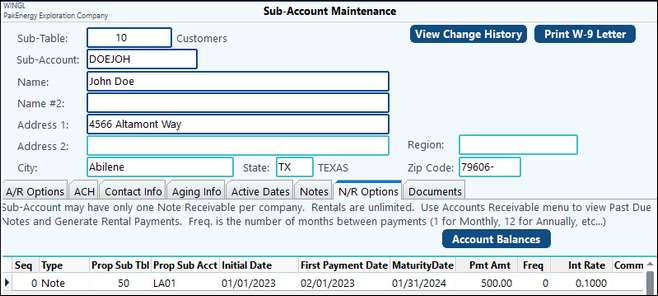

4.In Sub-Account Maintenance [F12], set up the customer (note holder), the Sub-Table must be the same one used in account maintenance.

On the Receivables tab, set up the note receivable (each Sub-Account may only have one Note Receivable per company). NOTE: The Notes Receivable tab will not show unless the box is checked in Sub-Table Maintenance and the Principle Balance Account entered in the Company A/R Options > Notes Receivable tab has the Sub-Table attached where the note is being setup for a Sub-Account (i.e. customer, owner).

Sub-Account Maintenance – N/R Options |

|

|---|---|

Type |

Note or Rental (enter the type of receivable). |

Prop Sub Tbl |

Enter the Sub-Table for the property that is being sold with the note. |

Prop Sub Acct |

Enter the Sub-Account for the property that is being sold with the note. |

Initial Date |

Enter the start date of the note. |

First Payment Date |

Enter date 30 days from the Initial Date. Make sure they both have the same day (ie: both on the 1st) in order for the first payment to calculate correctly. |

Pmt Amt |

Enter the amount required for each payment on the note. |

Frequency |

Enter the frequency of the payments (1 = Monthly, 12 = Annually, etc). |

Interest rate |

Enter the annual interest rate for the note. (interest is calculated on 30/360). |

Comments |

Enter any comments for the Note. |

Int Gen Date |

Must be blank for first payment. It will then default to last paid date. This may need to be reset if the deposit is unposted. |

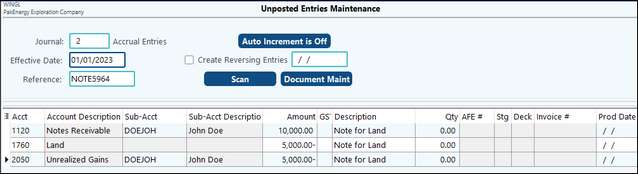

5.Enter the beginning balances of the Note through Unposted Entries Maintenance in the General Ledger Module.

Example entry explanation:

Debit to the Note Receivable account for the total of the note.

Credit to the Land account for the sale.

Credit to the Unrealized gain for the difference between the Note and the Land value. Gains will be automatically realized when payments are made

Payments:

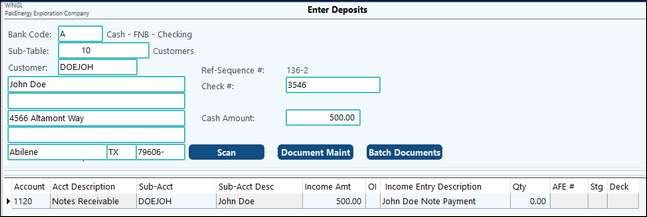

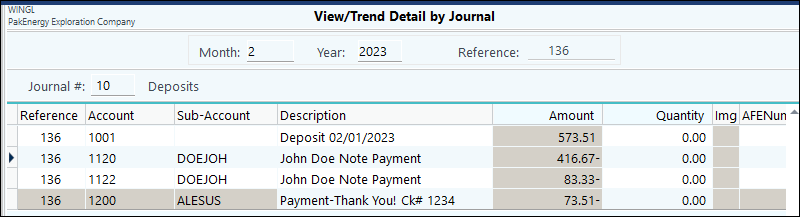

Enter payment on the note through the Deposit Entry module. Put the entire payment to the Note receivable account, the system will automatically split out the interest and principal when the entry is posted.

How the payment will look once posted.

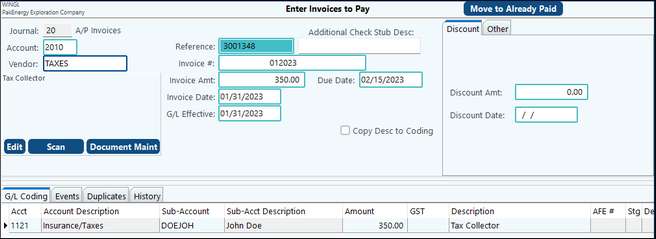

Insurance and Taxes

If you are charging insurance and taxes on the property to the note holder, record the amounts through a separate journal entry, or through Accounts Payable as the company pays the insurance and tax invoices.

Future payments on the note will automatically be applied to the insurance and tax balances until they are paid off.

Unpaid interest will accrue on the note if a payment is applied to insurance and taxes and doesn’t cover any principal or interest. Unpaid interest will be deducted first from the next payment before applied to current interest.

For each customer (note holder) a past due report can be viewed at Accounts Receivable > Notes Receivable > Notes Past Due Report. The report is based on any payments past due as of current date. Prepayments will affect this report. If a customer pays double one month, then skips a month, they will not show on this report because of the prepay. A partial payment will show up as past due.

1098 – Interest payment

1098’s can be printed for the interest payments on notes under the 1099 module. You extract the 1098 information from the deposit journal and the Notes – unpaid interest account.

How is a payoff and daily interest amount provided? The system stores the balance for each loan for the outstanding principle, accrued and unpaid interest, and un-amortized gain/loss in the General Ledger. The accrued interest will be up to date as of the last entry unless there is a modification of the entry or it is unposted. The system maintains the date of the last accrual on the loan master, currently located in the far right column "Int Generated Thru" on the N/R Options tab. It takes a payment for the interest to be generated and caught up at this time.

NOTE: At this time, the Notes Receivable function does not have an interest forgiveness feature.