Rentals

Setup:

1.In Account Maintenance [F11], set up the following accounts,

A/R account for Rentals Asset (Example: Sub-Table 10 – Customers)

Rental Income Acct Income (Example: Sub-Table 50 – Properties)

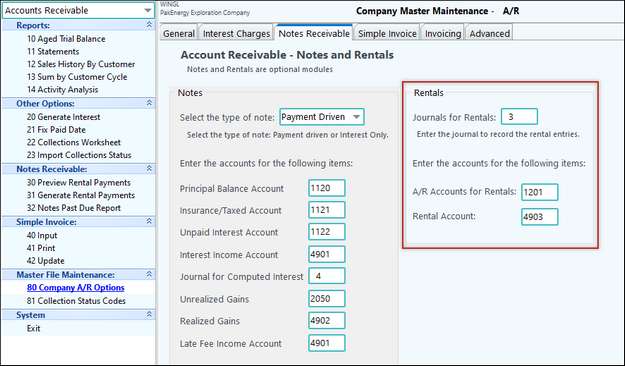

2.In Journal Maintenance, set up a Journal to record rental entries.

3.In Company Master Maintenance, enter the Account and Journal Numbers.

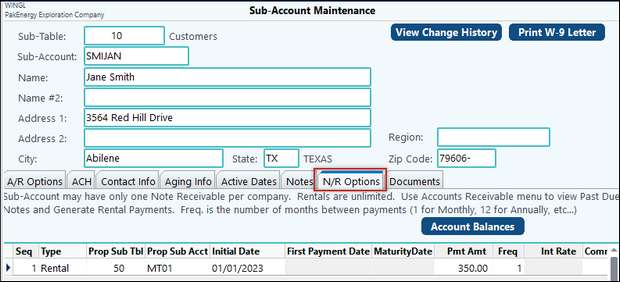

4.In Sub-Account Maintenance [F12], set up the customer. The Sub-Table must be the same one used in Account Maintenance.

On the Receivables tab, set up the Rental (rentals are unlimited). The same customer can have both a note and rental.

Sub-Account Maintenance – N/R Options

Type |

Note or Rental (enter the type of receivable). |

|---|---|

Prop Sub Tbl |

Enter the Sub-Table for the property that is being rented. |

Prop Sub Acct |

Enter the Sub-Account for the property that is being rented. |

Initial Date |

Enter the start date of the rental. |

Pmt Amt |

Enter the amount required for each payment rental. |

Frequency |

Enter the frequency of the payments (1 = Monthly, 12 = Annually). |

Renewal Date |

Enter the renewal date on the rental. |

Comments |

Enter any comments for the Rental. |

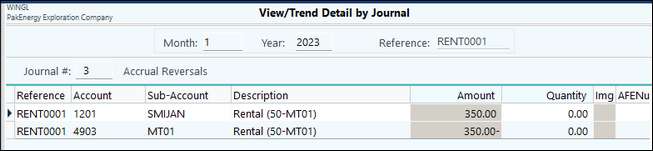

Rental payment must be generated in Accounts Receivable > Notes Receivable > Generate Rental Payments. Rental payments (receivable) will be generated based on the frequency set in Sub-Accounts maintenance thru the effective date. You can generate monthly, or generate a whole years worth of rental receivables.

The entry posted when rental are generated is as follows:

•Debit to Rental Receivable

•Credit to Rental Income

Payments:

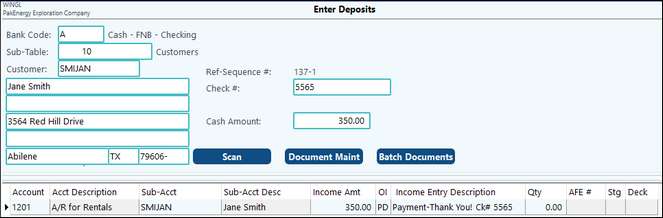

Enter payment on the Rental through Deposit Entry. Apply the payment to the Rental Receivable account.

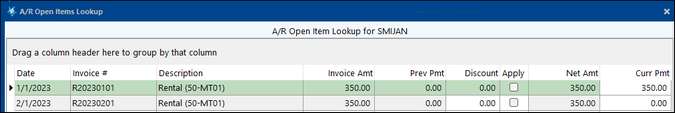

If customer is set to open item, payments can be applied to each invoice generated.

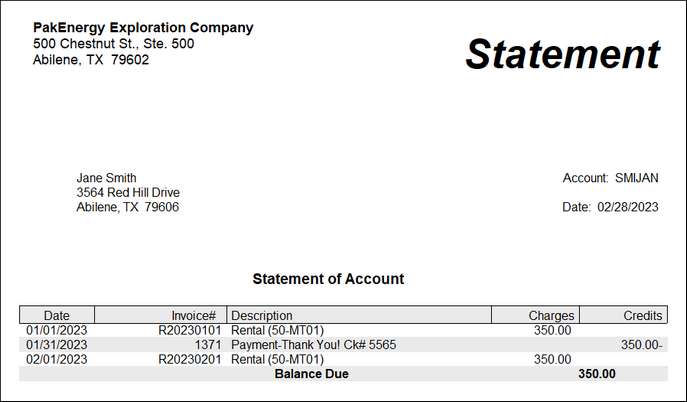

Printing Statements

Statements can be printed for rentals under Accounts Receivable > Reports > Statements. (If Open Item, check the box to Treat all Accounts as Balance Fwd Accounts to include payment information on the statement.)