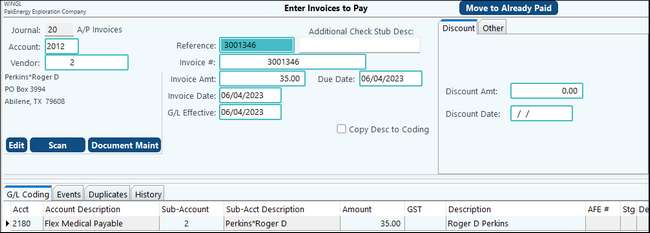

If you have situations where you need to isolate certain types of payables, or you have a different Sub-Table (other than the “normal” vendors) to use for payables, you will need to setup a new A/P account with the appropriate Sub-Table. Example: Paying Medical flex reimbursement to Employees 1.Set up a new Payable account (in Account Maintenance - F11) called “Expense Reimbursement”. Assign Sub-Table 40 (employees) to this account. 2.When an employee turns in a flex reimbursement request, record the Flex reimbursement request through normal A/P procedures (i.e. Enter invoice to Pay), instead of coding it to the normal A/P account, code to the special purpose A/P account. Our example uses account 2012 – “Employee Reimbursement” that we set up in step 1. Use the employee number as the vendor. The “expense” coding for the A/P entry will continue to be coded to the 2180 Flex Medical Payable (with the employee number as the Sub-Account.)

These type reimbursements can then be paid through A/P using this A/P account or can be run through the next Payroll cycle for reimbursement. Also see Employee A/R |

Normally, most refunds to Joint Interest Partners are handled through the refund option in Revenue/Billing. However, if management wants separate checks written and you are finding that you are writing a lot of refund checks, you might want to consider setting up a separate A/P account for this. (example: prepayment refunds) Other alternatives include: •Setting them up a 2nd time as a vendor and writing •ZZMisc check and having to key in their Name/address Setup/Use: 1. Set up a new Payable account called “Revenue Reimbursements”. Assign Sub-Table 101 (owners) to this account.

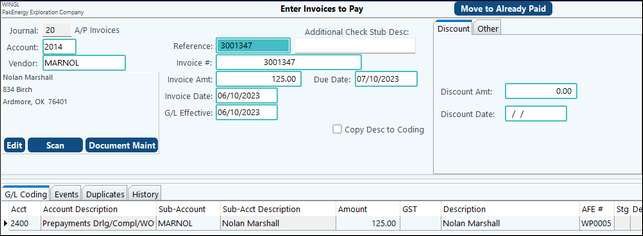

2.When owner has prepayment money available (Acct 2400) or a credit balance due in Accounts Receivable (Acct 1200), record the reimbursement through normal A/P procedures (i.e. Enter Invoice to Pay) but instead of coding it to the normal A/P account, record to this special purpose A/P account.

Our example uses account 2014 – “Revenue Reimbursements” that we set up in step 1. Use the owner number as the vendor. The “expense” coding for the A/P entry will be account 2400 Prepayment (with the owner number as the Sub-Account). Also include the AFE on the coding.

|

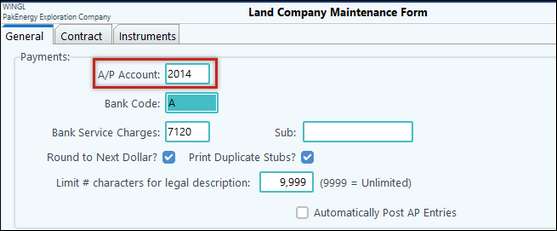

Example: Payments for Delay Rentals 1.Set up a new Payable account in Account Maintenance called “Land A/P”. Assign Sub-Table 101 (owners) to this account. 2. In the Land Company Options > General Tab: Make sure the special Payable account is specified as the A/P Account.

3. Process payments thru Land. Once Updated to G/L, these entries will be in Unposted Entries in the General Ledger module. 4. User will need to Post Entries in the General Ledger module > Post Entries. 5. These payments are now available in a separate isolated A/P account to pay these land owners and the land owners are not mixed in with your regular vendors. |