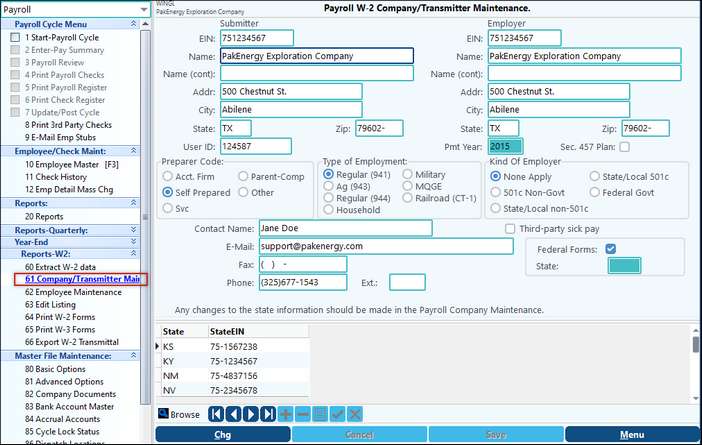

This menu provides information used when extracting, printing, and creating the electronic file for the payroll W2 and W3 reports.

The user ID is provided by the social security administration - and is used to file electronically.

Once the information is entered, it will be retained for following years.

Also see Folder Transfer/Compare if needing to transfer files between WPA and a local folder.

Company Transmitter Maintenance |

|

|---|---|

Submitter |

The submitter is the person submitting the electronic file. |

EIN |

Submitter ID number. Before you can file electronically, you must fill out some paperwork for the IRS and receive a transmitter number. Enter that number in this field. |

Employer EIN |

Employer's federal ID |

Name, Address, Zip |

Enter the identifying information for the company you will be filing the W-2's under. This is the name that will print on the W-2's, and on the transmittal file with the IRS. |

User ID |

Formerly the PIN number field. PIN numbers are supplied by the IRS for Electronic filing. See https://www.ssa.gov/bso/bsowelcome.htm for more information. |

Payment Year |

This value is carried over from the extract screen. |

Preparer Code: |

Check the method the W-2's were prepared by. |

Type of Employment |

The system defaults to use R (Regular) in this field. If you are anything other than regular, you will need to put the appropriate code in this field: Agricultural; Household; Military; MQGE; Railroad. |

Sec 457 Plan |

Check if you have a Sec 457 Plan. For more information, see instruction for form W-2. Blank -default value. |

Kind of Employer: |

Check to see if the company is a 501 c Non-Govt. employer, State/Local non-501c employer, State/Local 501c employer, or Federal Govt. employer. If none of these situations applies, then choose the option for None Apply. |

Contact name and information |

Enter the contact name and information of the person the IRS is to contact in case of questions. |

Third Party Sick Pay: |

Check to see if your company needs to mark the Third Party sick pay option. Your Customer Success Team can be contacted for assistance on this matter. |

Federal Forms/State |

Select if the Transmittal form is for Federal or State. Unchecking the Federal box will open up the State box. Currently the only supported states are OK and IL. |

State and State EIN |

Each state the company has employees should be set up. This information is carried forward from the Payroll Basic Option > States tab. This field cannot be overridden, changes need to be made in Company Maintenance. |