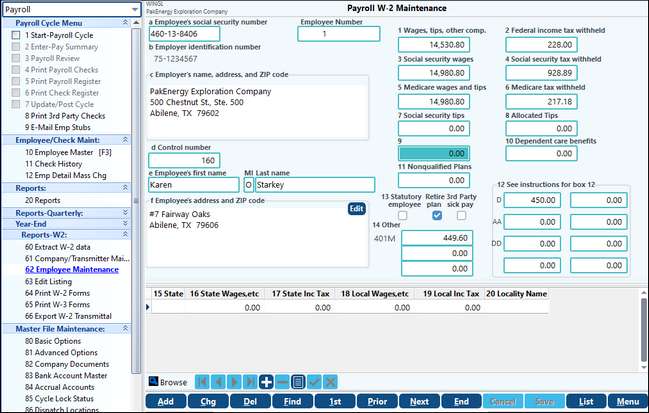

After the extract file is created, the information is available for verifying and editing on the Employee Maintenance menu item (Menu Item #62).

SPECIAL NOTE/WARNING regarding CHANGES to the W-2 amounts:

Yes, you can change the amounts on this screen, but you need to ask why the amounts need to be changed?

Reasons to do correcting cycles instead of manual adjustments:

1.Manual adjustments do not correct Payroll Check History.

2.Manual adjustments will cause the amounts not to agree with the 900 series forms filed. Totals on W2's must match the 940, 941, 943, or the 944 that are filed with the IRS.

3.Manual changes are not saved in the W-2 system.

a.Hypothetically if you make manual changes to the W-2 for the current year, then the immediate objective is accomplished. However, if an employee later asks for their W-2 from two years ago, that W-2 could be unavailable or inaccurate. If you did not save your W-2 forms to a PDF file, then the only way to get the W-2 would be to re-extract the data from two years prior. This wipes out the current year's extraction information. So, if you extracted a previous year's data, the manual changes are no longer in the history.

b.Also, if you did not make good notes about manual changes or you did not know there were manual changes made by a prior employee, you would not be aware that the W-2 information did not match what was previously reported to the social security administration, the IRS, or the employee.

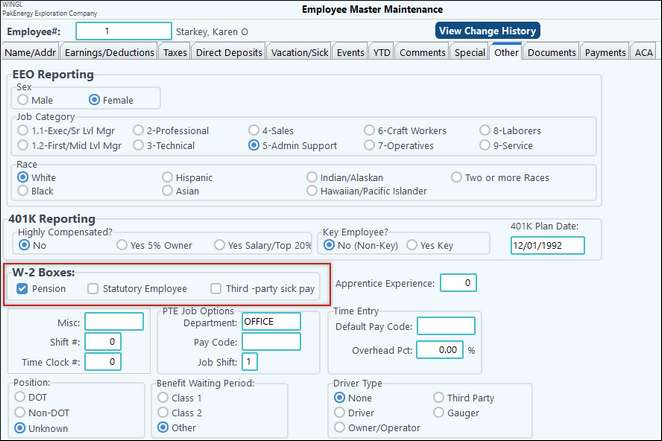

Field Box 13 on the W-2 has three check boxes that can be selected. However, changing the boxes here will not make a permanent change at the employee level. To set flags at the employee level go to Employee Master or F3. On the other tab - the boxes can be found in the W-2 boxes section of the screen.

If you make changes to the boxes in both locations, you will not need to re-extract. However, if you have changes for multiple employees, it might be easier to correct them all in employee master and then re-extract.

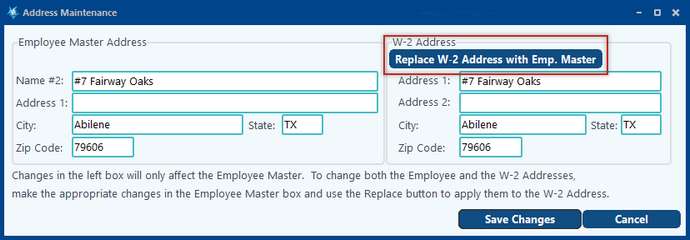

You can also make changes to the employee’s address by clicking on EDIT. This will bring up the address maintenance window. Making changes to the left box will only affect the Employee Master which is a permanent change in the system. To change both the employee and the W-2 address, make the appropriate changes in the Employee Master Address section, then use the Replace W-2 Address with Emp Master button to apply the change to the W-2 address. Click on save changes when finished.

Notes:

•For companies with employees in multiple states, the system will print State Wages for the Federal W-2 if the employee is in less than 2 states. Otherwise it will break out the wages on the state W-2's for only the states with a State Income Tax.

•The List button at the bottom of this screen is a good report to keep of employee detail. This report can also be saved as a PDF file.