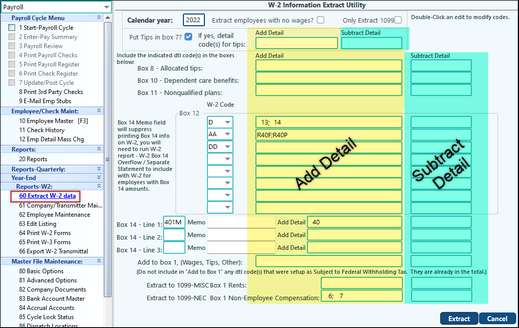

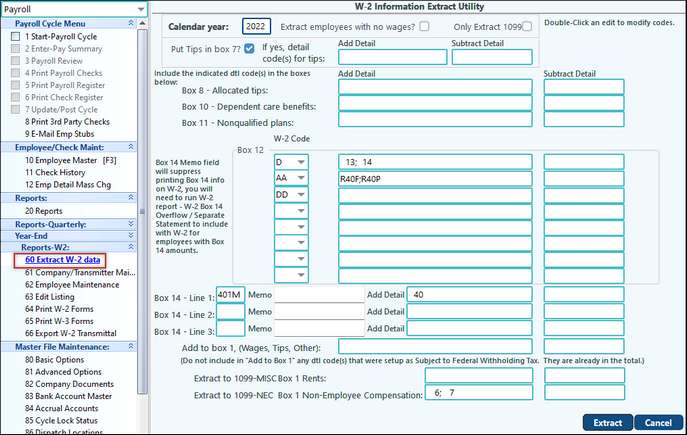

This is where to extract the Payroll Year-To-Date history information into the W-2 system.

NOTE: Box 12 must include W-2 code DD: Cost of employer-sponsored health coverage. This is an IRS requirement if your company offers health coverage. If you are submitting less than 10 W-2's, you are not required to report the cost of employer-sponsored health coverage.

See: Using Company Costs to Track Expenses for information on how to setup and track employer-sponsored health coverage.

Calendar Year |

Press "Enter" to accept the calendar year as "20XX" |

Extract employees with no wages?: |

Unchecked - Default - do not extract for employees with no wages; Checked - Select only if you will be keying in wages, deductions, etc. manually for employees who have no wages recorded on the system. |

Put tips in Box 7 |

For wages coded in the special category called "Tips" in the payroll system, Check if you would like to include these amounts in Box 7 "Social Security Tips," or Uncheck if you do NOT want it included in Box 7. If checked, enter the detail code for the tips. |

The following options allow you to report special earnings and/or deductions to the IRS. Please seek advice from your CPA as to the proper reporting of various pay and deduction plans that your company utilizes. |

|

Box 8 through Box 12 Amounts |

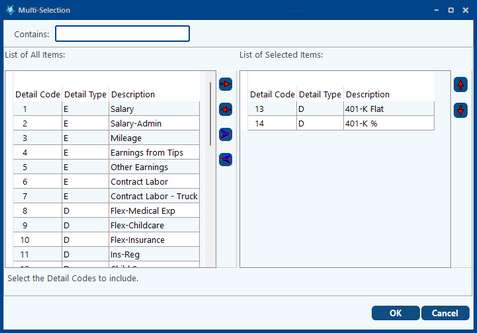

See the back of the W-2 for specific instructions as to what information to include in boxes 8 through 14. These rows (Box 8 Allocated Tips, Box 10 Dependent Care Benefits, etc) ) have fields where you can choose the code for the information you wish to include on the W-2 for income that government requires you to report. For example in the row Box 12 (which stands for line 1 of Box 12 on the W-2 form) if your company has a 401K plan: •use the drop down in the first column to select the W-2 code for the system to record the amount contributed to the plan. •The last 2 columns allow you to choose the detail code(s) that apply to that income by double clicking into the field.

• Click on the desired detail code and utilize the arrows to move one (red arrow) or all (blue arrow) of the detail codes over that apply

•Click OK when all desired detail codes are selected. |

Box 14 |

In the first column, enter a 4 digit description of the item(s). This will populate on the W-2 in the corresponding box. In the 2nd column enter a short memo (optional). If a memo is entered on this screen, and on the Print W-2 Form screen option 3 to print the Box 14 overflow is selected, then the memo will print as a separate statement. Column 3 and 4 work as discussed above. Double-click in the box to access detail codes to associate with the line item. |

Add to Box 1: Wages, Tips, Other |

In most cases, this amount will be calculated automatically and you will not need to make an entry here. Only if you have a special detail number that needs to be added to Box 1 for Wages for W-2 reporting, enter the detail numbers to be included. (Example: A company cost detail for life insurance you are providing for an officer of the corporation which is required to be reported to the IRS as compensation – you would enter the detail number of the company cost.) |

Extract to 1099-MISC / NEC |

Select the detail code for any payroll items that need to be reported on the 1099-MISC Box 1 Rents or 1099-NEC Box 1 Non-Employee Compensation form by double clicking into the field and then clicking on the desired detail code. Utilize the red arrow to move one code over to the right or the blue arrow to move all detail codes over to the right. Click OK when all desired detail codes are moved. (i.e. Contract Labor) |

Click on Extract to start. |

|