The system can maintain up to seven sets of books for depreciation entries. Using multiple books allows you to keep up with multiple sets of depreciation entries for a single asset.

Example, you may wish to use a MACRS depreciation method when calculating federal taxes, but a straight-line method for your internal books.

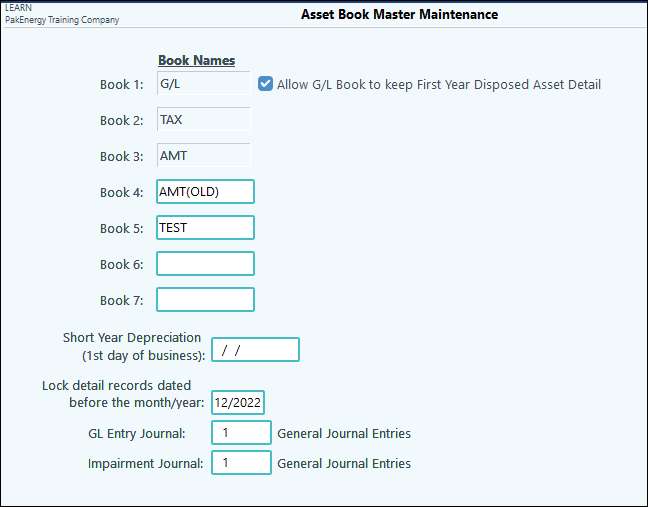

•The first three books, called G/L, TAX, and AMT are set up by default.

•Others can be added in Master File Maintenance> Asset Book. Simply click in a blank field, and enter the name of the book in the space provided. The name may be up to 10 characters, and is not case-sensitive.

•Once a new book name is saved the system will ask you which existing book you would like to use as a basis. Choose the book that most closely matches the new books parameters.

•You will be able to make changes to these options at the class level once the book has been added to the system.

The “Short Year Depreciation” only applies to the first year a company is in business. If the company chooses to utilize short year deprecation, all they need to do is place the 1st day of business in the date field to the right of “Short Year Depreciation”. This is not a common feature. Publication 946 has several pages of instructions on how to calculate Short Year Depreciation.

The “Lock Detail Records” locks all calculations generated before that month/year. Once entries are made and finalized, this date should be used to keep any changes from impacting previously reconciled periods. If you need to unlock the records simply change the lock month/year to a period prior to the period you need to unlock.

The "Allow G/L Book to keep First Year Disposed Asset Detail" allows depreciation to remain for G/L book ONLY for assets that are placed in service and disposed of in the same year.

When creating a new book you need to fill in a name for your new book in the next space available (4-7). You will be asked to copy the setup from one of the existing books. This will allow the detail to be generated for initial use. You then will have the ability to go to Asset Maintenance and change the asset detail for the new book as needed. You also can go to Asset Class in order to set up the default depreciation method, life, and convention for all new assets on the new book.