The Accounts Payable discount feature allows you to recognize income earned on discounts. On A/P invoices, if your vendors offer a discount if paid by a certain date then use A/P discounts to record the discount as income. If the invoice is not paid by the discount date, the system will not record the discount, but will pay the invoice in whole.

SETUP:

1.Setup an income account in Account Maintenance [F11] to record the Discounts Earned.

2.Enter the income account number in Master file maintenance / Company A/P Options / Advanced Tab/ Discounts. This is what turns on the A/P discounts feature. If an account is not entered here, the discounts tab will not show up on the A/P invoice.

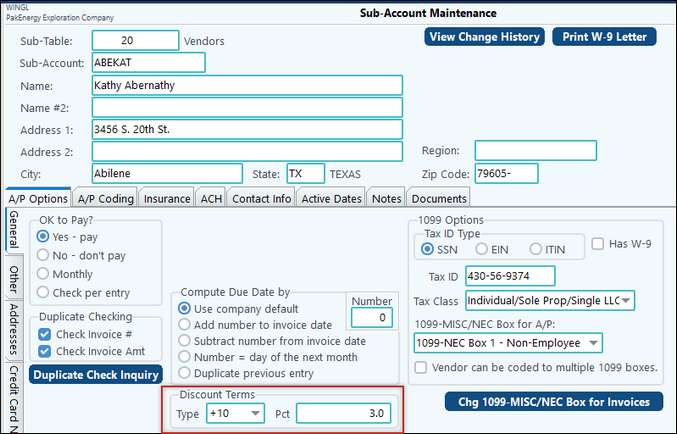

3.Set up the Discount Terms on the Sub-Account Maintenance / A/P Options tab for those vendors that offer discounts in the Discount Terms box.

USE:

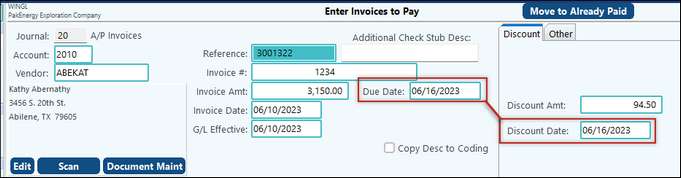

Once discounts are turned on, in the invoice entry screen a new tab with two fields will appear: Discount Amt and Discount Date. The system will calculate the discount amount automatically based on the Discount Terms set up in the vendor’s Sub-Account maintenance.

If the invoice is paid by the discount date, the system will automatically record the discount to the Discount earned account and pay the check minus the discount amount. If the invoice is paid after the discount date, the system will pay the gross amount of the invoice and doesn't record an entry for the discount.

Any discounts lost can be printed on the Discounts lost report (Reports / Invoice tab / I-4 Discounts Lost)

TIP: Make the invoice due date the same as the discount date so that when you pay by due date (either by writing a check or by GL ACH) you can still take advantage of the discount. Reports (i.e. open item, etc) and Check printing are based on the due date not the discount date.