Accrual Definition Revenue accruals is an estimated revenue value that a company anticipates receiving in a future accounting month. The Oil and Gas industry is a prime example. Purchasers pay for a product a month or two after it is produced. Accruals is a routine process that creates revenue receivable entries by property for a given accounting period. The revenue accrual results are visible on the financial statements. Accrual accounting allows businesses to plan better by having a clearer picture of the financial well-being of the business. What’s the big deal about automating accruals? Most clients currently calculate accruals manually outside Pak Accounting typically in a spreadsheet. Once calculated, multiple sets of general ledger entries are then manually entered or imported. •They create the original set of accrual entries predicting the revenue value for a given production month. •Once the actual payment of production is received and entered, a check stub entry is posted with the actual revenue amount. •Then, a third set is created to reverse the original accrual entries. Using spreadsheets exposes the user to formula errors and/or loss of consistency over time. Overview The criteria for the process parameters is a one-time setup of definitions as needed for each product, account or interest type. The automated accrual process provides flexibility for the user to define the basis, along with factors for determining the accrual value. The ledger accounts to be used are also defined in the initial setup. With definitive rules in place, we receive the benefit of consistency in the accrual calculations. Clients can use the automated process that resides within the software of record – Pak Accounting. This automated process can use data captured through other functions within the software (Check Stub, Production, General Ledger) to create the accrual entries with a push of a button. Entries can use date ranges set to utilize a single month value or an average dollar amount over a specified period of time (1 month, 3 month average or 4 month average). Accruals can also be based on quantities that are then multiplied by a price index to calculate a dollar amount. The basis of ending results can be either the 100% accruals or GL Owner share accruals. After a revenue payment is posted, the reversal process compares the actual value received against the original accrual entry. The user can review the actuals versus the accruals with the difference in amounts and percentages. At the user’s discretion, complete or partial reversals can be created. The reversal amount can be edited for the partial reversal or left alone for the complete reversal. For the reversal process, clients have the ability to filter selections by definition, property, accrual amount, production date, or outside variance percentages that are defined by the user. Partial reversal of accruals will reflect a remaining balance by accounting period in subsequent monthly accrual events. |

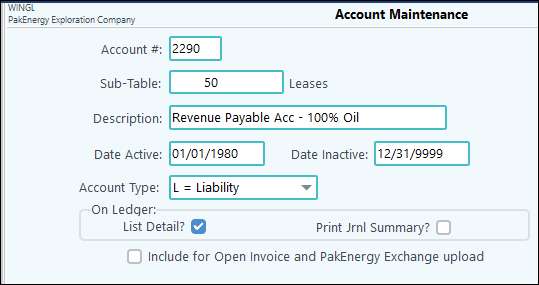

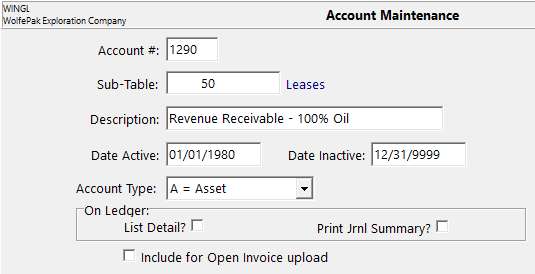

In the General Ledger module, you will find the Pak Accounting Accruals menu item. The first step you will need to do is create ledger accounts for accruals with each account subbed by the Sub-Table that the basis account is subbed by. If the basis account is 9621 – Gas Sales for example, this account is subbed out by property. You will need different accrual accounts for each product or definition type. These accounts can be added in the Chart of Accounts where you see fit. In this example, accounts 2290 and 1290 have been created for the Oil product. Each of these accounts we have subbed by the property Sub-Table.

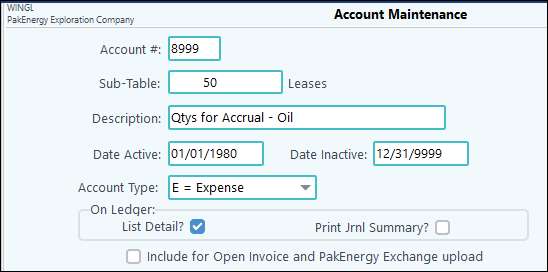

A ledger account also needs to be created to hold the field volumes received from field charts. This account needs to either be at the beginning of your G&A accounts or at the very end of that range. For example, we have created account 8999. This account will be used to record quantity values only. It is best practice for it to not be a Revenue/Billing type account. Real time quantity values can be imported into General Ledger into the 8999 account as they are received from the field. Those who have the Production module can set up GL entries to be imported from Production into General Ledger. These entries have no bearing on financial statements as they are only volumes, not dollar amounts.

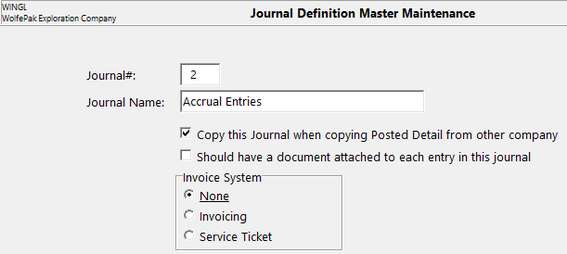

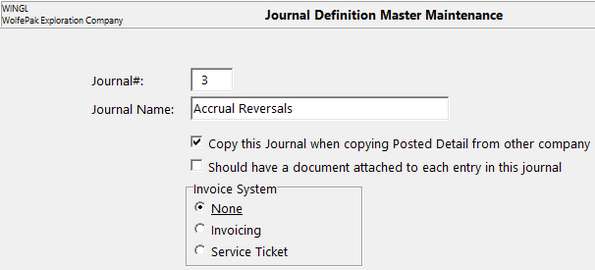

You will also need to create new Journal numbers to handle the accrual entries and the accrual reversals. It is recommended practice to use different journal numbers for different processes to make finding specific entries easier. Go to General Ledger - Master File Maintenance - Journal to set these up. In the example below we used Journals 2 and 3.

|

Other Setup:

Entries: