Definitions can be set up as an average dollar amount or an average dollar amount based on quantities multiped by a price index.

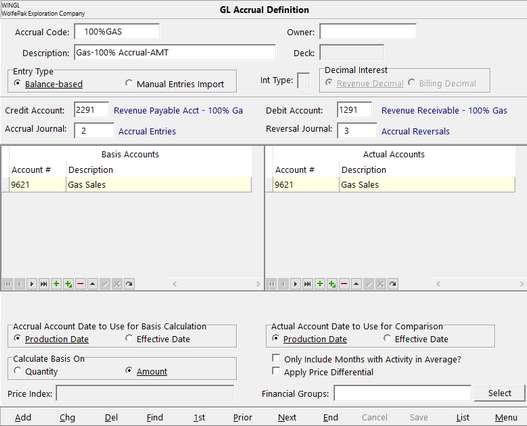

Amount Type Definition

Accrual Code |

Up to 10-digits (alpha/numeric) that describes the type of accrual, OIL100%, GASACCRUAL, etc. |

Description |

Expanded description, which will show up in description on GL posting. |

Owner |

Identifies if an accrual is for a specific owner (internal owner). |

Deck |

Defaults to the blank deck, but the deck can be selected and it will calculate the accrual based on the % interest on that specific deck/DOI. |

Int Type |

Select W, O, R for the owner and the accrual will calculate based on the specific interest type. (W=Working, O=Override, R=Royalty) If you have more than one interest type to accrue, a separate definition will need to be created for each type. |

Entry Type |

Selecting this option will affect the options available on this screen. Balance-based will allow you to setup the definitions to calculate the accruals. It will look at the Basis Account(s) on the definition. Manual Entries Import change the look of the definition screen, allowing you to create entries in an excel file and import them. |

Credit Account |

Where the dollar values are coming from (credit side of accrual entry) |

Accrual Journal |

The journal assigned to the Accrual Entries |

Debit Account |

This is where the entries are going to (debit side of accrual entry) |

Reversal Journal |

The reversal side needs to have a different journal number |

Basis Accounts |

These accounts are used to calculate the accrual amount. If Calculate based on Actual Quantity, and you are accruing 100%, this will be a quantity only account created in your general ledger. If Calculate based on Historic Quantity or Amount and the accrual is for your internal owner’s share, this will be your Sales/Income account for the product (9601/9621). There can be multiple basis accounts if desired. |

Actual Accounts |

When reversing the entries, Pak Accounting looks to the account listed here to pull in the comparison for Production Month Accrual vs Current Month Actual Sales/Income. |

Accrual Account Date to Use for Basis Calculation -- and -- Actual Account Date to Use for Comparison |

Typically, Production Date is the date to use for basis calculation and for the comparison. You can either use production date or effective date, but the two should match on the same definition. Usually, production dates are used for revenue entries and effective date is used for expenses |

Calculate basis on |

Select ‘Quantity’ or ‘Amount’. Quantity will take an average quantity produced for a specified range of dates and calculate sales/income amount based on a price index created by the user. Amount will take the average sales/income for a specified range of dates and use that figure for your current month accrual. |

Only Include Months with Activity in Average? |

If a month has no activity then it will not be used to determine averages. For example: January = $300, February = 0, and March = $400...when determining the average 2 months/$700 will be used instead of 3 months/$700 |

Apply Price Differential |

The average price will be divided by the current price to determine the differential to apply to the price index |

Price Indes |

Created in General Ledger. You can input daily or monthly. At this time, the Price Index will not transfer from other Pak Accounting Modules. Only required if ‘Calculate Basis On’ is Quantity or if applying a Price Differential. |

Financial Groups |

Indicate the group(s) you would like to use in this calculation |

NOTE: You can create multiple accrual definitions. After saving the setting for a definition, click on ‘Add’ at the bottom of the screen to create a new Accrual Definition.

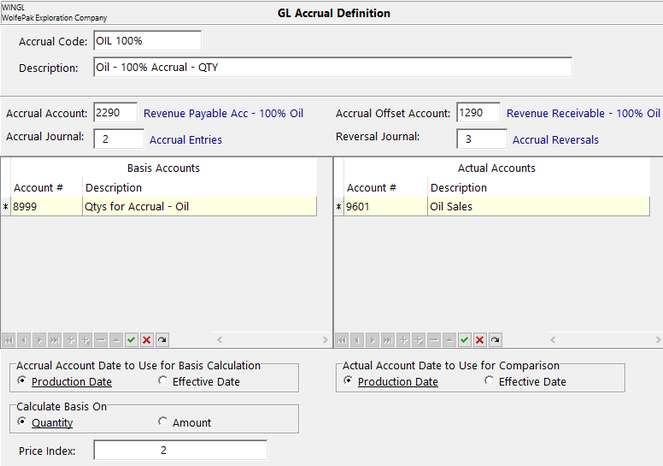

Quantity Type Definition

The other type of definition is based on quantities. This definition will take an average of quantities posted and multiply it by a price index. (Remember that quantities are typically entered as a negative number in the revenue account.)

Accrual Code |

Text field to type in the code |

Description |

A more detailed name of this definition |

Accrual Account |

Where the dollar values are coming from |

Accrual Journal |

The journal assigned to the Accrual Entries |

Accrual Offset Account |

This is where the entries are going to |

Reversal Journal |

The reversal side needs to have a different journal number. |

Basis Accounts |

When Calculate Basis On is set to Quantities, the basis accounts will be pointed to the G&A account we created earlier. Remember that this account will have real time production quantity values imported each month from the field charts or the Production module. |

Actual Accounts |

The reversal will also be based on the actual dollar figures. In the example above, 9621 will be both in the basis accounts and the accrual offset account columns. |

Accrual Account Date to Use for Basis Calculation -- and -- Actual Account Date to Use for Comparison |

Typically, Production Date is the date to use for basis calculation and for the comparison. You can either use production date or effective date, but the two should match on the same definition. Usually, production dates are used for revenue entries and effective date is used for expenses. |

Calculate basis on |

Allows you to choose between amount and quantity. In the example above, we have chosen Amount |

Price Index |

Required when using quantity basis |