Pak Accounting gives you the option to reverse all or part of an accrual. If you create a full reversal, the user would then need to create a new accrual entry at the end of the month for the current month’s production plus anything that not received for the prior month’s production. Alternatively, partial reversals are possible. Throughout the month, checks are received and journal entries are created in your Sales/Income accounts. Perhaps the payment received for a specific well is from one purchaser and you know you will receive a check for the remainder from a different purchaser. You can reverse the portion of the accrual you received and keep the accrual for the unpurchased portion.

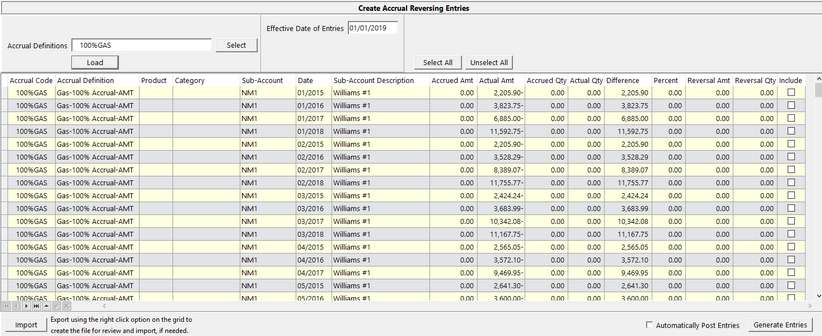

Go to the Reversal Entries menu. Choose the accrual definition that you want to reverse. In this example, we will use the Amount definition. If we are reversing December production, then we will use a 1/1/xx date. Normally, accruals are entered at the last day of the production month and reversed the first day of the following month.

Use the column heading to filter down to the selections needed to make the reversals.

Accrued Amount |

Shows the original accrual entry for that production month |

Actual Amount |

Pulls in data from the 100% account and show the actual check stub entry that was posted to the property |

Difference |

Subtracts the actual amount from the accrued amount |

Percent |

Shows the variance between the actual and accrued amount |

Reversal Amount |

Defaults to the original accrued entry, but if a partial reversal is needed, simply type over the reversal amount. Partial reversals will cause any left over balance to stay in the accrued account. Any left over balances from prior reversals will be kept in the accrual account and available to choose from next time you need to do reversals |

Include |

Allows a selection of entries to reverse |

Use the Select All button at the top to create reversals for every property.

From this screen, right-click on the grid view to export the data to Excel. For example, if you want to send information to the field supervisors for review and take recommendations from them on what to reverse. If new information is returned to you from the field, use the Import function to pull in corrected reversal amounts.

Automatically Post Entries will do just that. Otherwise, these entries when generated will go to GL #10 Entries as unposted.

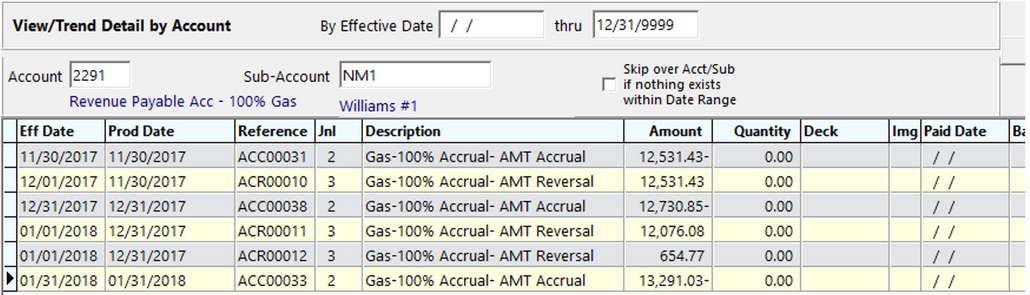

Go into View/Trend (F4) to see your entries. Notice that the accrual entries have an ACC start to the reference number. The reversal references start with ACR. For the production month of June, if partial reversals are done, you will see the first reversal and then a second reversal if the user decides to reverse the entire amount the following month, or even at the end of the year.

|

Note: If the entries associated with the actual amounts do not have a production date, the effective date will be populated in the Date column. The Production Date of the Reversing Entry will match the date that is populated in the Date column.