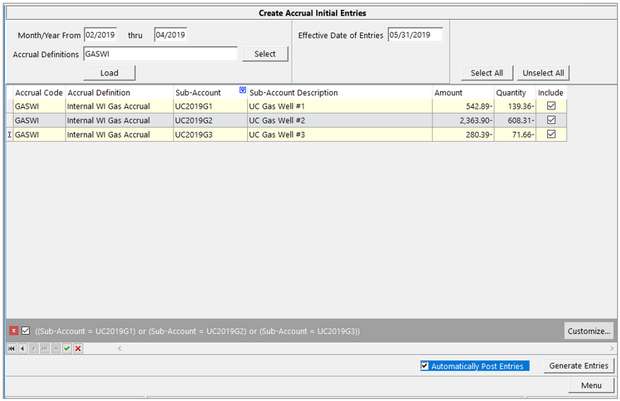

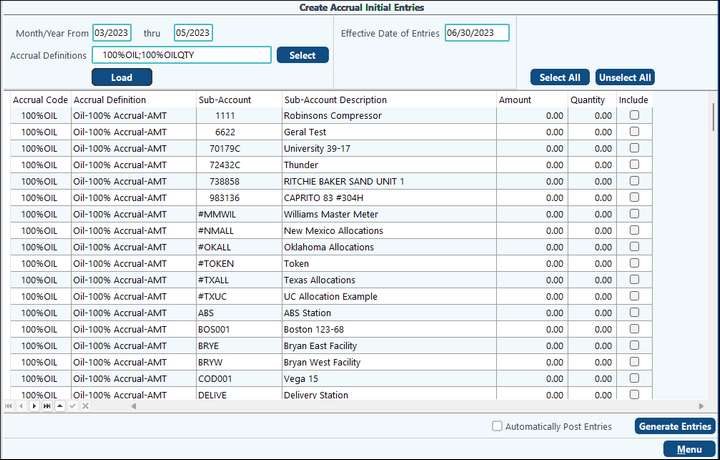

To make the initial entries, select the menu option under Pak Accounting Accruals.

Month/Year From |

These fields allow you to calculate the basis calculated on a single month or user defined time-period. For example, you are entering your accrual for June 2023 and you want to calculate the accrual based on the activity over the past three (3) months. In these fields, you would enter 03/2023 thru 05/2023. This process will look at your basis account (9601) at quantities for March, April, and May, then calculate the average quantity across that time-period. NOTE: Quantities associated with accrual entries for both qty based and amount based entries will post the quantity associated with the accrual amount. |

Effective Date of Entries |

This defines what date this accrual entry will post to your General Ledger. Typically, the initial accrual entries are made on the last day of the month. The effective date of the accrual entry will also be the production date on the entries. |

Accrual Definitions |

Select which accrual definition(s) you are wanting to use for this initial entry. If the field is blank, the bottom portion of the screen will populate all properties associated with any accrual definition created. |

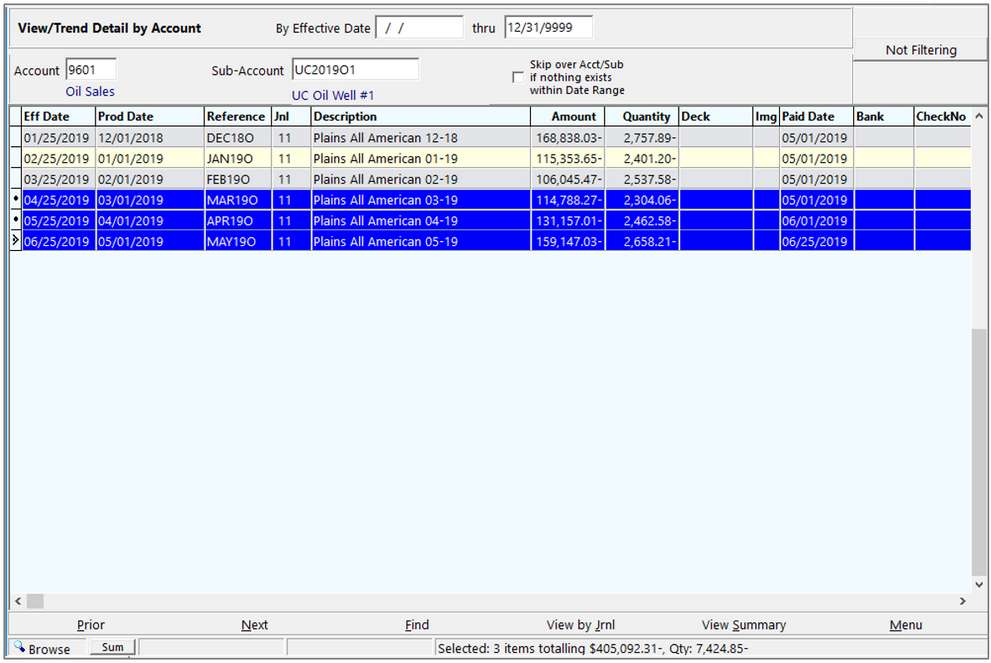

This process will go into View/Trend where the 100% numbers are posted and retrieve the production months that are specified. In this case, we have selected December, January and February. The dollar amounts will be found for those production periods and averaged to give us an accrual amount for March production.

Click the Load button to see all properties that have revenue entries. You can use the column names to filter down and select the properties to create entries for. If entries need to be created for all properties, choose the Select All button in the top right corner of the screen.

Check the box at the bottom to have Pak Accounting automatically post the entries created and click the Generate Entries box.

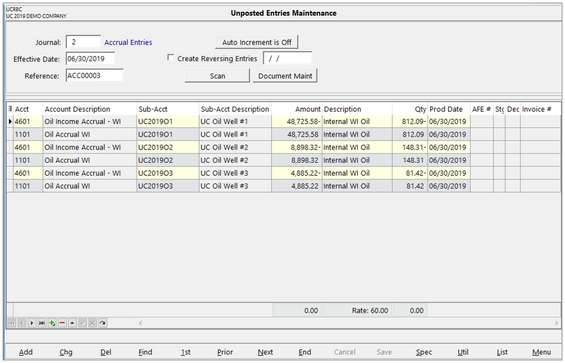

If this box is left unchecked, and the Generate Entries button is pressed, then the entries will go to General Ledger #10 Entries as unposted entries. They can be reviewed there.

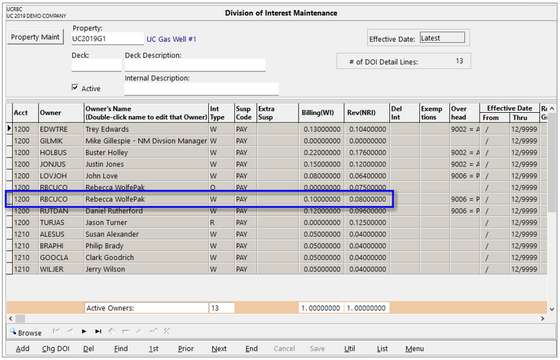

In this example, we will determine the accrual amount for property OK101A for owner WOLEXE.

Average Quantity (2,537.58 + 2,304.06 + 3,116.36) / 3 = 2,652.67

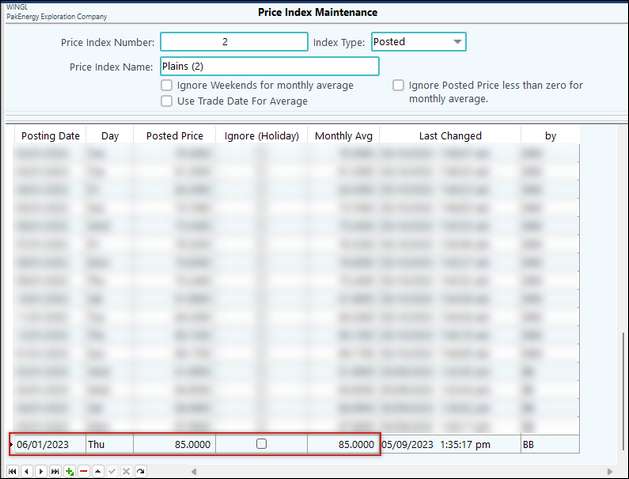

Note that the quantity is actually negative, as sales or income accounts are credit entries. The Price Index value for the accrual effective date is $85.00. So, the accrual for June Production would be -2,652.67 * $85.00 = -$225,476.95

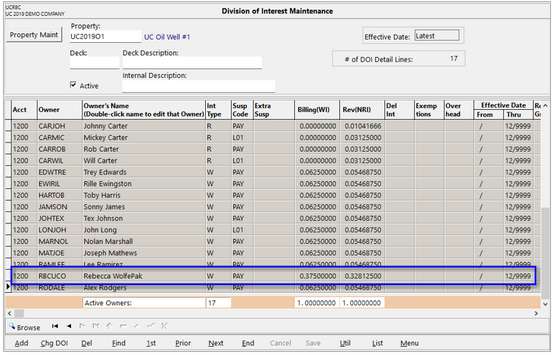

Next, the owner’s percentage of this accrual is calculated. On this property, the owners working interest % is 0.328125.

The accrual entry for June is calculated by multiplying the average quantity times the price index amount in the accrual posting period times the owner’s %: -2,414.28 * $85.00 * 0.328125 = -$73,984.62 Check the box at the bottom to have Pak Accounting automatically post the entries created if desired, then click the Generate Entries button. If the box is unchecked, the entries will go to General Ledger #10 Entries where you can review them if necessary.

Here, you can see both sides of the accrual entry as well as the production date, which will be the same as the effective date of the accrual entry. There may be a few cents difference due to rounding. |

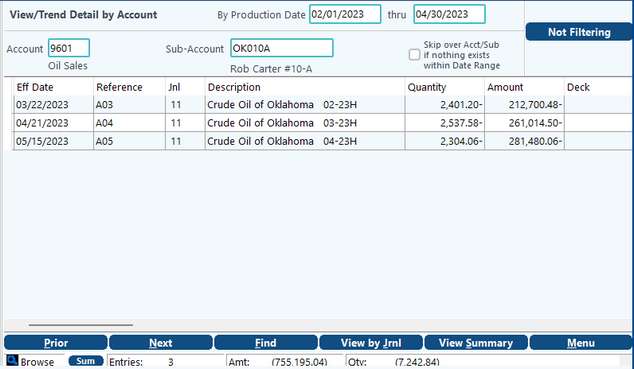

If your accruals are based on historic amounts, the basis account should be an Income/Sales account. In this example, we use GL account 9601 for Oil Sales. An amount-based accrual does not require the Price Index.

To make the initial accrual entries, the process is the same as making quantity-based entries. Select a range of months to create your basis amount. In this example, we are looking at February thru April to create the May accrual.

In this example, the average amount for property UC2019G1 is: (212,700.48 + 261,014.50 + 281,480.06) / 3 = 251,731.68 Note that the actual amount is negative since it is a sales/income account.

Next, the owner’s percentage of this accrual is calculated. On this property, the owners working interest % is 0.375.

The Accrual entry for May is calculated by multiplying the average amount times the owner’s %: -251,731.68 * 0.328125 = -$82,599.46 Again, check the box at the bottom to have Pak Accounting automatically post the entries created if desired, then click the Generate Entries button. If the box is unchecked, the entries will go to General Ledger #10 Entries where you can review them if needed.

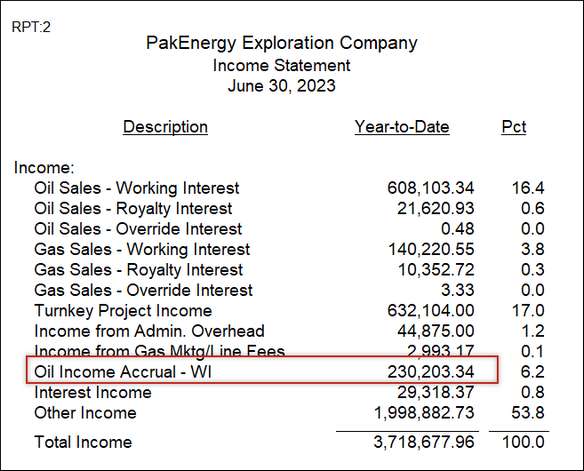

Once you post the entries, the accrual amount can appear in an income statement in a separate line item so you can easily identify it.

|