How do I…Process a Turnkey Project thru Revenue/Billing?

Turnkey Projects- are those projects where partners participate by paying a fixed amount of cost regardless of the actual amount incurred on the project. Normally this amount is prepaid before the project starts.

The goal of a Turnkey Project is for the operator to make a profit from the project. In a Turnkey Project participating owners are not allowed to see the actual cost of the project. we recommend setting up an AFE using the Internal Only option to track

budget versus actual expenses.

1.In F11 Account Maintenance

a.Add a “Turnkey Project Income” account (for example 4400 with Sub-Table 50 attached).

b.Also, add a “Turnkey Project Costs” (for example 5400 Account).

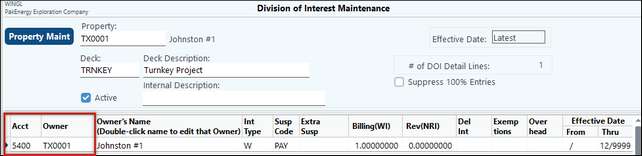

2.Revenue/Billing - Add DOI for the property with the Turnkey deck. Use the turnkey expense account for the account number and the Property# for the owner. Both the billing and the revenue percentages should be 1.0 (100%).

The DOI contains an Expense account and property rather than an owner so that other owners do not see the expenses for this project, but allows for 100% numbers be captured for the Operator. Remember that the Operator’s goal of offering a Turnkey is to make a profit. You do not want the other owners seeing that the expenses are less than they paid when the project is finished.

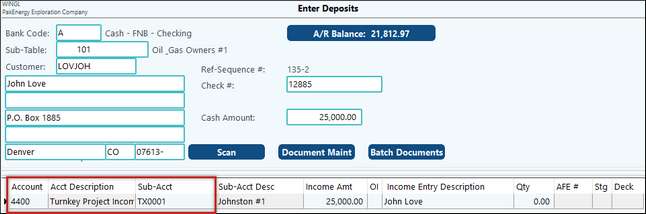

3.Deposit Entry - Coding deposits (income). When entering Turnkey income through Deposit Entry, credit the Turnkey Income Account / Property.

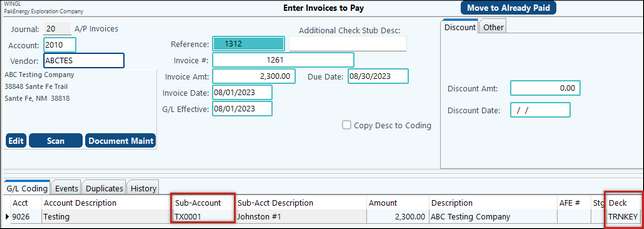

4.Accounts Payable - Coding AP Invoices. When entering Turnkey expenses (invoices) through Accounts Payable, code the normal JIB expense / well using Deck “Turnkey. The process of generating a Joint Interest Billing cycle to the property TX0001 / deck TRNKEY will automatically charge the correct expense account sub of 5400 / TX0001.