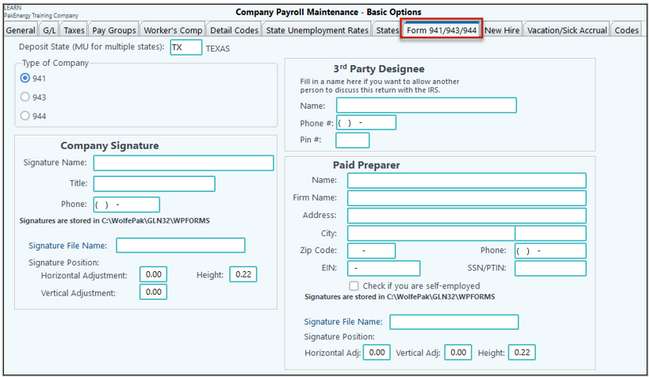

Form 941/943/944 |

|

|---|---|

Deposit state |

Enter state for deposits. Enter MU for multiple states. |

Type of Company |

Select the type of company to file. 941 - most used, 943 - Agriculture companies, 944 - less than $1000 tax liability in a single year (i.e. start up companies, or very small companies) Note: You will be notified by the IRS if you are a 944 company, otherwise assume you are a 941. |

Company signature |

Enter the signature name, title and phone number to print on the Form 941. If using a digitized signature, enter the file name. Signature files are stored in the GLN32/WPFORMS file. The file must be a Monochrome Bitmap 1-bit file. Also see: Signatures and Logos |

3rd Party Designee |

Enter the information if you want to allow another person to have the ability to discuss the 941 return with the IRS. |

Paid Preparer |

If using a Paid preparer to complete your 941. Enter the preparer's information to print on the form. Signature files are stored in the GLN32/WPFORMS file. The file must be a Monochrome Bitmap 1-bit file. |