Special Tab |

|

|---|---|

Subject to Federal withholding? |

Yes - subject to federal withholding; Yes, but at supplemental rate; No - not subject to federal withholding If the employee is subject to tax but for some reason, tax should not be withheld, consider having the employee increase the number of exemptions to prevent any withholding from being deducted. Use a new W-4 to change exemptions. |

Subject to State withholding? |

Yes - subject to state withholding; Yes, but at supplemental rate; No - not subject to state withholding. |

Subject to |

Is this employee subject to: Social Security, Medicare, Federal Unemployment and/or State Unemployment. |

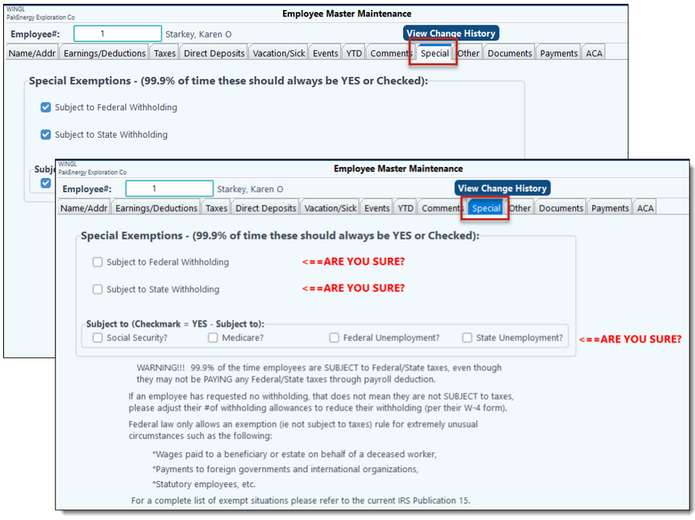

Notes:

•The screen will change and give you many warnings if any box is unchecked. This is because this IS NOT COMMON.

•Just because an employee says they are Exempt doesn’t mean they really are. You may want to double-check if they are truly exempt or if they just don’t want taxes taken out. If they just don’t want taxes taken from their check they may want to increase the number of deductions on the Taxes tab instead.

•They should be made aware that if any box is unchecked the system will NOT track their Federal Withholding/Wages and the corresponding box(s) will be $0 on their W2.

•If these are changed after initial setup, correcting payrolls will need to be processed. These options should not be changed on this screen. The system will now turn this Special tab Blue if changes have been made and give you a warning on the screen.