When setting up for specific states there a few other fields that may need to be filled in.

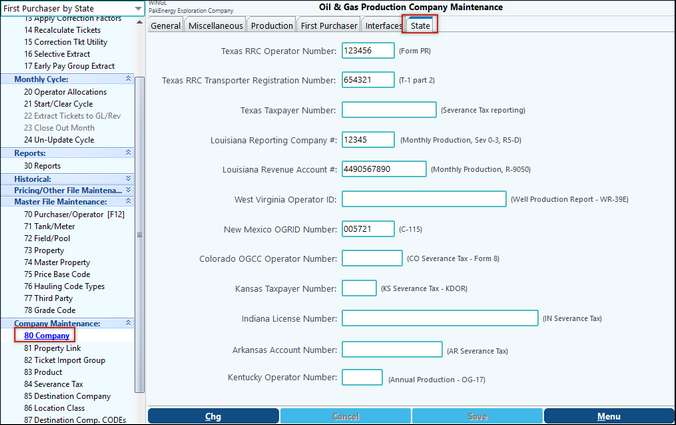

Company Maintenance > State tab: Enter in your state's Account Number. This is used for reporting Severance Tax and state reporting; the specific report is show in blue after each field.

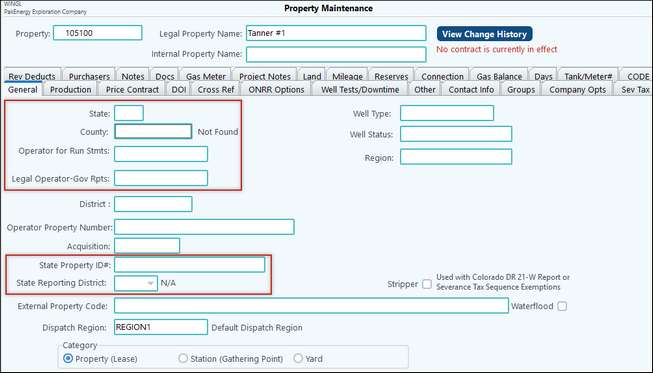

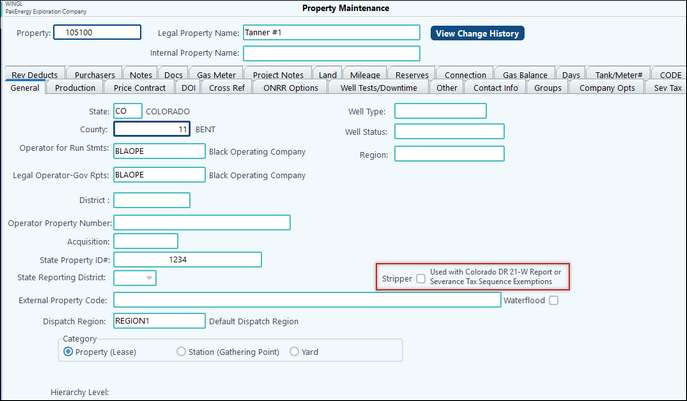

Property Maintenance: General Tab: Fill in the following fields: State, County, Operator for Run Stmts, Legal Operator-Gov Rpts, State Property ID# (if applicable), and State Reporting District (if applicable).

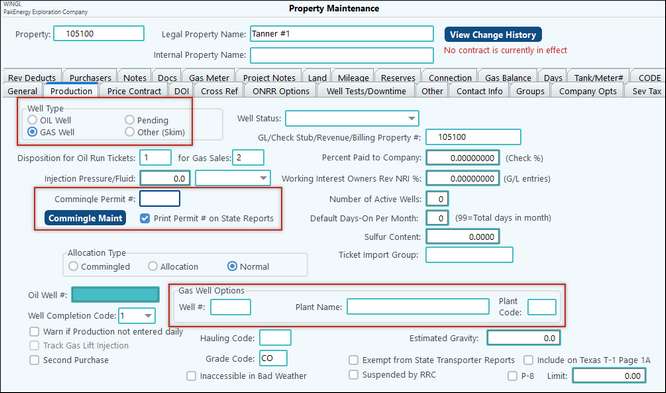

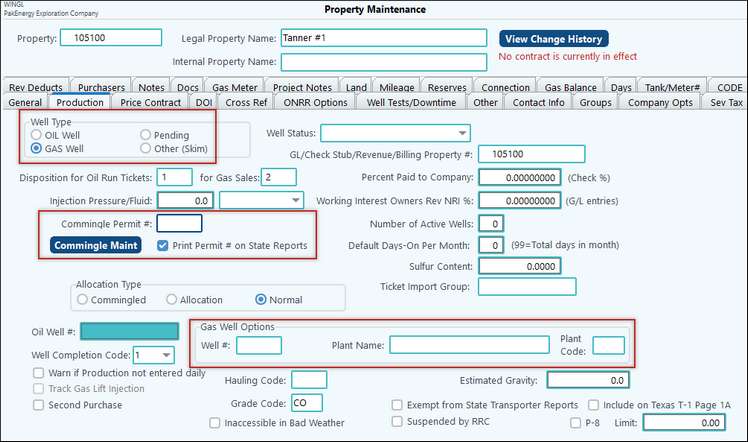

Production Tab: Enter in all the appropriate information. (Note: don’t forget the disposition codes.) If the property is a commingled property, •Be sure to enter the allocations using the Commingle button on the bottom of the screen. •Commingle permit # (if using commingle as an allocation type) •Print Permit # on state reports box (if using commingle) If you have a GAS Well Type: •Gas Well options

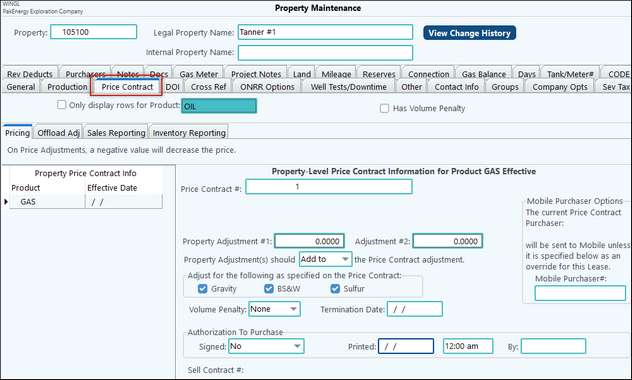

Price Contract Tab: Enter the Price Contract #(s) for this property and other applicable price adjustments specific to this property. This pricing will show on the run tickets and the Operator Run Statements. This can also be done in Price Contract - Properties Using tab.

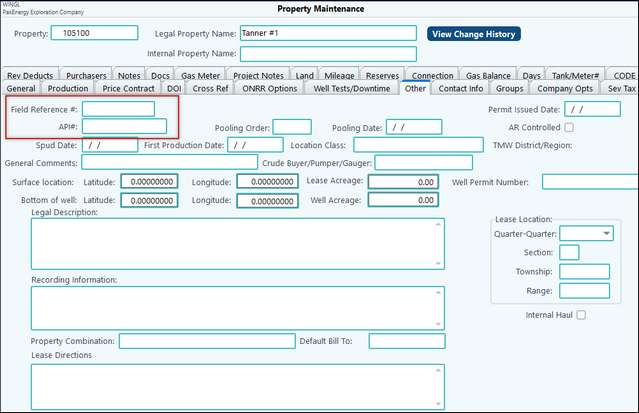

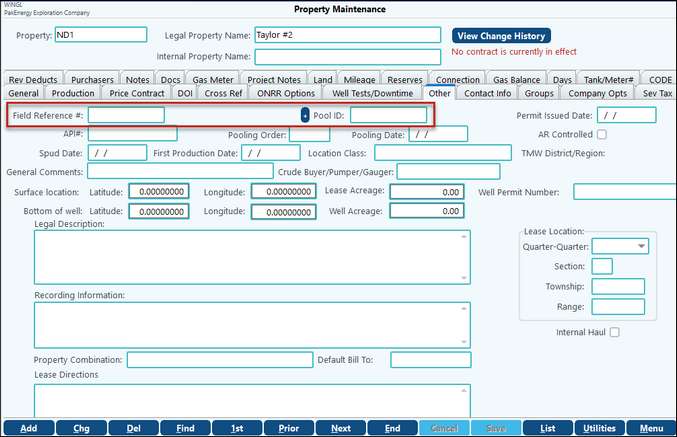

Other Tab: Enter the field reference # (prints on reports), API# and other info as needed.

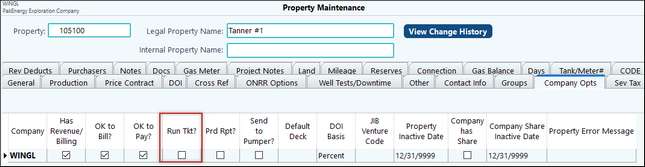

Company Options Tab: Be sure the enter “Run Tkt?” is checked.

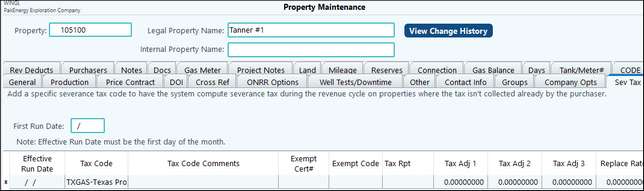

Sev Tax Tab: Enter the Severance Tax Code applicable to each property. (See Severance Tax Maintenance)

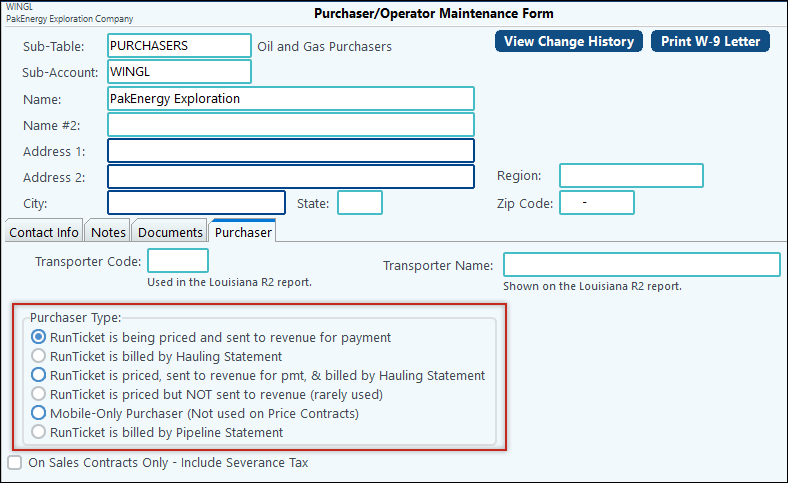

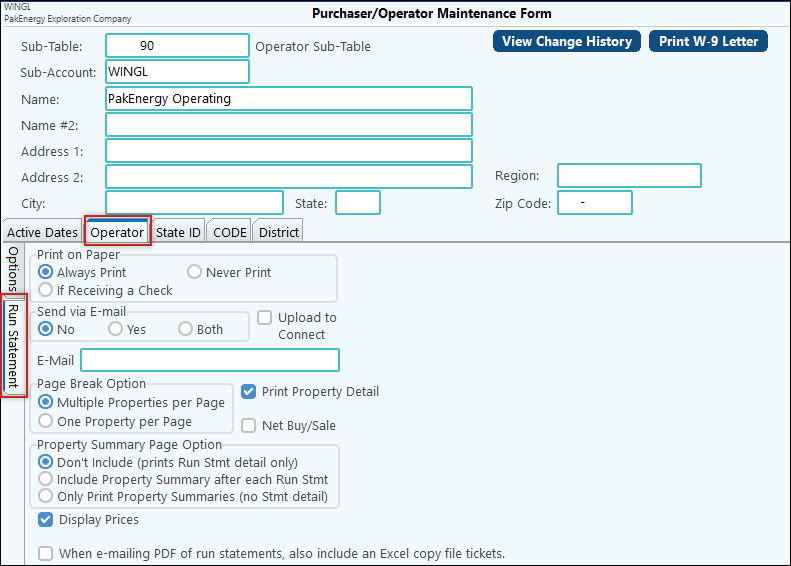

Purchaser/Operator Maintenance Form For your Purchasers, make sure the correct Purchaser Type is set on the Purchaser tab.

Operators The Operator tab is where you identify how this operator wants to receive their statements. Statements can be printed, sent via email, or both. If sending by email, enter in the email in the E-Mail field. Multiple addresses can be entered by using a semi-colon between the addresses. Do not put a space between the semi-colon and the next address.

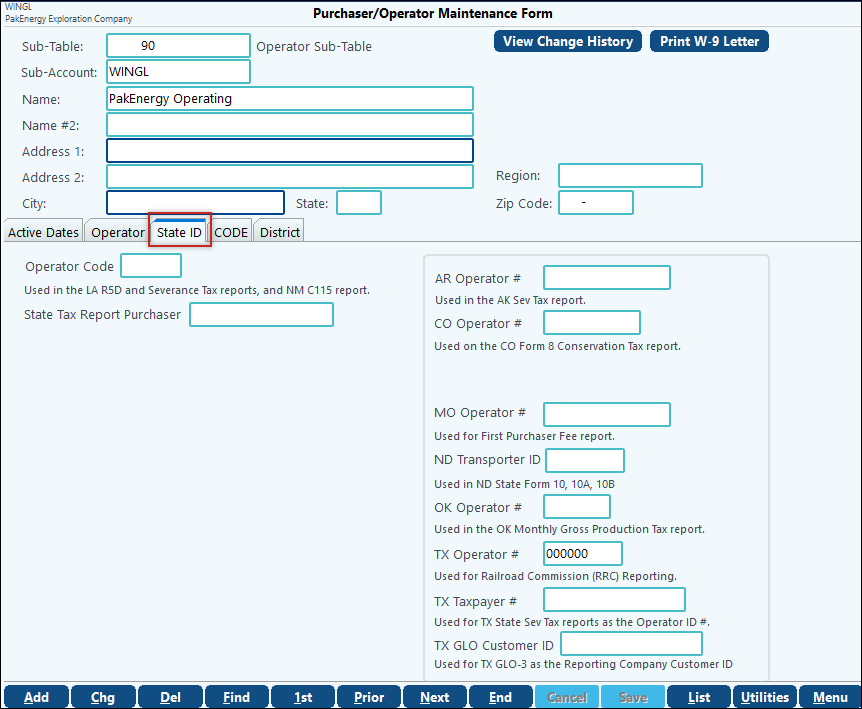

The State ID tab is where you can enter in the state's specific ID number. The information in blue below the field will indicate how the information is used.

|

There are no additional fields for Arkansas. |

Property Maintenance:

General Tab: Fill in the following additional fields: State Property ID#, State Reporting District, and the box if this is a Colorado Stripper well.

|

Indiana License Number |

Property Maintenance:

Production Tab: Fill in the following additional fields (if applicable). •Commingle permit # (if using commingle as an allocation type) •Print Permit # on state reports box (if using commingle) •If a GAS well, also fill in: oTrack Gas lift injection oGas Well options

|

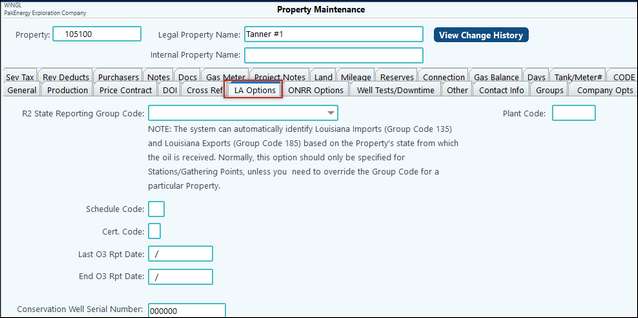

LA Options Tab: (This tab visible only if the state code on the General tab is set to LA.) R2 State Reporting Group Code – used for the R2 Part 2 reporting

|

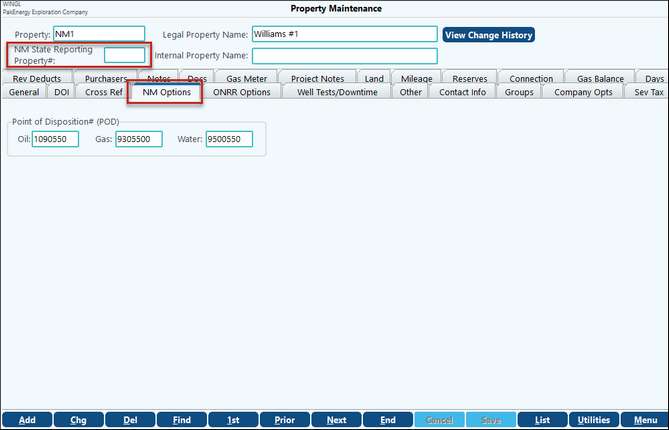

Property Maintenance When the state is set to NM, a few more options will be available. At the top of the screen enter the Property ID assigned by NM. There will also be a new tab: NM Options which will allow you to enter the Point of Disposition #s (POD).

|

When the state is set to ND on the General tab, a new field will be available on the Other tab. The Pool ID is required for the Transporter Reports 10, 10A, and 10B. You will also need to enter the field reference # (prints on reports), API#, and other info as needed.

NOTE: When a Unit or Central Delivery Point is allocated to individual tracts, the state will assign a group/unit number to allow all of the tracts to be reported under one number. If the API Number, Well Code, and Pool Code are all the same in Pak Accounting, the system will combine them into one reported line item on the T-12 report. |

There are no additional fields for Texas. |

See Severance Tax setup for special rules for West Virginia. Also see Rev/Billing > Property Reports > Well Status for a reporting option to Create the West Virginia WR-39E File with columns for NGL reporting. |

Also see Rev/Billing > Reports/Corrections > Reports > State/Fed Reports tab for state specific Severance Tax Reports.