Overview

Non-Consent Interest

Is an affirmative election by a working interest owner not to participate with his/her working interest in the drilling, re-working, or plugging of a well. Under most JOAs, the working interest owner will have 100% of his/her interest re-instated after a penalty has been met.

Example of when an owner might elect to go non-consent:

An operator proposes the drilling of a new well based on geological research and estimates the cost. Working interest owners that consent to participate in the project (potentially gaining profits) will owe their share of expenses. Those who don’t consent to participate in the project will be subject to a non-consent penalty before they are allowed to receive their proportionate share of revenue again. Typically this type of project is tracked through an AFE; however an AFE is not required.

Non-Consent Penalty:

•While non-consent penalties can vary, they are commonly 300% of the net revenue generated by the project.

•When a working interest owner(s) elect to go non-consent on a project some or all of the working interest owners who choose to participate must carry the burden for the non-consenting owners. This increases the cost/risk for the consenting owners thereby resulting in a hefty non-consent penalty.

How to Process a non-consent owner in Pak Accounting?

We recommend either removing the non-consent owner from the original deck, or setting up a separate non-consent deck.

Setup and Use

Set up a separate non-consent deck:

•This deck should only include participating owners with the billing and revenue interest they are assigned for the duration of the project. This can be accomplished one of two ways: either exclude non-consent owners altogether or, include them with a zero percent. This allows any non-project related revenue/expenses be paid/billed separate from project related revenue/expenses.

•A separate deck also keeps the original deck unchanged for when/if the participating owners recover their investment plus a penalty and the non-consent owner(s)’ interest is reinstated.

Example: We will use Property HOFFMAN #1. Working Interest Owner TURJAS -Jason Turner opts to go non-consent for the drilling of the new well.

This is the original deck:

Scenario 1: To use the original deck remove the non-consenting owner from the DOI:

Notice that TURJAS had been removed and the Working Interest owners have a larger Billing and Revenue Interest than before because they will carry the burden for TURJAS. They also get their pro-rate share of his Revenue Interest.

Note: If you would like to leave the non-consent owner on the deck, instead of removing them, simply zero out their billing and revenue interest.

Scenario 2: To use a separate non-consent deck:

Go to Revenue/Billing/ Division of Interest, Add the Non-Consent Deck (NON), and add the participating owners. (Use the Chg DOI button to allow editing)

Payout Master Maintenance:

Payout Maintenance is located in Reports > Owner tab > O-20 Payout Maintenance/List:

Owners that opt to go non-consent on a project sometimes want to know when their interest will be re-instated after a project is finished. Participating Owners often want an estimate for a return on their investment. Pak Accountings’s Payout Maintenance is a quick and convenient way to track and report an owner’s payout. The Payout maintenance will track revenue net of any project related expenses.

Note: When tracking non-consenting owners keep in mind that consenting owners are typically entitled to recoup the cost of the project and earn a 300% of their investment before a non-consent owner’s interest is re-instated.

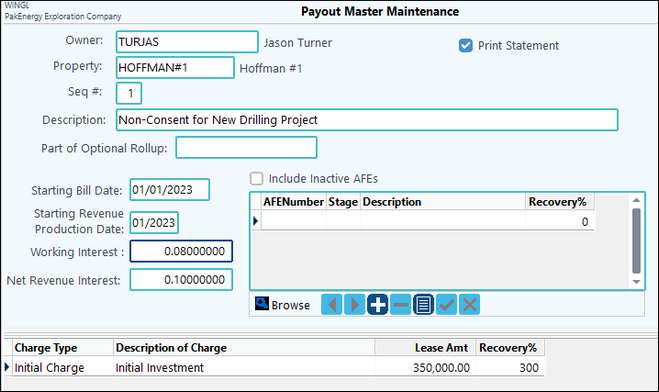

Payout Master Maintenance:

The Payout Maintenance is owner and property specific, but can track multiple payouts for that owner/property, as well as AFE and non-AFE related charges on the same payout.

Owner |

Sub-Account # for owner |

Property |

Property # |

Seq# |

System will automaticaly asign a new sequence number if tracking separate payouts for the same owner/property. |

Description |

Allows description of the Payout to be printed on the Payout Statement |

Print Statement |

If checked a statement will print when list option Records marked to Print on Statement is used. |

Statrting Bill Date |

Enter the date project expenses started. |

Starting Revenue Production Date |

Date Revenue production for the project began. |

Working Interest |

Owner’s Billing Interest |

Net Revenue Interest |

Owner’s Revenue Interest |

Description of Charge |

Payout Balance Description |

Lease Amt |

Total lease cost of the project |

Recovery % |

Percentage of Revenue to be Recovered |

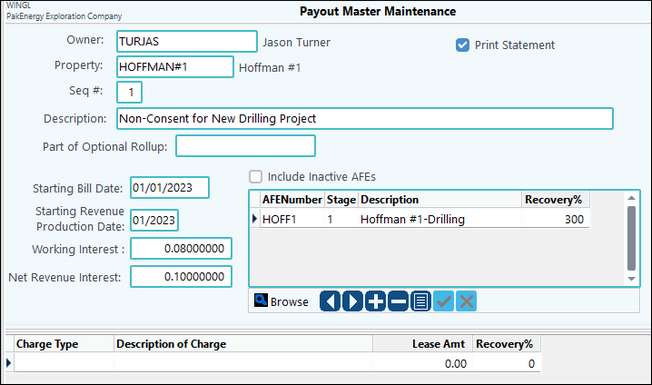

If using an AFE for expenses: • AFE • Stage • Description • Recovery % |

AFE # |

Example of an AFE related Payout:

Note: A non-AFE and an AFE related can be tracked on the same Payout as long as they are for the same property.

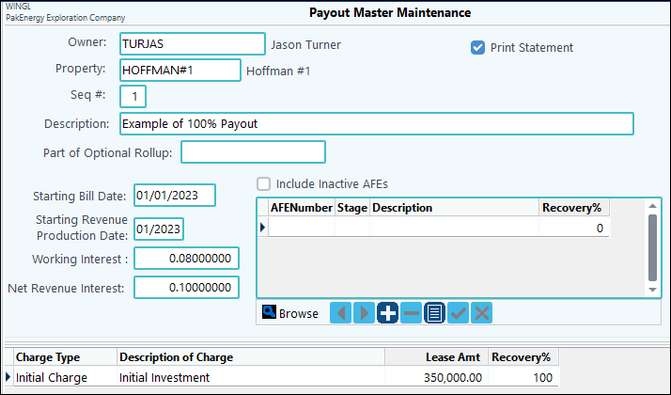

Payouts can also be set up for Participating owners. To accomplish this under the Recovery % enter 100%.

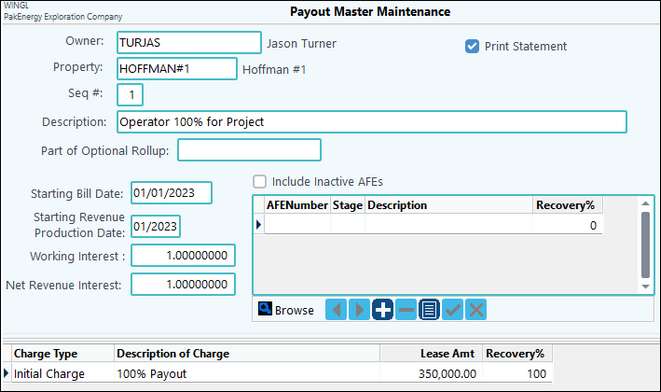

Payout can also be tracked for Operators to show 100% numbers for the project. To accomplish this, enter 1.0 for the Working Interest and the Net Revenue Interest in the Payout Master and 100% for the Recovery%.

Payout Statement:

To Print a Payout Statement use the List option on the Payout Master Maintenance and choose the option- Records Marked to Print on Statement.

Note: To email statements Owner Maintenance/Contact tab/ Statement Email must be filled in.

Name and Address |

Populates from the Payout Master Maintenance “Owner”. |

Account |

Lists the Owner Sub-account code, Property Code and Sequence #. Pulls from Payout Master Maintenance. |

Date |

Populates from the Payout Master Maintenance List option Current Period “thru” date. |

Property Name |

Populates from the Payout Master Maintenance “Property” |

Description |

Populates from the Payout Master Maintenance “Description” |

Starting Billing Date |

Populates from the Payout Master Maintenance “Starting Bill Date” |

Working Interest |

Populates from the Payout Master Maintenance “Working Interest” |

Current Period |

Populates from List options “Current Period from and thru date” |

Starting Revenue Production Date |

Populates from the Payout Master Maintenance “Starting Revenue Production Date” |

Net Revenue Interest |

Populates from the Payout Master Maintenance “Net Revenue Interest” |

Payout Balance to Recover: |

Populates from the Payout Master Maintenance “Description of Charge” or AFE section “Description" |

Actual Costs |

Populates from the Payout Master “Lease Amt” |

Recovery Pct |

Populates from the Payout Master Maintenance “Recovery %” or AFE section “Recover%" |

Recovery Amount |

Calculates from Actual Costs multiplied by RecoveryPct |

Your Share |

Calculates from Recovery Amount times Working Interest |

Current Revenue and Expenses |

Pulls from the GL For Billing and Revenue accounts for the Property being reported on Current Amouts are any expenses or Revenue falling within the Current Period from/thru used on the List Options screen |

Current Period Amounts |

Current Amouts are any expenses or Revenue falling within the Current Period from/thru used on the List Options screen |

Payout to Date Amounts |

Includes Current Period amounts and non-current amounts |

Your Share |

Payout to Date Amounts multiplied times Net Revenue Interest for Revenue and Payout to Date Amounts multiplied times Working Interest for Expenses |

Net Income Applied to Payout Balance |

Current Amounts- Current Revenue minus Current Expenses Payout to Date Amounts- Payout to Date Revenue minus Payout to Date Expenses |

Balance Remaining to be Recovered |

Owners share of Payout Balance to be Recovered minus Owners Share of Net Income Applied to Payout Balance |

The List options screen allows Payout Statements to be printed, viewed to the screen, or saved to a file. The List options screen also allows for the Payout Maintenance to populate for one owner, a range of owners, or all owners that have a Payout Master Maintenance set up. The Payout Maintenance can also be limited to a property, a range of properties, or all properties that are set up in the Payout Master Maintenance. Payout Statements can be printed as well as emailed. If using the Option to “Email those with Email Address” the Pak Accounting e-mailer utility will populate allowing owners to be emailed and only those without an email will print.