Overview

Pak Accounting Inter-Company Payroll feature allows corporations to use a “common paymaster” which will automatically create G/L entries to record their expenses into multiple Pak Accounting companies. Advantages of using a common paymaster are:

1.Saves Money – avoids duplicate tax liability. Since employees are paid out of only one company, the tax limits (Federal & state unemployment, and social security limits) are only paid once!

2. Saves time – maintaining company and employee information and running payroll cycles, tax reports, check stock, ACH transmission are done only once in the “common paymaster” company. Short handed in one company; it is real easy for an employee to get expensed out in another company on a one time or reoccurring basis.

3.Easier on employees – employees get only one check instead of one from each company for which they did work. Income tax withholding is more accurate and social security limits are applied.

Setup

1.In the “payer” corporation (“common paymaster”),

a.Set up a Sub-Table to identify inter-company payroll company codes to be used in the “Common Paymaster”.

b.Add a Sub-Account in this Sub-Table for each of the other corporations that will be paying employees out of this common paymaster using the same exact 5 character Pak Accounting company code (including the exact number of leading zeroes if applicable).

c.Set up an inter-company receivable account to record the offset entries that utilizes the Sub-Table defined in step

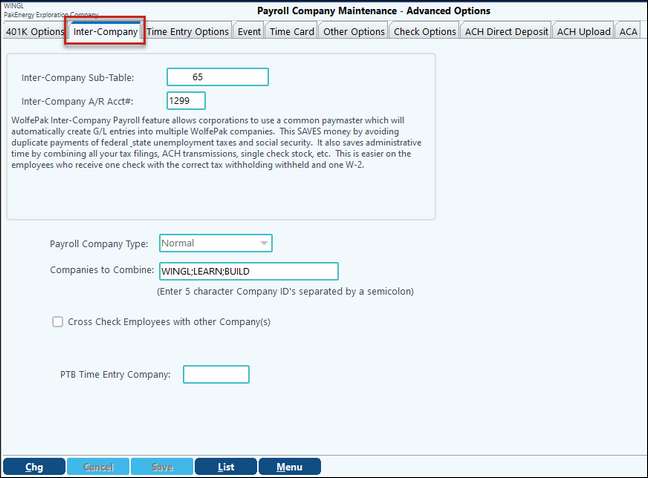

d.In Payroll Company Maintenance – Advanced Options, let the payroll know of your account and Sub-Table. (Note: Payroll company type is normal.)

2.In each of the other companies:

a.Setup an inter-company Sub-Table.

b.Add the common paymaster’s 5 character Pak Accounting company code as a Sub-Account.

c.Setup the same account number for an inter-company account.

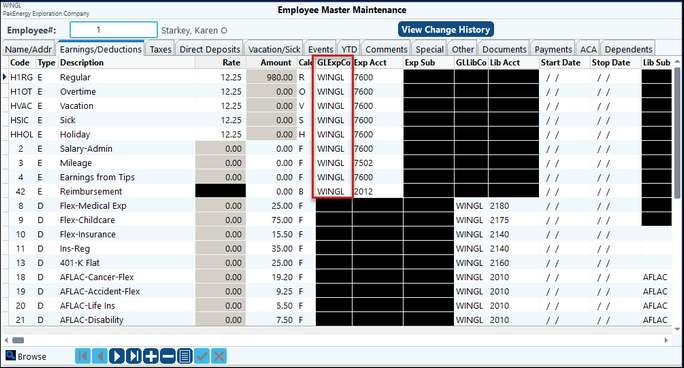

3.In the paymaster’s company payroll setup, under Employee Master Maintenance > Name address tab, enter the Default company to record the expense side of the payroll entries.

4.Each employees earning and deduction codes will default to the company setup, the company code can be overridden.

Payroll cycle

When running a payroll cycle, the company to which the entries will be posted will show on the Summary maintenance screen and has the same override abilities at the cycle level as changing account or Sub-Account information. The Payroll Register will display the company posting information only if the entry is going to a different company than the “Common” company. If automatic posting is on, General Ledger entries will automatically post in each company.

Limitations:

1.The same Account number must be used for the inter-company Due to/From Account. The Sub-Account will be the 5 character company code.

2.On the Company Maintenance > Accrual Accounts screen, if using the same Earnings Expense accounts in all companies, then the “Accrual” Payroll Tax Expense accounts must be the same in all companies as the “Common Paymaster” company.

3.The G/L entries created by voiding a check only automatically post in the common G/L company at this time. The system creates the G/L entries in the other book(s), it just doesn’t automatically post them at this time.

Cross Check Employees with other Company(s) and PTB Time Entry Company:

These two field work specifically with the PTB Time Entry program. Check the box and select the time entry company to cross reference all employees between multiple payroll companies and automatically replicate address, phone #, W-4's, etc changes from one company to all companies they are defined in. NOTE: This does not affect employee master, it specifically applies employees in the PTB time entry program.