Company 401(k) Options Maint |

|

|---|---|

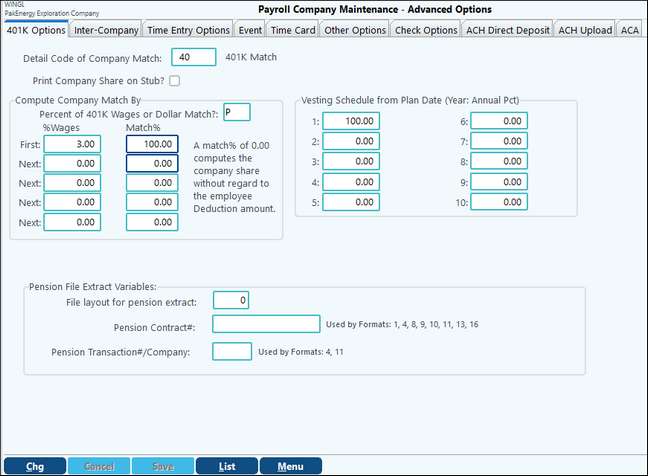

Detail number of Company Match |

Number of the detail item defined for company match. |

Print Company share on stub? |

Check if you want the company share of the 401K to print on the check stub. |

Compute Company Match by: |

|

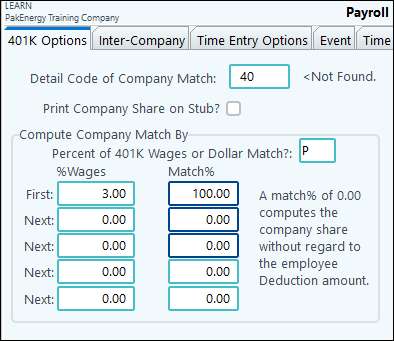

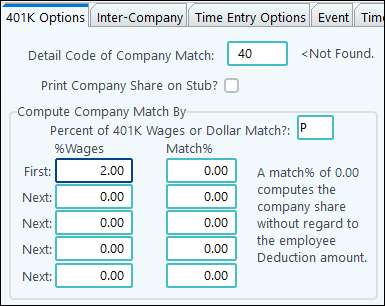

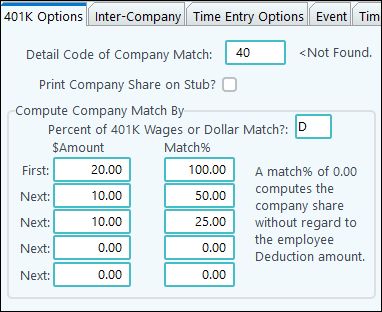

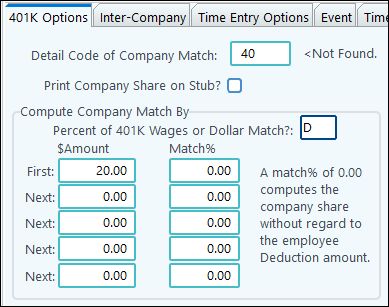

Pct of 401k wages or Dollar match? |

D - Company match is a fixed dollar amount P - Company match is a percentage of employee contributions Y - Year to date amount |

First... |

This table determines company match amounts. For example, in the screen shown above, The first 3% an employee invests will be matched 100%. |

Pension File Extract Variables |

0=Standard file layout for all companies 1 = TCDRS (Texas County and District Retirement System) 3 = Fidelity Investments 4 = Manulife 6 = LH 7 = mod Manulife 8 = QC 9 = ING 10 = TCDRS EE only 11 = ADP 12 = Wachovia 13 = Now Trac-Wachovia 14 = PCS Capital 15 = MBM Advisors 16 = Regions Bank/Ascensus 17 = CUNA Mutual Group 18 = Unified Trust |

Vesting Schedule |

Defines the vesting schedule as percentage per year. The percentages must add up to 100%. This is currently not used in reporting or calculations. |

Example 1: Company will match 100% of employee deductions up to 3%. Employee earnings = $1,000 Employee 401 deduct = 5% or $50 Company Match = 3% or $30 If employee 401K deduct = 2% or $20 Company Match = 2% or $20 If employee 401K deduct = 0 Company Match = 0

Example 2: Company will match 2% of employee wages, no deduction required. Employee earnings = $1,000 Employee 401 deduct = 5% or $50 Company Match = 2% or $20 If employee 401K deduct = 2% or $20 Company Match = 2% or $20 If employee 401K deduct = 0 Company Match = 2% or $20

Example 3: Dollar Match "D" Example Employee earnings = $1,000 Employee 401 deduct = $50 Company Match = $27.50 ($20 @100% + $10 @ 50% + $10 @ 25%) If employee 401K deduct = $20 Company Match = $20 If employee 401K deduct = 0 Company Match = 0

Example 4: Company will match $ of employee wages, no deduction required. Employee earnings = $1,000 Employee 401 deduct = $50 Company Match = $20 If employee 401K deduct = $20 Company Match = $20 If employee 401K deduct = 0 Company Match = $20

TECH TIP!!! If your company match is showing up 0 or less than it should be:

Check the earnings detail: If the company match for 401K is based on a percentage of employee's earnings, then the earnings detail codes must be NOT be set to "No Effect", or the company portion will not calculate. Set to Base Wage/Hrs.

Check the cycle start screen: The company 401K detail must be checked.

|