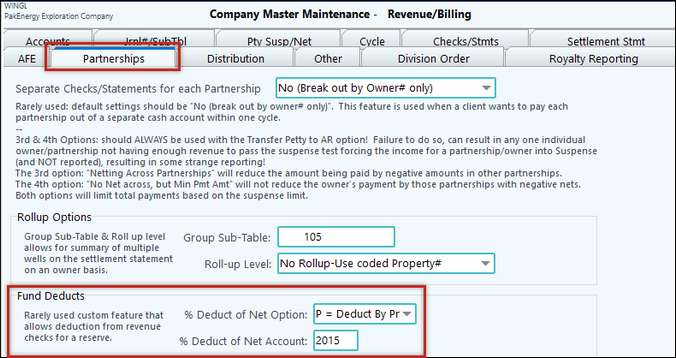

Fund deducts allow owners to be paid a return on investments and allow the excess to be remitted to a re-investment fund account. See Revenue / Billing Partnerships tab. For this tab to be visible the information on the Partnerships tab must be defined for the Fund Deducts box.

The deduction can either be setup for the cash flow of each property to be on their own or if multiple properties are to be grouped together for that computation.

For each owner participating in this automatic deduction, the properties (or group of properties, depending on how the company option is defined) are identified along with a Type of computation and the rate information. The two types are:

Pct Deduct: A Percentage to be deducted is specified (as long as the property/group has a positive cash flow).

| Max to Owner: The amount invested and a Percentage return are also coded for each property/group. The system will display the maximum monthly amount to be paid to the owner each month for that property/group, with any amount over that amount getting deducted. If there is not sufficient cash flow for the owner to obtain the stated return, there won’t be a deduction made during the current Revenue Cycle for the fund for that property/group. Deductions to the fund flow in only one direction. It will not create a refund from the fund to try to bring up the cash flow for the month to the owner’s stated percentage return. The Max Monthly Amt to owner assumes that there will be one payment to the owner each month. |

Special considerations:

The A/R Account Range (Company A/R Options > General Tab) must include the A/R account setup for this owner on the DOI.

The property/group cash flow is computed at Revenue less revenue related deductions (Severance Tax, other revenue deducts), less Billing expenses plus any prepaid AFE amounts applied to the account. Normally, an owner would be Netted (amount to pay the expenses deducted from their revenue) for this option to work effectively. Prior month’s negative cash flow (i.e. A/R balance – if the owner hasn’t funded it), is not part of the above computation.

Owner Minimum payment code should be set that the owner gets a check each month. Otherwise, the revenue will get held, but the expenses will get charged each month until the revenue amount will exceed the minimum payment amount, then the computations are based on the revenue being paid and only the current billing’s expenses.

See the Revenue/Billing > Partnerships tab to set the Fund Deducts options.

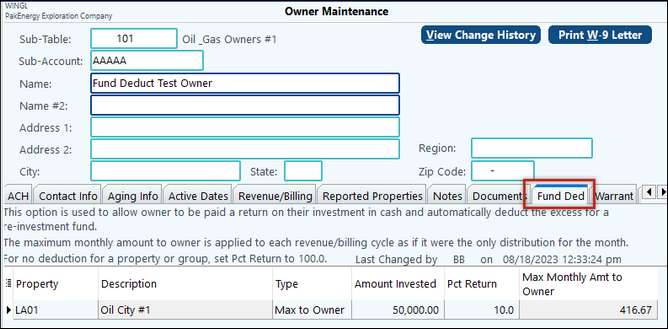

Fund Deduct "P" Option on Owner Master

Fund Deduct "P" Option See Rev / Bill Partnerships Tab |

|

|---|---|

Property |

Add each property that is desired to be paid a return to the owner. If the owner is netted, it will base the percent returned on the netted amount. |

Type |

Max to Owner - This option allows you to define the amount invested and base a percent return to calculate the max monthly amount to the owner.

Pct Deduct - This option will allow you to define the percentage of the owner's income for this lease that is allowed to be paid to the owner. |

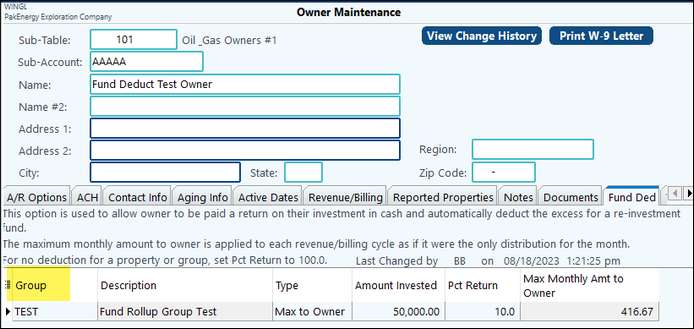

If the Fund Deduct is set to the "G = Deduct by Rollup Group" option in Company Master, the Owner Maintenance screen will look like this:

Fund Deduct "G" Option See Rev / Bill Partnerships Tab |

|

|---|---|

Group |

Add each "rollup" group that is desired to be paid a return to the owner, If the owner is netted, it will base the percent returned on the netted amount. |

Type |

Max to Owner - This option allows you to define the amount invested and base a percent return to calculate the max monthly amount to the owner.

Pct Deduct - This option will allow you to define the percentage of the owner's income for this lease that is allowed to be paid to the owner. |

Once the setup is complete, the Revenue cycle will have a new option on the Revenue Tab: "Make Fund Deductions." When this option is checked and the Company Maintenance is set to "P" or "G," the "Owner Pct Deductions" is run within the cycle. In addition, the "Extract G/L 1099-INT to Billing" option appears in the 1099 module.

How to create a Roll-Up Group-See Rollup Settlement Statements

Owner Master > Revenue Billing Tab > Project Reporting

If entering Project Notes in Property maintenance. Select the report destination and enter an email if notes are to be sent via email.