Before printing the W-2s, use the Edit Listing to verify that all information is correct. The From and Thru boxes can be populated with an employee or a range of employees. Leaving the boxes as the default will bring up all employees.

Run the Errors Only report after extracting to help easily identify any errors. Check the Print Only Errors box, then print or view the report. Any errors will print on this report. All errors should be fixed before continuing with the W-2 process.

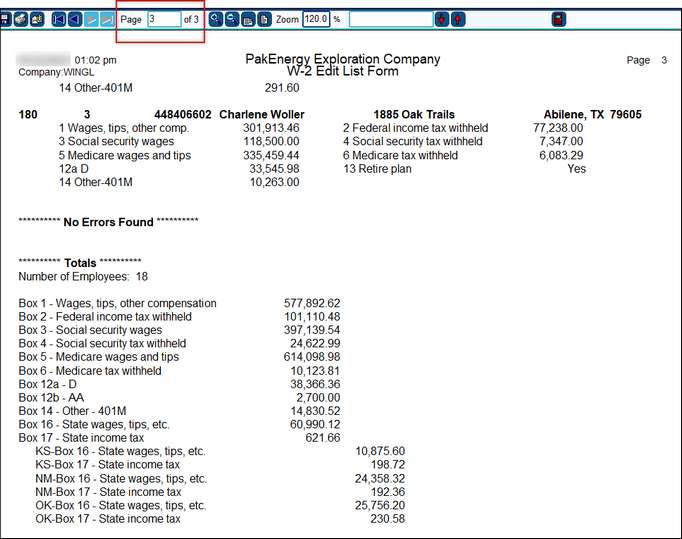

Once all of your errors have been corrected. Run the Edit Listing without the print only errors box checked. This listing will show you all employees along with their W-2 information.

There will be a message that there are no errors. If there are errors, they will need to be corrected before moving on.

The end of the report will give you totals for all W-2's extracted.

NOTES:

•Error messages will print if FICA and Medicare amounts are incorrect for an employee. Call your Customer Success Team for assistance.

•For employees with zeroes for their SSN a warning message will appear stating: WARNING: This employee has a SSN of all zeroes. This is only used when the employee is applying for a SSN. This can be used to allow the company to file W-2s with the SSA. You MUST enter the correct SSN as soon as you receive it, and a corrected W2 must be sent to the SSA and the Employee. Corrected forms can be done from the SSA website.

•If there are errors, run correcting cycles or update missing information in #10 Employee Maintenance, re-extract, then rerun the edit listing until there are no errors reported.

Also see Assessing Year End Data