After extracting, reviewing, and making necessary corrections to the W2 information, it’s time to starting printing.

Filing Basics

•You must file electronically if you have 10 or more W2's.

•You can file electronically if you have less than 10, but it's not required.

•Whether filing electronically or printing Pre-printed Forms, you can print employee, employer, and state copies on plain paper.

•We recommend also saving the plain paper copies as a PDF.

oThis makes it easier to retrieve a lost W2 for an employee. This would eliminate the need to re extract a prior year, which would erase a current extract.

oSince historical forms are not retained within the system, the saved PDF would maintain the correct formatting.

•Plain paper copies are for internal purposes only and are not meant to be filed with the Social Security Administration.

•Copy A and the electronic transmittal are the only two formats that should be sent to the social security administration.

W-2 Forms Overview

There are differences between printing on plain paper forms versus pre-printed forms.

•Plain paper forms – you only need to load plain paper into the printer. All of the data will be printed, and no additional formatting is required.

•Pre-printed forms - additional steps that require attention.

1.Requires special forms that need to be ordered and formatted to the printer before printing.

2.The correct form option must be chosen when printing W2s. For example, you do not want to choose the copy A, which is a red form when printing a copy B which is a black form.

3.When printing multiple forms, some fields may not align correctly and may begin to vary from copy to copy.

•Different copies need to be sent to the Social Security Administration versus the one sent to the employee.

•Custom W-2 envelopes are required for mailing any printed employee W2 forms.

•Clients can order forms and envelopes from PakEnergy’s forms department

Note: If you are sending a paper copy to the IRS, you will only need to print the Copy A using Pre-printed forms. Then, you can use the Plain Paper to print the other copies (i.e. Copies B, C and 1). Copy D is the office copy for your company records. It is recommended that you save the Copy D’s as a PDF file. This is the easiest method if an employee asks for a lost W-2 in a later year.

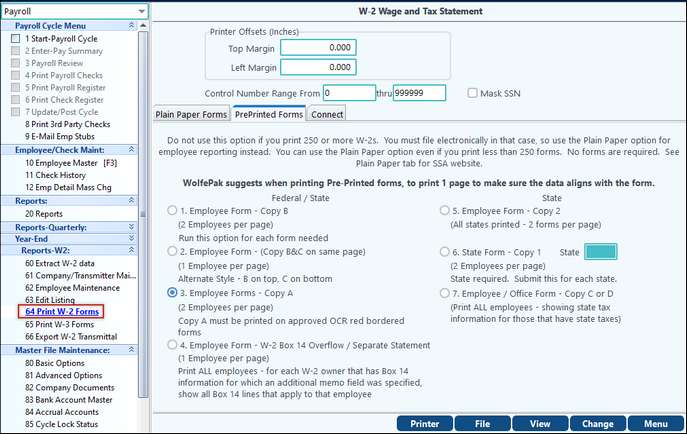

W-2 Pre-Printed Forms

PrePrinted tab – if printing Copy A forms, this tab must be used.

SPECIAL NOTE: We strongly suggest that before printing the forms, you should print a couple of pages to plain paper. Then hold those up to the pre-printed form to make sure the fields align properly.

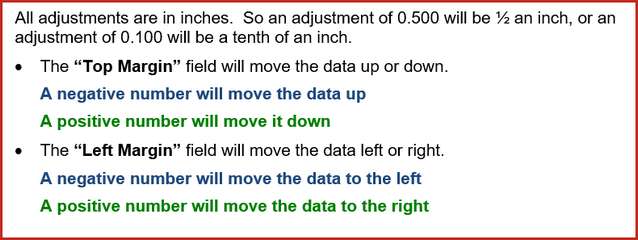

If forms are purchased from PakEnergy, the forms should print without any adjustments needed. Adjustments may be needed depending on the printer being used.

If forms were not purchased from PakEnergy, and the fields do not align properly, you will need to use the “Printer Offsets” options to correct the printing alignment. These settings allow the user to move the data around on the page so that the fields print in the correct boxes/positions.

Mask SSN: This option will mask the first 5 digits of the social security number on all forms except Copy A that is sent to the Social Security Administration.

There are four Federal / State print options, and three State only print options.

Choose the correct form option to print on the pre-printed W-2 form. You do not want to choose the Copy A option when printing on the Copy B pre-printed form. Some fields do not align the same on different copies.

The Federal / State print options are:

1.Employee Form – Copy B (2 employees per page)

2.Employee Form – Copy B&C on same page (1 employee per page)

3.Employee Form – Copy A (2 employees per page). The copy A must be printed on the approved OCR red bordered forms.

Special Note: For each employee, up to two states of tax information can be printed. If more than two states of tax information exist for an employee, then an additional copy A will print showing the next two states information.

4.Employee Form - W-2 Box 14 Overflow/Separate Statement (1 Employee per page) - This ties back to the Box 14 information setup on the Extract Menu.

5.Employee Form – Copy 2 (all states printed – 2 forms per page)

6.State Form – Copy 1 (2 employees per page) – the state field will appear to select which state to print. You must submit this option for each state needed.

7.Employee / Office Form Copy C or D (print ALL employees – showing state tax information for those that have state taxes). You

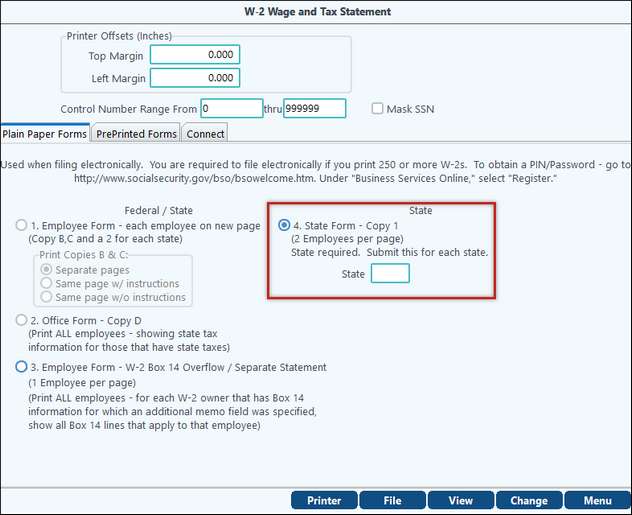

W-2 Plain paper

Plain Paper tab – special forms are not required.

Mask SSN: This option will mask the first 5 digits of the social security number on all forms except Copy 1 that is sent to the State.

You have three options to choose from:

1.Employee Form with sub-option to Print Copies B & C on

a)separate pages

b)same page with a page of instructions or

c)same page with no instructions. This menu option prints a copy B, C, and a separate copy 2 for each state (if the employee has state tax information to report.)

2.Office Form will print Copy D for all employees, showing state tax information for those that have state taxes.

3.Employee Form W-2 box 14 Overflow/Separate Statement. This ties back to the Box 14 information setup on the Extract Menu.

4.State Form will print Copy 1 (2 employees per page). This option will add a new field to the menu where you enter which state you want to print. You must enter the state code to produce these forms.

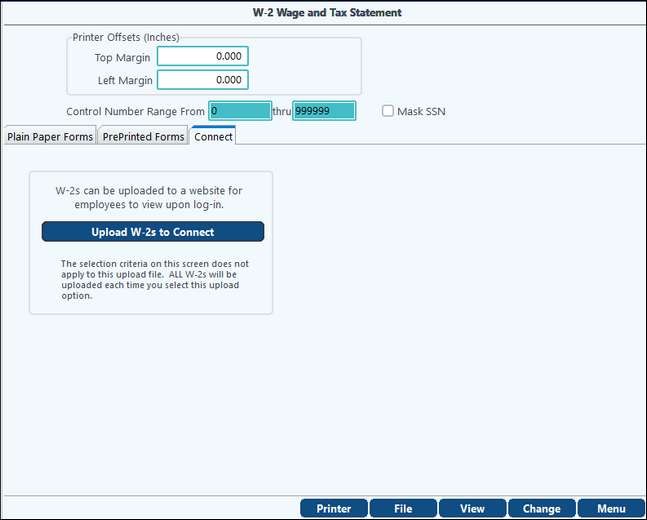

W-2 Connect: Add-On - uploads employees W-2 Wage and Tax Statements to Web Connect.