First, it’s important to know that the information on all quarterly and Year-To-Date payroll reports pulls from the Payroll Check History file, not the General Ledger.

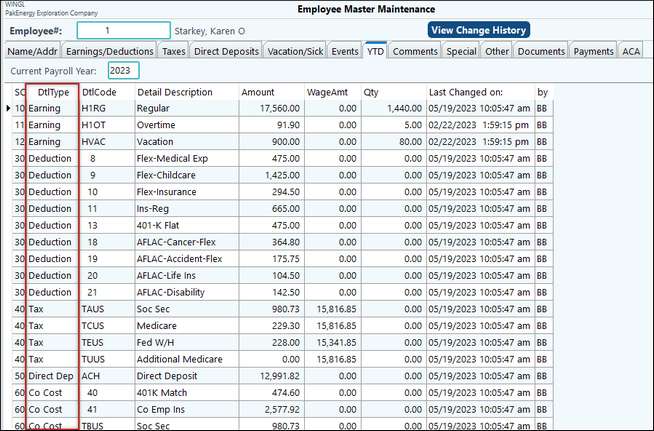

Employee Master

In the Employee Master file (F3), you will find the YTD tab that shows you all Earnings, Deductions, Company Costs, and Taxes.

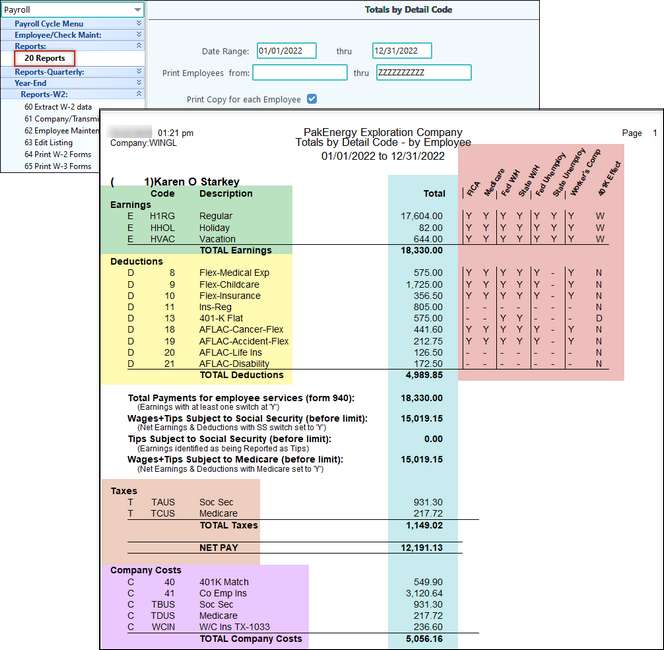

H-10 Totals by Detail Code

You can also find YTD information by running the # 20 Reports > Historical Tab > H-10 Totals by Detail Code report. This report will show you all Earning and Deduction detail codes along with tax flag switches for those codes, and amounts. You will also see totals for taxes paid by the employee, and company costs.

Enter in the needed date range. For example, to tie back to the W-2, enter in the date range using the month, day, and year format.

In order to get employee detail, make sure to select the box to Print Copy for each Employee. If this box is not selected, then only a company summary page will print.

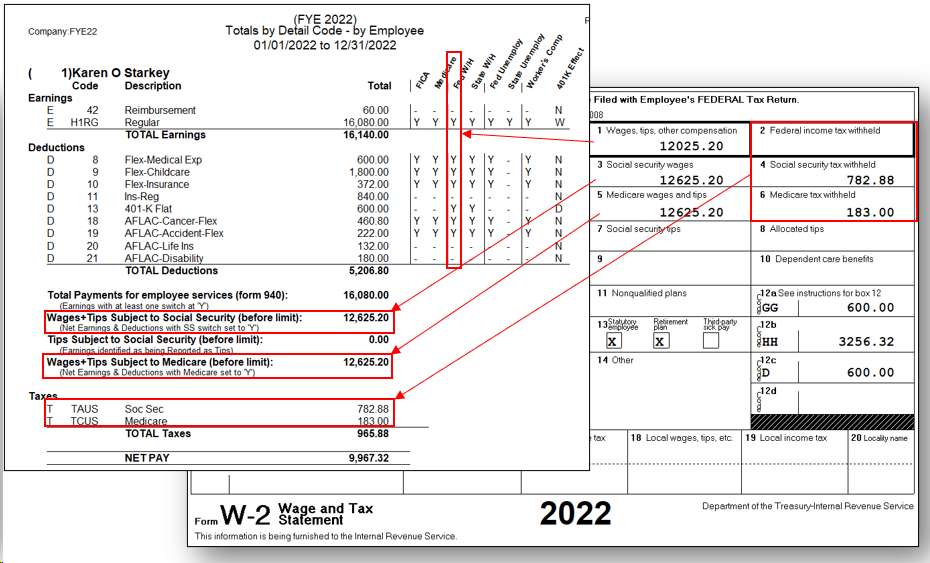

You can use this report to tie back to the employee’s W-2.

Box 1 Wages, tips, other compensation, is the net of the Earning and Deduction codes with the tax flag set to yes.

You may be wondering why the Wages and Tips are less than the Social Security wages and Medicare wages. The answer is in the switches. When comparing the switches for FICA, Medicare, and Federal Withholding, we can see that the 401k Flat detail code is set to pre-tax. Meaning it will reduce the federal taxable wages.

With this switch set to yes, or turned on, the calculation for box one reflects the pre-tax deduction.

Reviewing this report can be a good tool in spotting errors. Such as if there is a duplicate earning or deduction code that may have a tax flag that was changed sometime during the year. A correction may be needed.

Another excellent tool for finding errors is the Edit Listing.

See Correcting Cycle for more information.