Direct Pay Sales Tax is used to pay the taxing authority directly.

To setup the Direct Pay Sales tax feature in Pak Accounting:

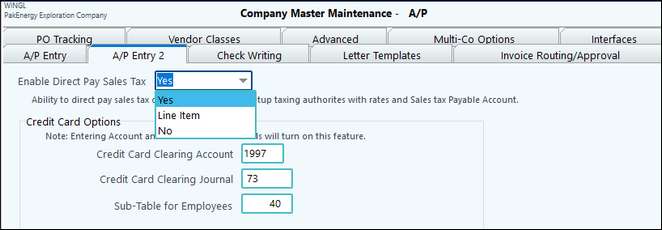

1. Turn on the feature in Company Maintenance/Accounts Payable/A/P Entry 2 screen. Selecting " Yes" will allow the invoice to be coded to one tax authority. Selecting "Line Item" will allow each coding line to be coded to a different tax authority.

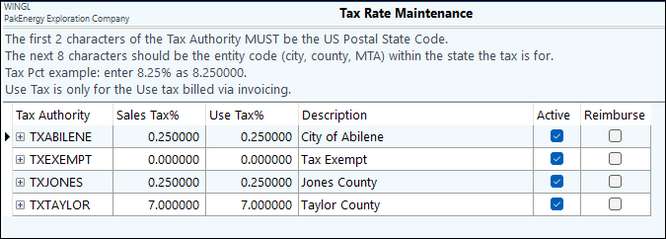

2. In the Accounts Payable Menu, Master File Maintenance heading, Tax Rate Maintenance: define each taxing authority and their corresponding tax rate.

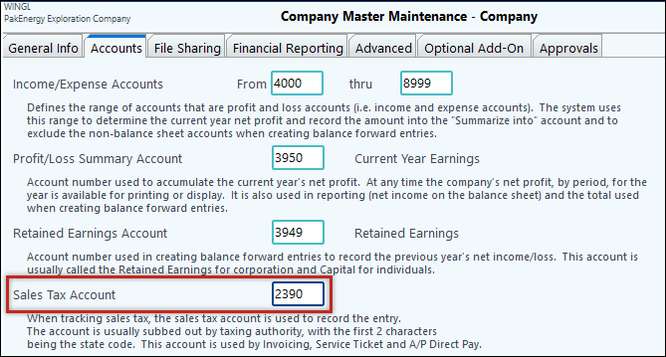

3. In General Ledger > Master Files Maintenance > Company Options > Accounts Tab, define your Sales Tax Payable Account (after setting up in F11). The Sales Tax Payable account is normally subbed out by Taxing Authority for easy reference.

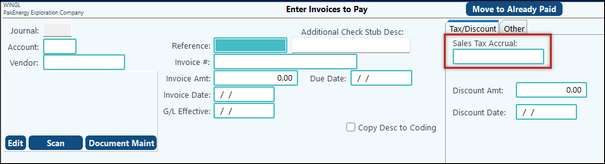

4. When entering the A/P Invoice, the user will need to fill in the Sales Tax Accrual box under the Tax/Discount tab (if setup was for a tax authority "Yes" was selected).

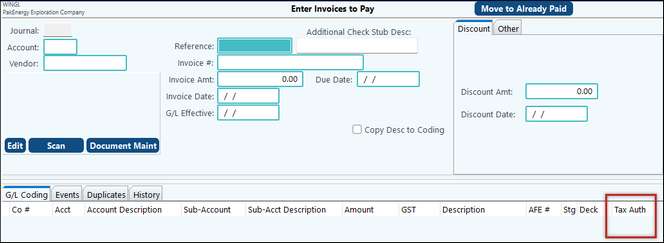

5. If the company option is set to “Line Item” level, a new field will be available on the “G/L Coding” grid where the tax authority is coded on a line by line level:

Journal entry that is created. Acct 2390 is credited for the sales tax payable, and it is subbed out by taxing authority so you will know exactly how much tax is owed by each individual taxing entity: