Deleted Interest Setup for Revenue

For normal O&G Operators, it is not all that unusual to have some Revenue Deleted Interest if the First Purchaser pays the Royalty owners and you are only distributing revenue to the Working Interests (and perhaps netting them for their convenience).

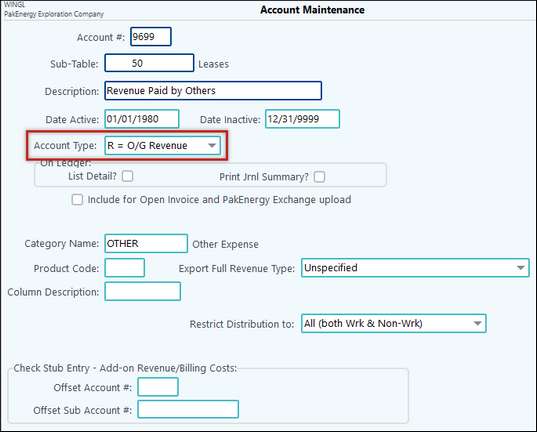

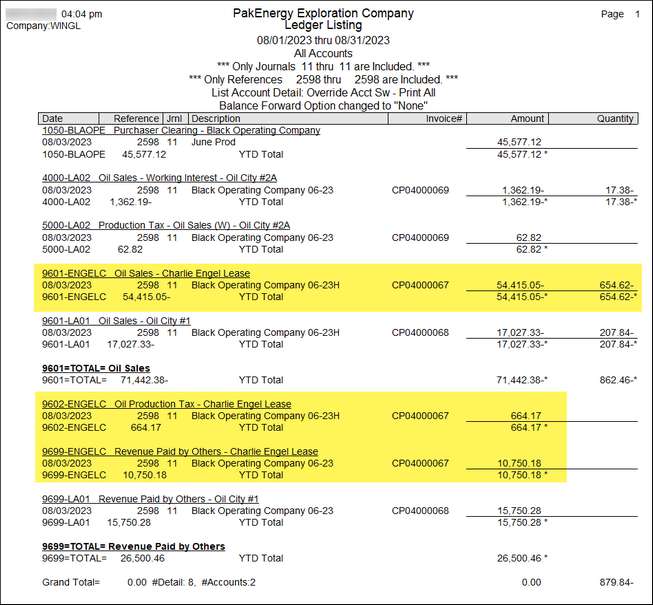

Revenue uses a separate Deleted Interest type Account which is broken down by the Property Sub-Table. In our example company, that account is “9699-Revenue Paid by Others.

Example:

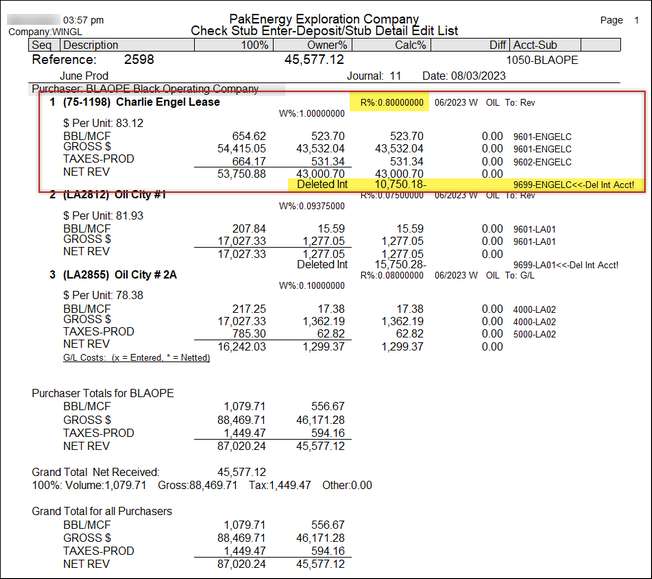

In this example: only 80% was received from the Purchaser, and 20% went to Deleted Interest.

Debit Credit

A Check is Received from the Purchaser

Cash is Debited (1050) 800.00

Oil Gross Sales are Credited (9601) 1,200.00

Oil & Gas Taxes Deducted (9602) 85.00

Oil & Gas Other Deductions (9606) 115.00

Deleted Interest (9699) 200.00

A Deleted Interest Owner is set on the DOI, so when the $1,200 flows through the DOI, the 20% that went to the Deleted Interest will not be paid out.

SETUP

Note that this setup is for Revenue Deleted Interest only. The Billing Deleted Interest is setup differently

1.Set up the Deleted Interest account in Account Maintenance (F11). The Account Type must be "R" or there will be an error when trying to run a Revenue cycle. The Revenue Deleted Interest account is used as a balancing account. Unlike the billing deleted interest account, this account will not zero.

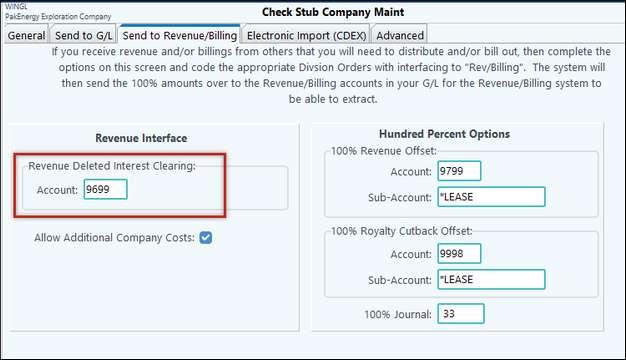

2.Add the account to the Check Stub > Company Maintenance > Send to Revenue Billing tab in the Revenue Interface box - Revenue Deleted Interest Clearing.

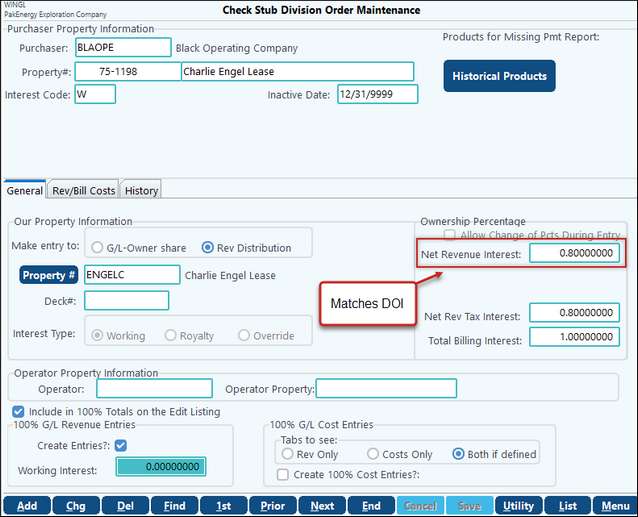

3.Revenue Deleted Interest can be an Owner or a Dummy owner's A/R account for ALL product types or certain products. An example of a Revenue/Billing > Master File Maintenance > Division of Interest setup with Deleted Interest Revenue:

4.Example of Check Stub > Master File Maintenance > Division Order setup for Revenue Deleted Interest:

Process

1. Enter your Check Stub for "your" amount received.

2. You will see the Deleted Interest reflected on the Edit List.

3. After you update, the system will create entries to gross up the Revenue amount to 100% numbers with Deleted Interest going to Revenue Paid by Others.

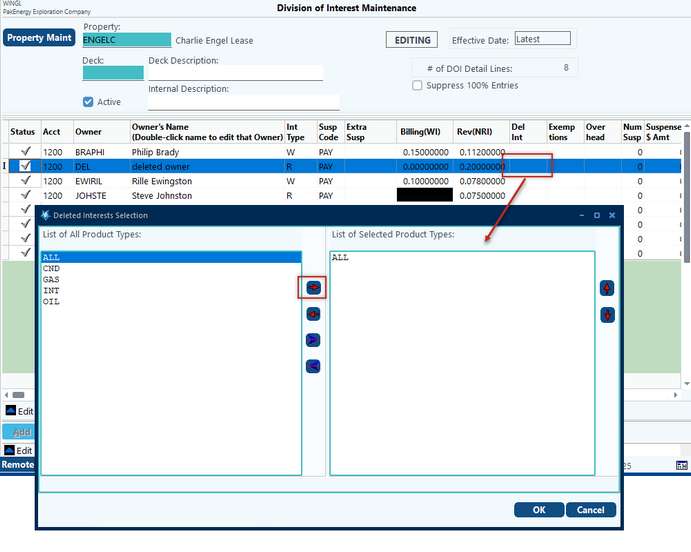

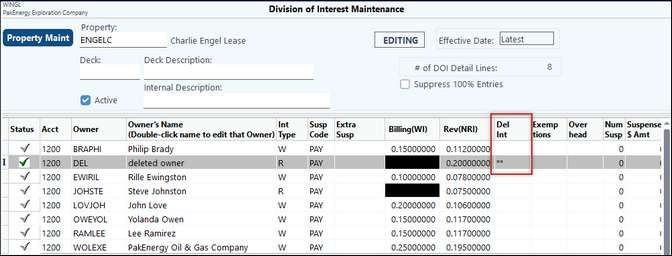

Example 1 – You pay the working interest owners, and the purchaser pays the royalty owners. This property is an oil only well. Enter your owners as you normally do. Be sure to select the “Deleted Owner” and set it to Royalty. Double click in the field in the Del Int column for this owner. This will bring up another box.

Since this well is oil only, mark it deleted interest for all products. You can do this a couple of ways. You can double click on the All in the left box which will then display in the box on the right. Or, you can single click on the "All" option in the left box and then use the right pointing arrow to display the "All" option in the box on the right. (Note: using "All" instead of each product will automatically make this owner deleted interest for any new products added. If you have each product in the right box and this well has this new product, you will have to come back and add the new product to the box on the right.) Click on the OK to save this setting. If you selected All, you will see the All in this field. If you selected the individual products, you will see two asterisks in this field regardless of how many products were selected.

You can see the products not distributed to this owner by double clicking on the Del Int box. There is no need to go into Change DOI edit mode to open this box. You can see them from this screen but not make any changes. Note: this will prevent accidental changes. |

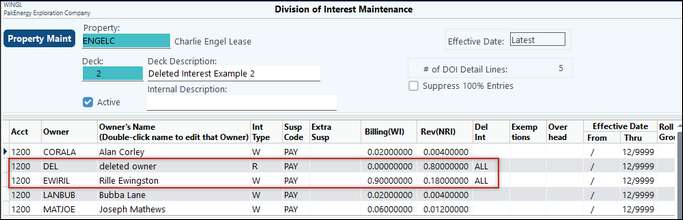

Example 2 – You are one of several working interest owners of a non-operated property. You have split a portion of your interest to some other working interest owners, and you distribute to them. In this situation, you need a deleted interest owner not only for the royalty owner, you also need one for those other working interest owners paid by the operator.

|

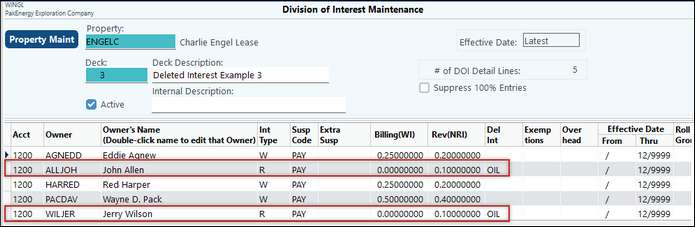

Example 3 – You receive oil and gas revenue on a lease. You pay the gas revenue to all owners. The oil purchaser pays the royalty owners and you pay the working interest owners only for the oil. The 2 royalty owners on this DOI are marked deleted interest for oil only. You will pay them for the gas revenue but not the oil revenue.

|