This is an optional add-on.

Overview

What are partnerships?

Pak Accounting defines oil and gas partnerships as partnerships for tax purposes (K-1’s) not joint operations partnerships. Once the partnership is set up, transactions are recorded at the partnership level within the partnership’s books. Capital applications are recorded at the owner level. Owners in multiple partnerships retain the ability to net at the partnership level instead of the owner level. A single Settlement Statement can be printed for each partner and the detail can be separated & summarized by each partnership. The partnership data then can be automatically sent to another set of books set up specifically for the partnership.

Why would you set up partnerships?

Revenue/Billing Partnership Reporting helps make K-1 Reports much easier to prepare. The system will not produce the K-1s, only give you all of the information necessary to prepare them.

Use this feature to track distributions to each partner for multiple partnerships. Also, to create separate books for each partnership, with entries automatically created by the distributing company’s revenue/billing cycles.

Setup

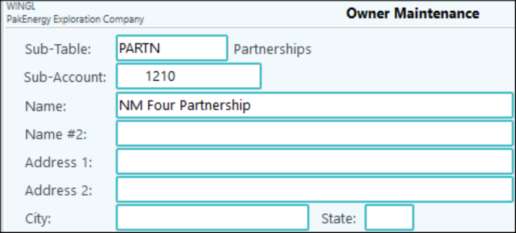

Sub-Table/Sub-Accounts

Create a Sub-Table for Partnerships. Then create a separate Sub-Account for each partnership A/R account

Company Setup

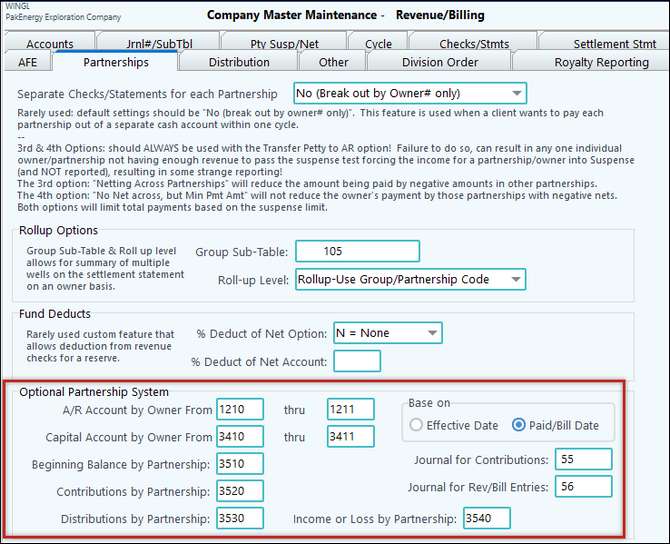

To begin using Partnership Reporting, you must first setup the Revenue/Billing > Company > Partnerships tab > Optional Partnerships System Section.

•The A/R and the Capital accounts

oThe accounts in these fields will need to be subbed by your owner Sub-Table.

•Beginning balance, Contributions, Distributions, and Income and Loss by Partnership accounts

oThe accounts in these fields will need to be subbed by your Partnership Sub-Table.

•Base On: The user has the option to select Effective date or Paid/Bill Date when extracting the Revenue/ Billing history to create entries to the G/L for Distributions & Income/Loss detail for the Partnership Statements.

•Journal numbers for Contributions and for Rev/Bill Entries need to be defined. It is recommended that a unique journal number is defined for each.

Use

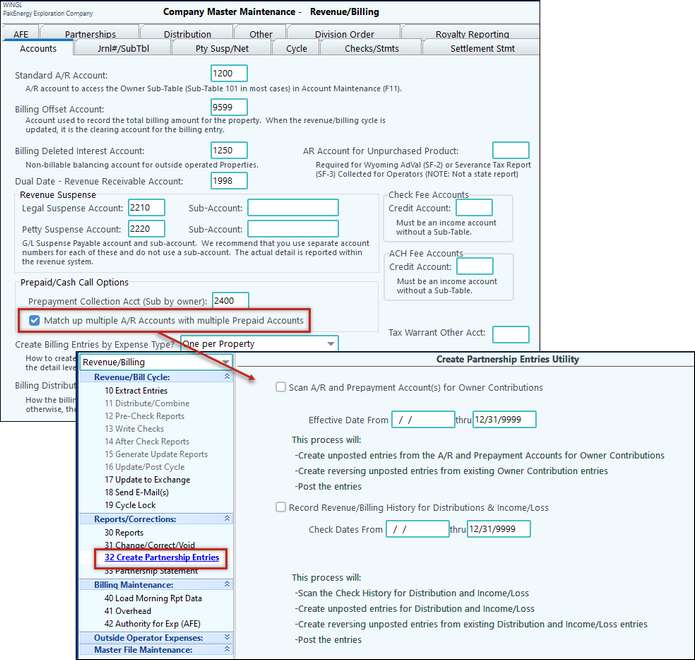

Once the Company Setup is complete you can now Create Partnership Entries. This will use the accounts you just defined in the Company Maintenance. The option to Create Partnership Entries is located in Revenue/Billing > Reports/Corrections. This utility will allow you to create entries for a specific time frame for the A/R and Prepayment Account(s) for Owner Contributions and/or the Revenue/Billing History for Distributions & Income and Loss.

If using the Company Option to match up multiple A/R accounts with multiple prepaid accounts; this scan feature will scan both A/R and Prepaid accounts.

Also see Partnership Statement