Frequently Asked Questions about A/P Checks and Payments

Click on the blue link for the answer.

First, it is important to know if the vendor is going to return the extra funds or take a credit on your next invoice. If the vendor is going to issue a credit on your next invoice 1.Delete the voided check from check history. 2.In AP > Handwritten Checks/Drafts > Enter Checks/Drafts: enter in a new invoice a.Add the original payment/check information to it. b.Offset to an account of your choice. See "What is the best way to enter a prepayment for a vendor?" below if you don't want it to hit your expenses until the new invoice. 3.Update/Post the entry.

If the vendor is going to return the funds: 1.Delete the voided check from check history 2.Do an AP entry to ZZMISC/off set a clearing acct. Put in the description the original vendor and that they cashed the voided check (or the actual situation). a.That way they have a check to clear during bank rec. b.We don’t want to hit the original vendor for 1099 purposes 3.When you receive the money back from the vendor. Deposit it to the cash and offset to the same clearing as before. |

These steps assume that you still have possession of the check and it has not been sent out - or it was entered in after the fact. 1.Void the check in AP/Void AP Check. a.If the bank rec is still open then void as of the same date as the check. b.If the bank rec has been reconciled then use the current date.

If you are using blank checks or the Handwritten Checks menu

2.Go to Bank Reconciliation > Check History, find the check, make sure the Check Status says Void and then delete the check history. 3.Go into Accounts Payable > Un-Update Open Invoice, find your invoice and un-post it. The invoice will now be in your Enter Invoices to Pay screen. Correct the amount of the invoice and repost. 4.Enter/print the check a.If Handwritten Check: Go into AP/Add Ck# to Updated Invoice, find the invoice, and add the correct payment information back to the invoice. Post/Record the invoice. b.If a new check needs to be printed, print as normal.

If you are using pre-printed checks and need to print a new check. 2. Go into Accounts Payable/Un-Update Open Invoice, find your invoice and un-post it. The invoice will now be in your Enter Invoices to Pay screen. Correct the amount of the invoice and repost. 3. Print new check as normal. |

Go to the Bank Reconciliation module/Master File Maintenance/Check History and "Find" the draft that needs to be voided. It will be cleared since drafts automatically clear when they are posted to the General Ledger. Make the draft outstanding again by choosing the outstanding option in the "Check Status" box. Then "blank" out the Date in the "Check Status" box. This can be done by placing your cursor in the month part of the date field and hitting the space bar on the keyboard twice. Finally, go to the Accounts Payable module > Void A/P and void the draft just as you would a check. Reversal entries will be made in the General Ledger and the invoice will be outstanding again. |

Unfortunately, this cannot be done. The ZZMISC vendor that is a part of your Vendor Sub-Table contains special programming logic designed specifically for it. If you do not have the ZZMISC vendor as a part of your vendor Sub-Table, you can add it in through F12 like you would any vendor and it will work as normal. |

We will use US and CN as our example: In most cases the Cash account will say US and the A/P will say CN (on the far right side of the screen). You will have no problem voiding the check. However if they are both CN. Follow the steps below.

1.Look and see what currency was used in put the A/P invoice in (In most cases this one will be CN). (All the way to the right of the screen) If it is CN 2.Look in the cash account and see what currency was used (In most cases this will be US). If this is also CN 3.Go to - Master File Maintenance – Bank Account – Find the Bank used to write the check – in the bottom left corner is a small box that reads – “Instead of US Currency, Print checks using CN Currency” check that box. – Go and Void the check. – After voiding come back and uncheck the box.

If they are not using (2) currency’s that box won’t be there. |

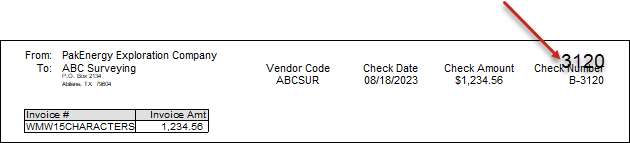

Pak Accounting will accommodate as many invoices as you need to pay in the total dollar amount of the check.The invoice numbers are then printed on the check stub . The system will print 42 invoices on one check stub before going to the second page. Where a check would normally print on the second and subsequent pages, the word "Void" will print to ensure that those pages are not mistaken as a check. |

To fix a check that was dated incorrectly, you will have to void the check in the Accounts Payable module > Void A/P Check. Once this is done, the invoice will become an open item again. The invoice can then be paid with the correct date. To re-use the same check number, delete the check history from the Bank Reconciliation module > Check History. Then reprint the correct check through Pay A/P and enter the original check number. |

| When I pay AP invoices, the next check number is defaulting to one that is too high. The check number should be in the 7900 range instead of the 110,500 range. How do I fix this? |

The system automatically defaults to the next check number after the highest check posted. If someone uses a high check number out of sequence it can be moved. To accomplish this the check history in the Bank Reconciliation module > Check History will have to be deleted out of the higher check number and re-entered in at a lower check number. It is recommended that you "print screen" the information before deleting. Once the check is moved to a lower check number, the default should work correctly the next time invoices are paid. If there are numerous checks that have been entered in out of sequence at a higher check range, it may be more beneficial to create a "dummy" bank account and mass change these checks . This is recommended if the checks in question are not in the current tax year. It is also recommended to generate a check register to ensure that you move the correct checks. |

Clearing an A/P extract is accomplished in the Pay A/P screen. A "Clear Extract" button is located in the top, right-hand corner. Simply click the button and the extract will be cleared. |

|

|

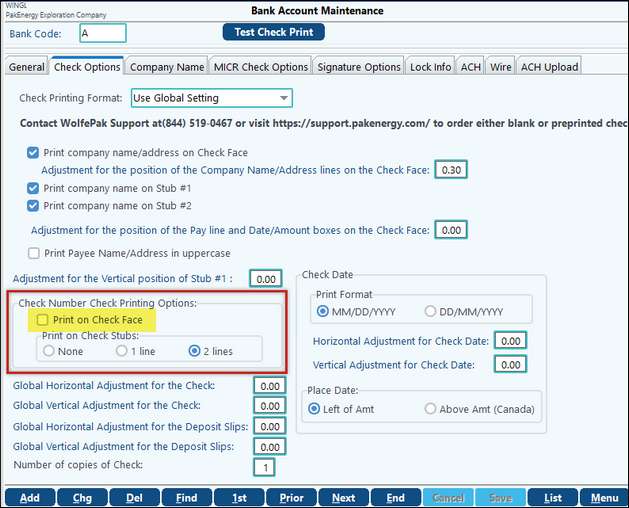

If you have pre-printed checks, and the check number is not over-printing on the Check itself just on the stub, then on the Check Options tab, make sure the Check Number Check Printing option is set to None. Change the option, then use the Test Check Print button at the top of the screen to print or preview a test check to make sure only what you are wanting to print is printing.

|